#Global #ETF Weekly & Month-end (thread): 29 Jan 2021

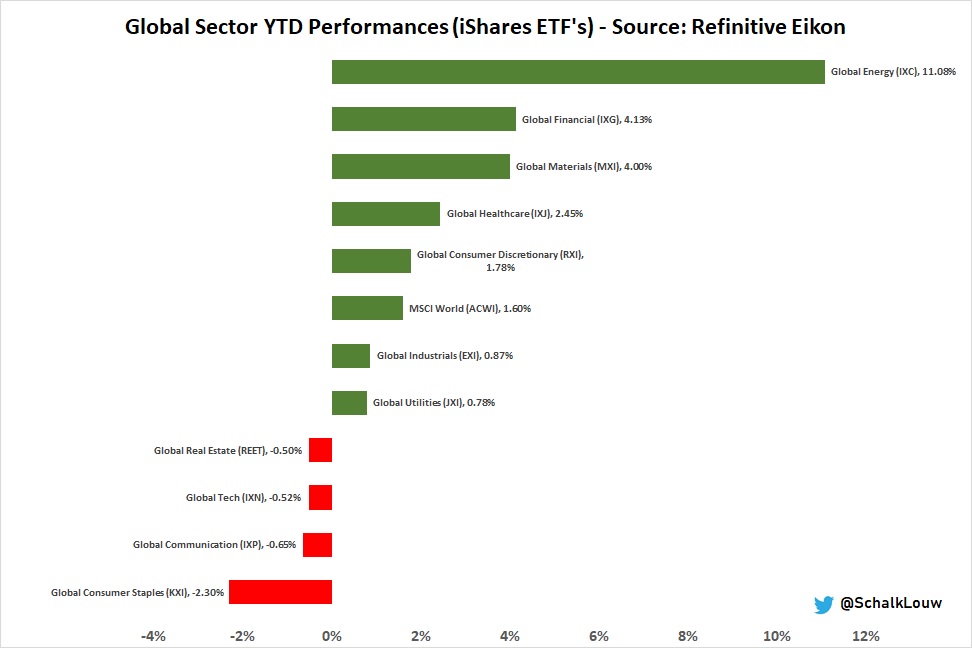

- 2020 worst perf #sector making comeback in 2021 $IXC

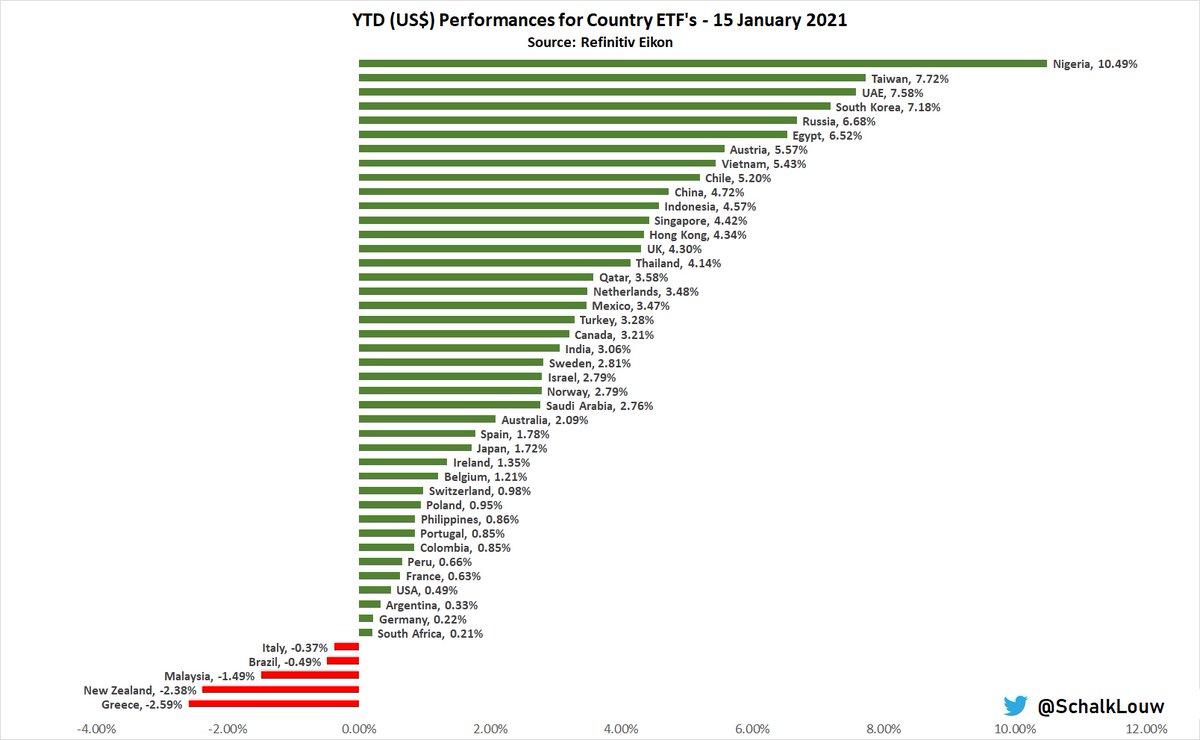

- This is helping #oil producing countries with #Nigeria & #UAE in top5 #Country ETF YTD performers in USD $NGE $UAE

- #SouthAfrica $EZA moved into top15 YTD performers

- 2020 worst perf #sector making comeback in 2021 $IXC

- This is helping #oil producing countries with #Nigeria & #UAE in top5 #Country ETF YTD performers in USD $NGE $UAE

- #SouthAfrica $EZA moved into top15 YTD performers

2/12

#EmergingMarkets #ETF still storming ahead against #DevelopedMarkets ETF, still not relatively "overbought" yet, but getting close.

