1/ I just read #KuCoin's 2021 Annual Report and 2022 Forecast on the Crypto Industry.

Here are my key takeaways, a thread. 🧵

Lets go! 👇👇👇

#DeFI / #NFT / #DAO / #Stablescoins / #Memecoins / #Risks

Here are my key takeaways, a thread. 🧵

Lets go! 👇👇👇

#DeFI / #NFT / #DAO / #Stablescoins / #Memecoins / #Risks

2/ #BTC and #ETH remain the undisputed market leaders.

🔸BTC was the best performing major asset in 2021

🔹ETH has also been gaining traction as a store of value

ETH becoming deflationary is a big change (pictured).

More on ETH next 👇

🔸BTC was the best performing major asset in 2021

🔹ETH has also been gaining traction as a store of value

ETH becoming deflationary is a big change (pictured).

More on ETH next 👇

3/ #ETH Gas Fees

ETH network occupancy rate was over 98% in 2021 (pictured)!

This is close to its resource critical point leading to high gas fees / the scaling problem.

#DeFI ecosystem is limited by the performance of ETH.

ETH2.0 is expected in 2022. Next, #shitcoins 👇

ETH network occupancy rate was over 98% in 2021 (pictured)!

This is close to its resource critical point leading to high gas fees / the scaling problem.

#DeFI ecosystem is limited by the performance of ETH.

ETH2.0 is expected in 2022. Next, #shitcoins 👇

4/ Best #shitcoins to watch in 2022:

🔹49 / 100 top projects on CMC are underlying ecosystem projects.

Top ecosystem coins:

👉 #ETH, #Binance Smart Chain (BSC), #Polygon, #Cadano, #Cosmos, #Terra, #Polkadot, #Kusama, #Solana, #Flow, #Algorand, #NEAR

Next, #memecoins👇

🔹49 / 100 top projects on CMC are underlying ecosystem projects.

Top ecosystem coins:

👉 #ETH, #Binance Smart Chain (BSC), #Polygon, #Cadano, #Cosmos, #Terra, #Polkadot, #Kusama, #Solana, #Flow, #Algorand, #NEAR

Next, #memecoins👇

5/ #Memecoins

#Dogecoin & #Shiba topped the list in 2021.

Memecoins have yuuuge / unlimited tokens in circulation (1st red flag), can be purchased for cents on the dollar (2nd red flag) and rely on branding/herd mentality - look mom, I am a #frognation member!

Avoid. Next 👇

#Dogecoin & #Shiba topped the list in 2021.

Memecoins have yuuuge / unlimited tokens in circulation (1st red flag), can be purchased for cents on the dollar (2nd red flag) and rely on branding/herd mentality - look mom, I am a #frognation member!

Avoid. Next 👇

6/ Permanent Blockchain Storage

Surprised to see #Arweave featured in the report.

It is a revolutionary blockchain storage platform focused on PERMANENT storage.

Keep an eye on this (buy it on #KuCoin/#Binance).

Next, decentralization 👇

Surprised to see #Arweave featured in the report.

It is a revolutionary blockchain storage platform focused on PERMANENT storage.

Keep an eye on this (buy it on #KuCoin/#Binance).

Next, decentralization 👇

7/ #Decentralization - key point for #DeFI

Validating nodes ranking:

1️⃣ #ETH - 3.7 million nodes (sexy)

2️⃣ #SOL - 1,375 (meh)

3️⃣ #AVAX - 1,203 (meh)

4️⃣ #Terra - 130 (WTF)

5️⃣ #BinanceSC - 21 active nodes (WTF, RUN)

Next, transactions 👇

Validating nodes ranking:

1️⃣ #ETH - 3.7 million nodes (sexy)

2️⃣ #SOL - 1,375 (meh)

3️⃣ #AVAX - 1,203 (meh)

4️⃣ #Terra - 130 (WTF)

5️⃣ #BinanceSC - 21 active nodes (WTF, RUN)

