#GM!

1/ How do the cross-chain #bridges works? In this #visualguide, we explain how assets are transferred between chains and how interoperability becomes a fundamental aspect of the future.

#DeFi #Cryptocurrency #Ethereum #Bitcoin $ETH $BTC

1/ How do the cross-chain #bridges works? In this #visualguide, we explain how assets are transferred between chains and how interoperability becomes a fundamental aspect of the future.

#DeFi #Cryptocurrency #Ethereum #Bitcoin $ETH $BTC

2/ Blockchain networks are very fluid and efficient as single entities but lack the ability to communicate with each other. This creates demand for seamless transfer across different chains without using centralized exchanges as intermediaries or selling the token first.

3/ Cross-chain #bridges solve the problem by enabling the transfer of tokens, smart contracts, data, feedback, and instructions between two independent chains without intermediaries.

4/ In general, cross-chain #bridges are divided into two based on the transactions validator: trustless bridge and trusted bridge.

5/ Based on the purposes, #bridges can be classified into:

- Asset-specific @WrappedBTC

- Chain-specific @auroraisnear, @NEARProtocol ~ Rainbow Bridge

- Application-specific @THORChain, @compoundfinance

- Generalized @axelarcore, @LayerZero_Labs

- Asset-specific @WrappedBTC

- Chain-specific @auroraisnear, @NEARProtocol ~ Rainbow Bridge

- Application-specific @THORChain, @compoundfinance

- Generalized @axelarcore, @LayerZero_Labs

6/ Based on the architectures, #bridges also can be classified into:

- External validators & federation

- Light clients & relay

- Liquidity providers' network

- External validators & federation

- Light clients & relay

- Liquidity providers' network

7/ By understanding the #bridges architecture we can look at different traits that explain the strength and weaknesses of each bridge.

8/ Wrapped tokens are an integral part of the #bridges to achieve interoperability. Assets that are transferred to the bridge will be minted in the form of wrapped token that adheres to the rules, data, and contracts (native) on the destination blockchain.

9/ In this diagram we can see how assets move between chains by using the lock & mint mechanism and burn mechanism. These two mechanisms are the most popular and versatile to move assets across multiple chains.

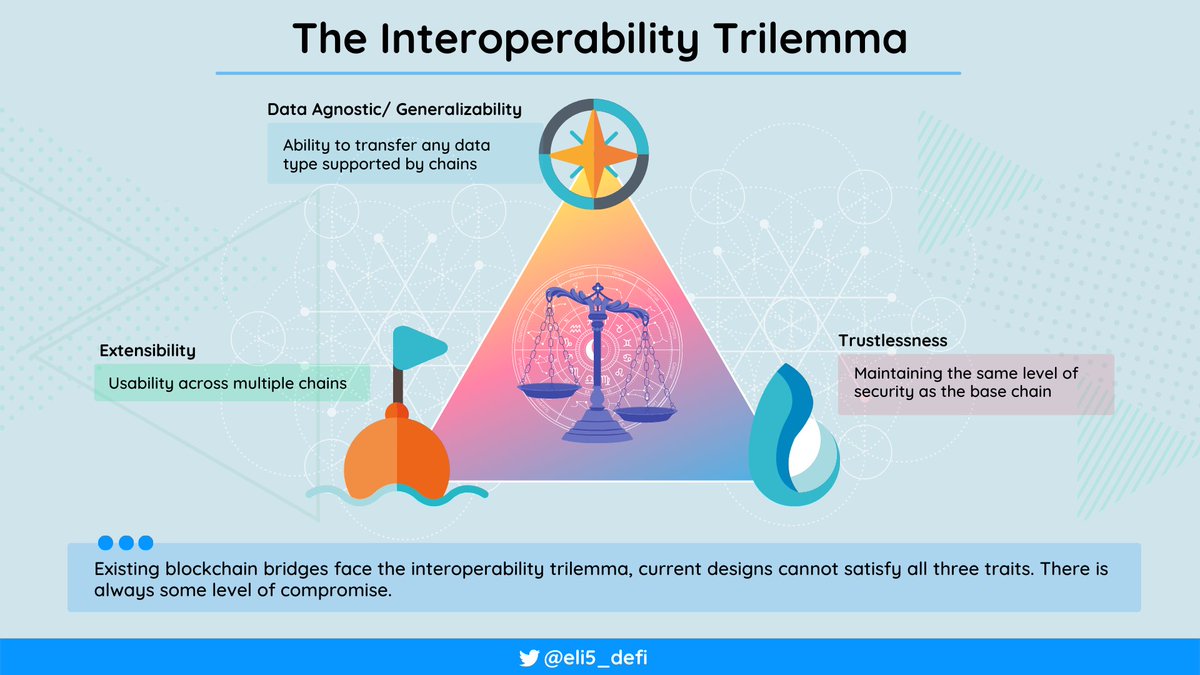

10/ Existing blockchain #bridges face the interoperability trilemma, current designs cannot satisfy all three traits. There is always some level of compromise.

11/ Despite facing the trilemma, cross-chain #bridges are still important because they can increase asset productivity, improve user experience, and support the distribution of liquidity across the chain and decentralized apps (dApps).