#SouthAfrica might need a lot of catch up, but $EZA YTD performance in USD (+0.2%) continued 2nd half on 2020 recovery against $URTH (-0.8%)

#EmergingMarkets #ETF still storming ahead against #DevelopedMarkets ETF, still not relatively "overbought" yet, but getting close.

#SouthAfrica might need a lot of catch up, but $EZA YTD performance in USD (+0.2%) continued 2nd half on 2020 recovery against $URTH (-0.8%)

3/12

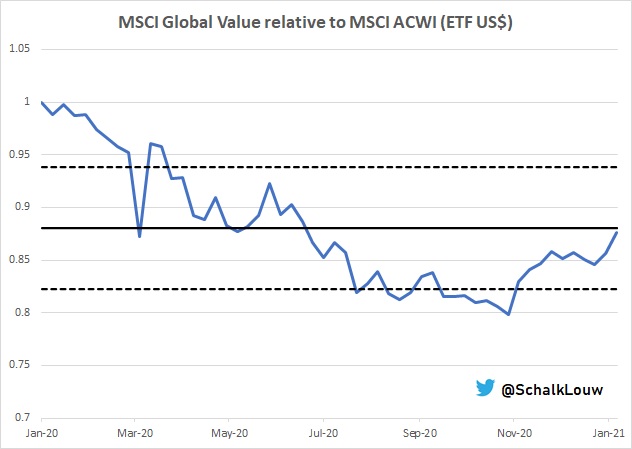

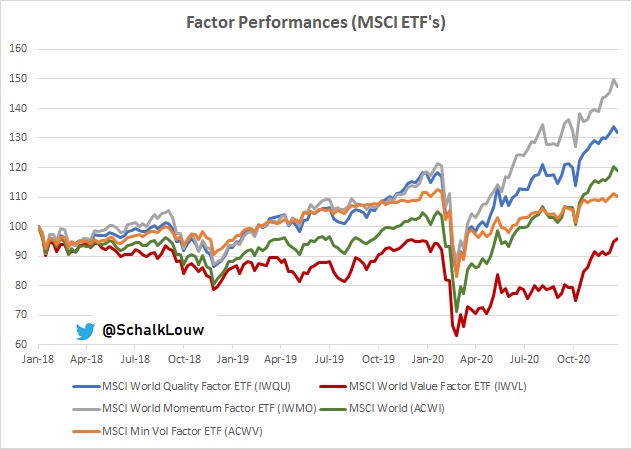

#Global #Value #stocks still making short-term recovery, with $IWVL #ETF still looking strong relatively over the short-term. Over 3yr period it is however still lagging quite substantially.