Next, transactions 👇

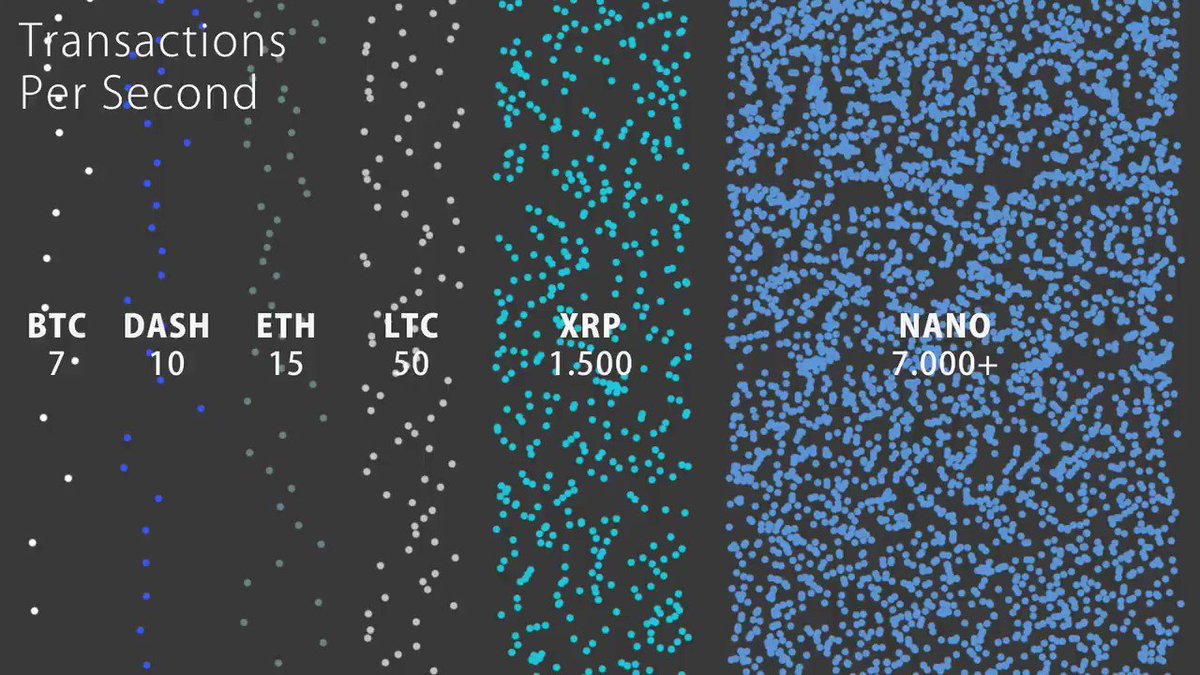

8/ Transactions/s or tps

1️⃣ #SOL - 3,290 (ok)

2️⃣ #Terra - 1,000 (ok)

3️⃣ #AVAX - 300 (meh)

4️⃣ #BinanceSC - 75 (WTF, RUN)

5️⃣ #ETH - 14 (meh, at least this is decentralized!)

ETH2.0 can be expected to reach 100,000 tps.

More on #DeFI next. 👇

1️⃣ #SOL - 3,290 (ok)

2️⃣ #Terra - 1,000 (ok)

3️⃣ #AVAX - 300 (meh)

4️⃣ #BinanceSC - 75 (WTF, RUN)

5️⃣ #ETH - 14 (meh, at least this is decentralized!)

ETH2.0 can be expected to reach 100,000 tps.

More on #DeFI next. 👇

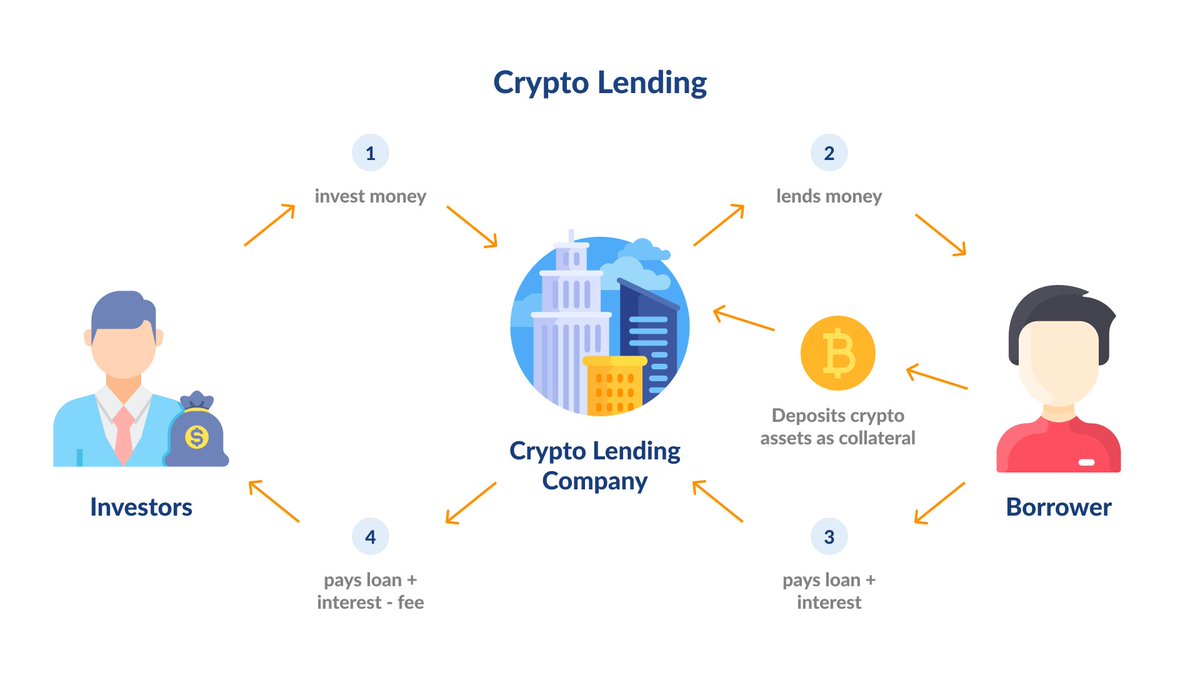

9/ #DeFI stats

🔹Increase to >$100 bil in 2021!

🔹#DeFI lending & #DEX exchanges account for approximately 90% of the whole DeFI (by TLV)

🔸DeFI has extended to #NFT, #GameFi, #SocialFi, but it is attracting regulators now...

Top #DeFI platforms next 👇

🔹Increase to >$100 bil in 2021!

🔹#DeFI lending & #DEX exchanges account for approximately 90% of the whole DeFI (by TLV)

🔸DeFI has extended to #NFT, #GameFi, #SocialFi, but it is attracting regulators now...

Top #DeFI platforms next 👇

10/ Top #DeFI platforms:

🔹Lending ($40 bil): #Maker, #Aave & #Compound dominate

🔹DEX ($20 bil): #Uniswap, #Sushiswap & #Curve

🔹Derivatives ($3 bil): #SNX, #DYDX, #Nexus

Beyond 2022 - combining DeFI with NFT + Play to Earn (#PTE) + #SocialFI+ #GameFI

Next, stablecoins 👇

🔹Lending ($40 bil): #Maker, #Aave & #Compound dominate

🔹DEX ($20 bil): #Uniswap, #Sushiswap & #Curve

🔹Derivatives ($3 bil): #SNX, #DYDX, #Nexus

Beyond 2022 - combining DeFI with NFT + Play to Earn (#PTE) + #SocialFI+ #GameFI

Next, stablecoins 👇

11/ #Stablecoins - at risk of regulation!