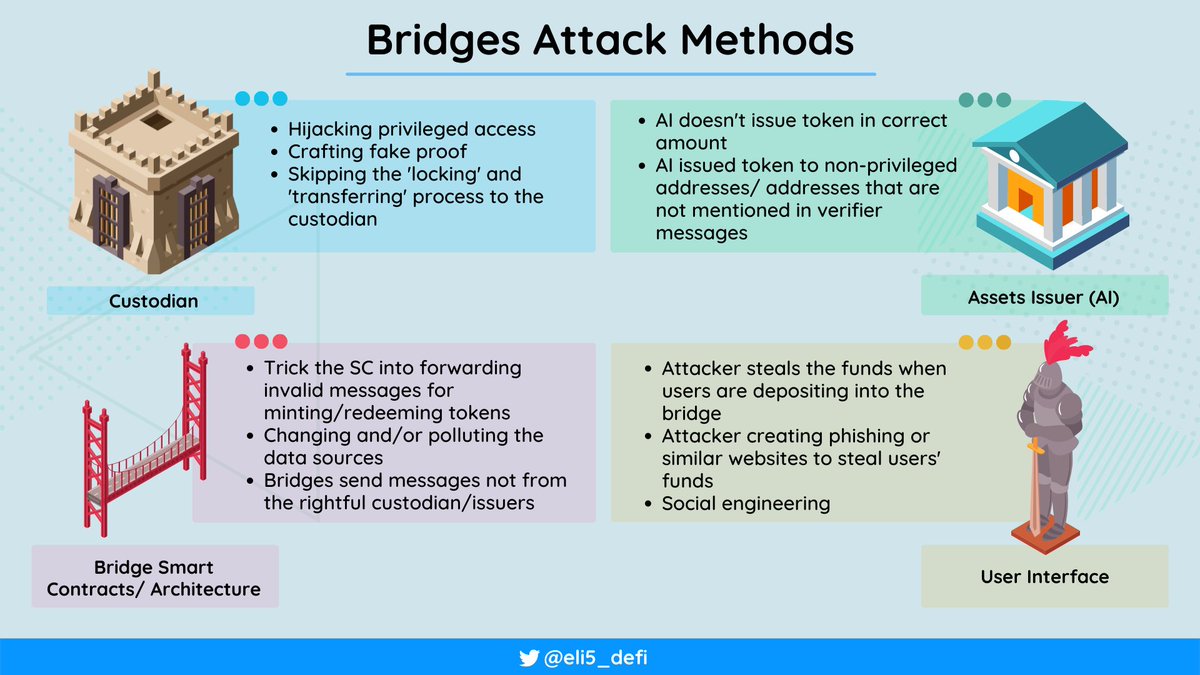

12/ #Bridges are not without issues, growing concerns directed toward asset centralization and imbalance of liquidity. Security also becomes a big problem since the massive assets deposited lure hackers to steal and exploit the bridges.

13/ #Bridges attacks not only target the asset custodians, but other targets such as asset issuers, smart contract vulnerability, and bridge users are also prone to security hacks.

14/ Beyond the #bridges: #eWASM is a project to bring highly flexible, near-native performance and optimization of web assembly for Ethereum to achieve interoperability and flourish application developments on #Ethereum.

@ethereum

@ethereum

15/ Beyond the #bridges: Layer-0 like @Polkadot and @cosmos allows developers to create custom blockchains that can be tailored to their requirements by combining various elements from different L1s while retaining their own ecosystem

$DOT $ATOM

$DOT $ATOM

16/ Beyond the #bridges:@axelarcore, @LayerZero_Labs, @OneAnalog, and @MapProtocol are several examples of projects that focused to bring interoperability across the chains.

17/ The Takeaway from The Bridges

#DeFi #Cryptocurrency #Ethereum #Bitcoin $ETH $BTC $NEAR $SOL $FTM

#DeFi #Cryptocurrency #Ethereum #Bitcoin $ETH $BTC $NEAR $SOL $FTM

19/ If you want to understand more about #Ethereum L2 #Rollups after bridging from the mainnet. Please find below thread:

https://twitter.com/eli5_defi/status/1533504611273031680?s=20&t=HvMMRsgP6TlaoRsaGmf0Wg

20/ Like our threads and want to support us? please use our #GMX referral link for 10% trading discount:

gmx.io/#/?ref=eli5defi

gmx.io/#/?ref=eli5defi

21/ Shout-out to the account below for amazing educational content:

@SalomonCrypto

@blocmatesdotcom

@shivsakhuja

@rektdiomedes

@knowerofmarkets

@rektdiomedes

@BarryFried1

@The_ReadingApe

@VirtualKenji

@ManoppoMarco

@Storgan_ManleyX

@alpha_pls

@SalomonCrypto

@blocmatesdotcom

@shivsakhuja

@rektdiomedes

@knowerofmarkets

@rektdiomedes

@BarryFried1

@The_ReadingApe

@VirtualKenji

@ManoppoMarco

@Storgan_ManleyX

@alpha_pls

22/ If you find our thread and #visualguide useful, please like and retweet. Big thanks to @mimiLFG for proofreading and reviewing this #visualguide

https://twitter.com/eli5_defi/status/1569337743221862402?s=20&t=t4S4Xvlm89YSEcb-zB_IJg

• • •

Missing some Tweet in this thread? You can try to

force a refresh