#Global #Value #stocks still making short-term recovery, with $IWVL #ETF still looking strong relatively over the short-term. Over 3yr period it is however still lagging quite substantially.

4/12

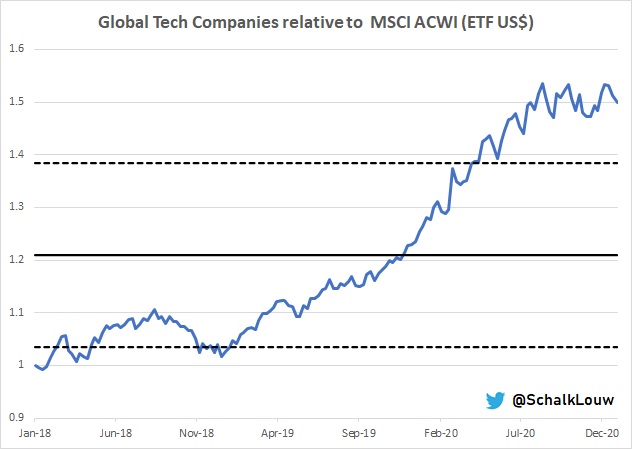

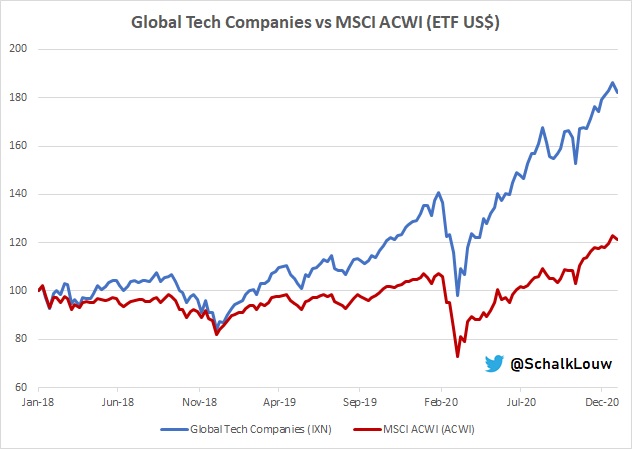

This one is worrying, but then again, it's been for some time. #Global #Tech #stocks relative to #MSCI All Country World Index is definitely creating some concern. Be very careful.

$IXN vs $ACWI

This one is worrying, but then again, it's been for some time. #Global #Tech #stocks relative to #MSCI All Country World Index is definitely creating some concern. Be very careful.

$IXN vs $ACWI

5/12

#Internet companies still big driver on performance, with US Internet Co's #ETF growing 1.8% in January (YTD) in USD versus #MSCI World $URTH losing 0.8% over same period

#Chinese Internet Co's $KWEB however grew 13% in Jan. Wow! That helped #Naspers/#Prosus & also SA $EZA

#Internet companies still big driver on performance, with US Internet Co's #ETF growing 1.8% in January (YTD) in USD versus #MSCI World $URTH losing 0.8% over same period

#Chinese Internet Co's $KWEB however grew 13% in Jan. Wow! That helped #Naspers/#Prosus & also SA $EZA

6/12

#US #Bonds had slight recovery in latter part of January, after US #stimulus was announced. Be careful over short-term as $TLT #ETF relative to $SPY indicate oversold (bonds) &/or overbought (equities) & could see further profit taking.

#US #Bonds had slight recovery in latter part of January, after US #stimulus was announced. Be careful over short-term as $TLT #ETF relative to $SPY indicate oversold (bonds) &/or overbought (equities) & could see further profit taking.

7/12

#EmergingMarkets Government #Bonds still lagging #Global Government Bonds. Yield seekers might use low interest rate environment to start buying EM bonds.

$EMB vs $IGLO

#EmergingMarkets Government #Bonds still lagging #Global Government Bonds. Yield seekers might use low interest rate environment to start buying EM bonds.