Centralized (at risk):

#USDT ($80 bil) - risky

#USDC ($52 bil) - ok

#BUSD ($18 bil) - meh

Decentralized:

#UST ($12 bil) - meh, artificial growth

#DAI ($10 bil) - ok

#FRAX ($2.6 bil) - ok

#LUSD ($0.7 bil) - ok

NFTs next 👇

Centralized (at risk):

#USDT ($80 bil) - risky

#USDC ($52 bil) - ok

#BUSD ($18 bil) - meh

Decentralized:

#UST ($12 bil) - meh, artificial growth

#DAI ($10 bil) - ok

#FRAX ($2.6 bil) - ok

#LUSD ($0.7 bil) - ok

NFTs next 👇

12/ #NFT / #Metaverse - industry giants are getting in big

🔹The greatest single-day NFT trading volume in 2021: $570 mil (Nice #FOMO!)

🔹NFT users went from 193k at the start of 2021 to 1,3 mil (717% increase)

#DAOs next or Decentralized Autonomous Organizations 👇

🔹The greatest single-day NFT trading volume in 2021: $570 mil (Nice #FOMO!)

🔹NFT users went from 193k at the start of 2021 to 1,3 mil (717% increase)

#DAOs next or Decentralized Autonomous Organizations 👇

13/ #DAOs

🔹They are open, fair and secure, based on blockchain technology and decentralized. Easy to set up

🔹 #Vitalik (ETH founder) first mentioned DAOs in 2013

🔹Almost all decentralized projects can be called DAOs, such as #Bitcoin and #Ethereum

Types of DAOs next 👇

🔹They are open, fair and secure, based on blockchain technology and decentralized. Easy to set up

🔹 #Vitalik (ETH founder) first mentioned DAOs in 2013

🔹Almost all decentralized projects can be called DAOs, such as #Bitcoin and #Ethereum

Types of DAOs next 👇

14/ Types of DAOs:

🔹Protocol DAOs (#Uniswap, #Compound, #Sushi, #MakerDAO)

🔹Investment DAO (Yield Guild Games - play to earn)

🔹Social DAOs (Friends with Benefits)

🔹NFT collectible DAOs

🔹Media DAOs (#Forefront, #Bankless, and #DarkStar)

🔹Service DAOs

Risks next 👇

🔹Protocol DAOs (#Uniswap, #Compound, #Sushi, #MakerDAO)

🔹Investment DAO (Yield Guild Games - play to earn)

🔹Social DAOs (Friends with Benefits)

🔹NFT collectible DAOs

🔹Media DAOs (#Forefront, #Bankless, and #DarkStar)

🔹Service DAOs

Risks next 👇

15/ Security risks in crypto:

1️⃣ Oracle attacks = price manipulation

2️⃣ Flash loan attacks = buy low, sell high manipulation

3️⃣ Cross-chain attack = siphoning funds / stealing

4️⃣ Free airdrops = enter your email & wallet keys to get it! #Recked 🤣

Best crypto audit firms 👇

1️⃣ Oracle attacks = price manipulation

2️⃣ Flash loan attacks = buy low, sell high manipulation

3️⃣ Cross-chain attack = siphoning funds / stealing

4️⃣ Free airdrops = enter your email & wallet keys to get it! #Recked 🤣

Best crypto audit firms 👇

16/ Security & Privacy:

🔹Best crypto audit firms: #CertiK and #SlowMist

🔸Coin mixer (on #ETH): Tornado.cash - popular with hackers, scammers to cover their tracks

More next 👇

🔹Best crypto audit firms: #CertiK and #SlowMist

🔸Coin mixer (on #ETH): Tornado.cash - popular with hackers, scammers to cover their tracks

More next 👇

17/ If you liked this thread, #retweet the first post to get more of this content in the future! 😍

Stay in touch + follow:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Stay in touch + follow:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

18/ Link to #KuCoin's full report where you can also download it.

Thanks for reading! 🤩

businesswire.com/news/home/2022…

Thanks for reading! 🤩

businesswire.com/news/home/2022…

• • •

Missing some Tweet in this thread? You can try to

force a refresh