handsoffmypension.ca

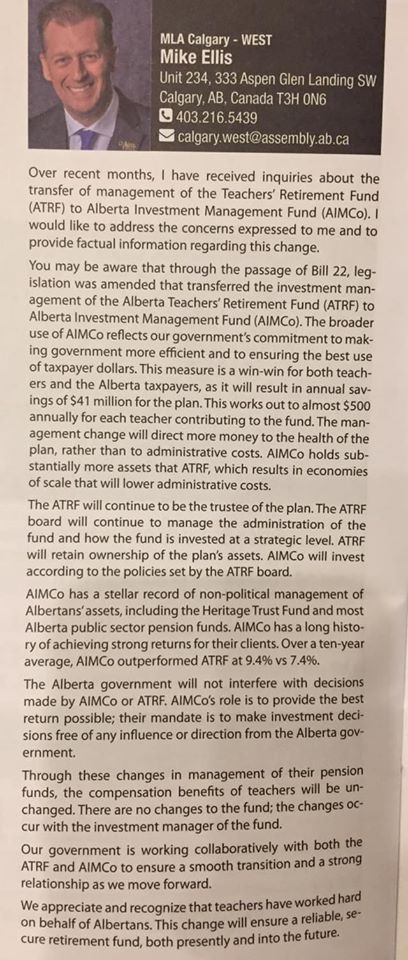

" AIMCo is expected to provide maximum returns to its clients"

#handsoffmypension

AIMCO HAS NOT HISTORICALLY PROVIDED MAXIMUM RETURNS?

#kevinisembarrassedaboutthis #ABLeg

Not in the communist dictatorship of Alberta...

#lowestcommondenominator #ABLeg

As it should be in a democracy.

#somebodyshitondemocracy #itwasnotme #ABLeg

You remember Leo? I Tweeted about him before... #ABLeg

Take a look...

pensionpulse.blogspot.com/2020/01/making…

"Anyway, I'm done tweeting about these things with people who think they know best, they clearly have an agenda" #ABLeg

Leo also needs to acknowledge that my "Twitter fight" with him was more about me trying to get him to correct earlier material misstatements he made about ATRF. (I was trying to educate him as I always do.) #ABLeg Go have a look.