$EMB vs $IGLO

8/12

Comparing $GLD (gold price) #ETF with $GDX (#Goldminers), one can see that miners getting close to gold ($/oz). Relative not cheap yet & can still see further weakness.

Comparing $GLD (gold price) #ETF with $GDX (#Goldminers), one can see that miners getting close to gold ($/oz). Relative not cheap yet & can still see further weakness.

9/12

Massive outperformance however coming from $SLV (silver bullion) #ETF versus $GLD (gold bullion) in January, going from totally "oversold" relative last year March, to total "overbought"

Possible reason could be after #WSB/Reddit crowd called it "The biggest short squeeze"

Massive outperformance however coming from $SLV (silver bullion) #ETF versus $GLD (gold bullion) in January, going from totally "oversold" relative last year March, to total "overbought"

Possible reason could be after #WSB/Reddit crowd called it "The biggest short squeeze"

10/12

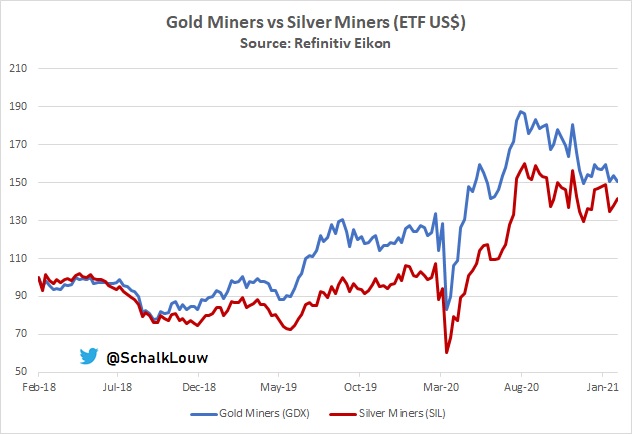

Massive jump in $SLV naturally helped #Silver #Miners $SIL #ETF closing its 3yr lag versus #Gold Miners $GDX ETF. Gold Miners however getting mighty close to being "oversold" relative to Silver Miners.

Massive jump in $SLV naturally helped #Silver #Miners $SIL #ETF closing its 3yr lag versus #Gold Miners $GDX ETF. Gold Miners however getting mighty close to being "oversold" relative to Silver Miners.

11/12

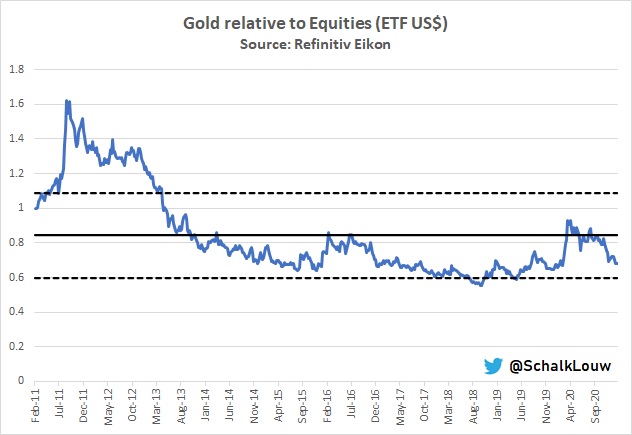

#Gold is not only lagging #Silver over short-term, but also #MSCI #Global #Equities. Not back at mid 2019's levels yet, but getting mighty close

$GLD versus $ACWI

#Gold is not only lagging #Silver over short-term, but also #MSCI #Global #Equities. Not back at mid 2019's levels yet, but getting mighty close

$GLD versus $ACWI

12/12

#Global #Financials #ETF, taking a bit of a breather in latter part of January, relative to #MSCI All Country World Index. Still however have a MASSIVE gap to fill, which could take some time. IMHO, it's still an opportunity.

$IXG vs $ACWI

#Global #Financials #ETF, taking a bit of a breather in latter part of January, relative to #MSCI All Country World Index. Still however have a MASSIVE gap to fill, which could take some time. IMHO, it's still an opportunity.

$IXG vs $ACWI

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh