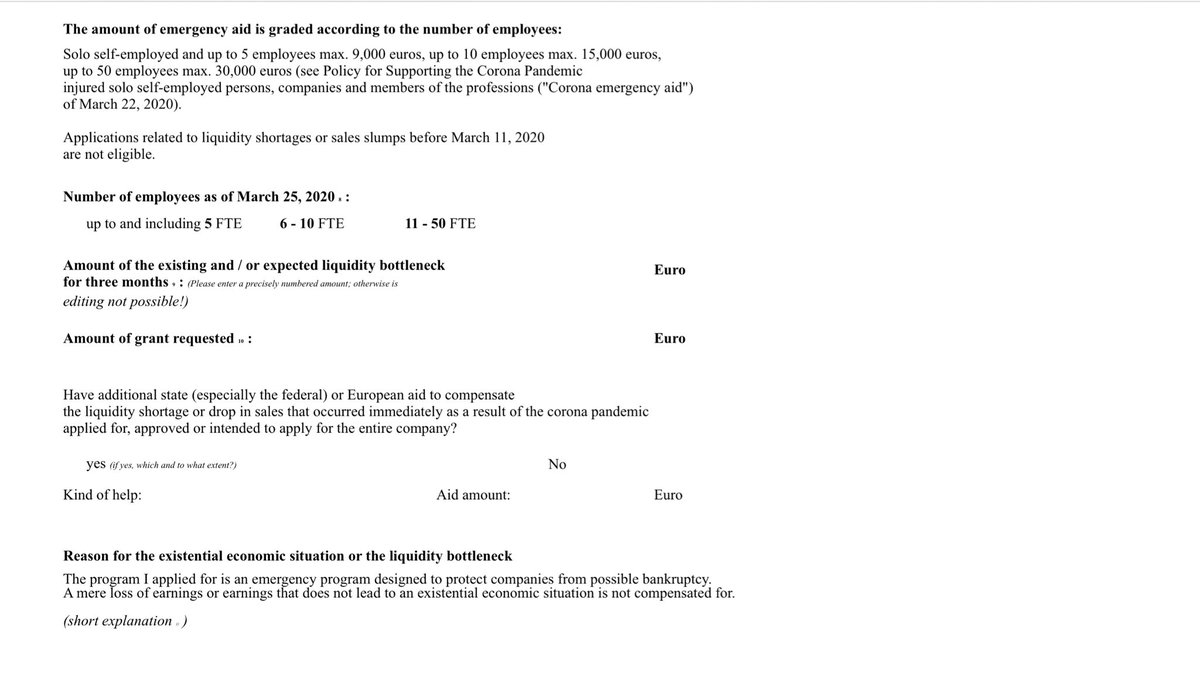

Parity with Employees for self-employed earning below 50k in Jan tax return or averaged over previous three years. 80% of income up to £2,500 a month for three months.

Paid as one off grant in June

Taxable

Not for company owners paid in dividends

Self employed will get to carry on working, dont have to “self furlough”.

Will have to be declared on tax returns on Jan 22

Government has chosen to prioritise the complex design of a scheme for employed workers first. This is because there is a public policy aim of keeping people on payrolls, ready for a rebound in economy when shutdown lifted...

Until June - Government and self employed will have to be reliant on banks being generous with overdrafts, expecting they take into account a lump sum of up to £7,500 in the accounts in June... and also universal credit etc...