The report authored by @asheth99 - the most powerful person in Indian VC who is not a VC or founder:-) - is worth a read.

Here is what I found interesting from the report.

1/

Link - bain.com/insights/india…

Not surprising that Multiples led by Renuka Ramnath has done well - they are the closest to this w plays in Delhivery, IEX & Dream11 (Believe they made a 10-bagger on Dream11)

5/

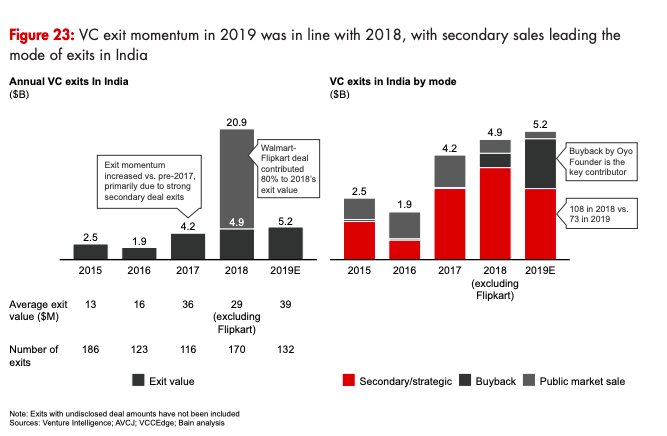

Now let us look at Exits.

7/

However contrasted w $4.6b invested in 2014 (if holding period of ~5 yrs) clearly show value / exits take longer to realise in India.

Also look at low share of IPO. This is why @bkartred has been screaming for IPOs.

8/

Link - bain.com/insights/india…

Thanks @sheth99 & team for the report!

9/9 End.