A few months ago, #markets expected U.S. #inflation to peak by mid-2022 at around 7% to 8% at the headline level and then anticipated that generalized #price gains would decline into year end, closing the year around 4%.

However, the tragic war now unfolding with Russia’s attack upon Ukraine has not only sent #energy prices skyrocketing but it has led to much greater uncertainty over #economic growth and #MonetaryPolicy reaction functions, in Europe and indeed around the world.

Core #CPI (excluding volatile #food and #energy components) came in at 0.5% month-over-month and 6.4% year-over-year. Meanwhile, headline CPI data printed at 0.8% month-over-month and came in at 7.9% year-over-year, the greatest increase over a 12-month period since January 1982.

Today’s report showed continued strong prints in #gasoline, #shelter and food components, which are all areas that have been impacted by #supply disruptions/constraints, and unfortunately, are all essentials.

Interestingly, used #car prices declined 0.25% this month. The explosive growth of #AutoPrices, and particularly used autos is clearly dulling sentiment, which plummeted recently in the #ConsumerSentiment surveys, so as they say: “High prices cure high prices.”

Perhaps even more concerning is the large jump in #fruits and vegetables, up 2.34% this month, and running at a 16.3% three-month annualized rate, which is a daunting foreshadowing of even higher #FoodPrices on their way over the coming weeks and months.

With 34% of #wheat production coming out of the #Ukraine and Russia, and 17% of global #corn production coming out of these countries, the prices for feed for animals, vegetable oils, etc., suggest that #food prices are going to stay sticky-high, or may go even higher.

Still, with all the confusing #macroeconomic crosscurrents at play today, how else do we think the Russia/Ukraine war will impact the #economic outlook and #inflation?

First, the war, and the attendant #energy price shock, pose a significant downside risk to European, and therefore global, #industrial production, so we can expect to see sharp declines in Euro-area #PMIs and other data that correlate to growth in industrial production.

Further, we are also likely to see a relative #growth shock from these events, as #Europe will be impacted to a much greater degree than the United States.

Still, we do not currently foresee an outright #recession in the #eurozone, and we also saw today that the @ecb is taking a more hawkish path.

While most of the near-term #InflationShocks are supply-side, it is clear (now to the ECB) that excessively easy #monetary policy is the wrong stance, and the ECB made that point with today’s more rapid acceleration of #asset purchase program slowing and earlier exit.

Similarly, in the U.S., the @federalreserve will likely moderate the pace of policy #normalization, now that @QuantitativeEasing has finally ended, but this does not change the direction of travel.

Finally, while #economic growth in the U.S. may witness a minor hit as a result of increased #energy costs, the normalization from pandemic period consumption behavior is likely to swamp this effect.

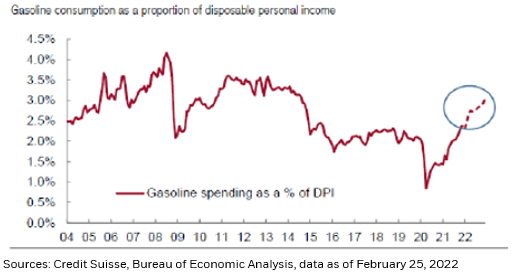

The fact is that #gasoline consumption as a proportion of #DisposableIncome, while set to grow sharply, is still starting from such a relatively low base that its influence should be modest at the aggregate level.

That said, the share of after-tax #income spent on both #food and #fuel is much greater for lower- to middle-income cohorts, so if #inflation in these areas continues to rise in a persistent manner this year, it will cause considerable stress for these households.

In all, with all the #crosscurrents in growth, inflation and #geopolitics today, this may be toughest balancing act we have ever seen a #Fed have to negotiate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh