the key criterion [for liquidity] isn't "can you sell it?" it's "can you sell it a price equal or close to the last price?"

selling may take a long time

require accepting a big discount

or both.

it's not illiquid or liquid; it's entirely situational.

can you sell x percent of the portfolio in a day, y percent in a month, or z percent in a year?

does any fund provide liquidity reporting like this? i haven't seen it yet but i kind of like it as a measure. however...

sell the things people are buying, and

buy the things people are selling

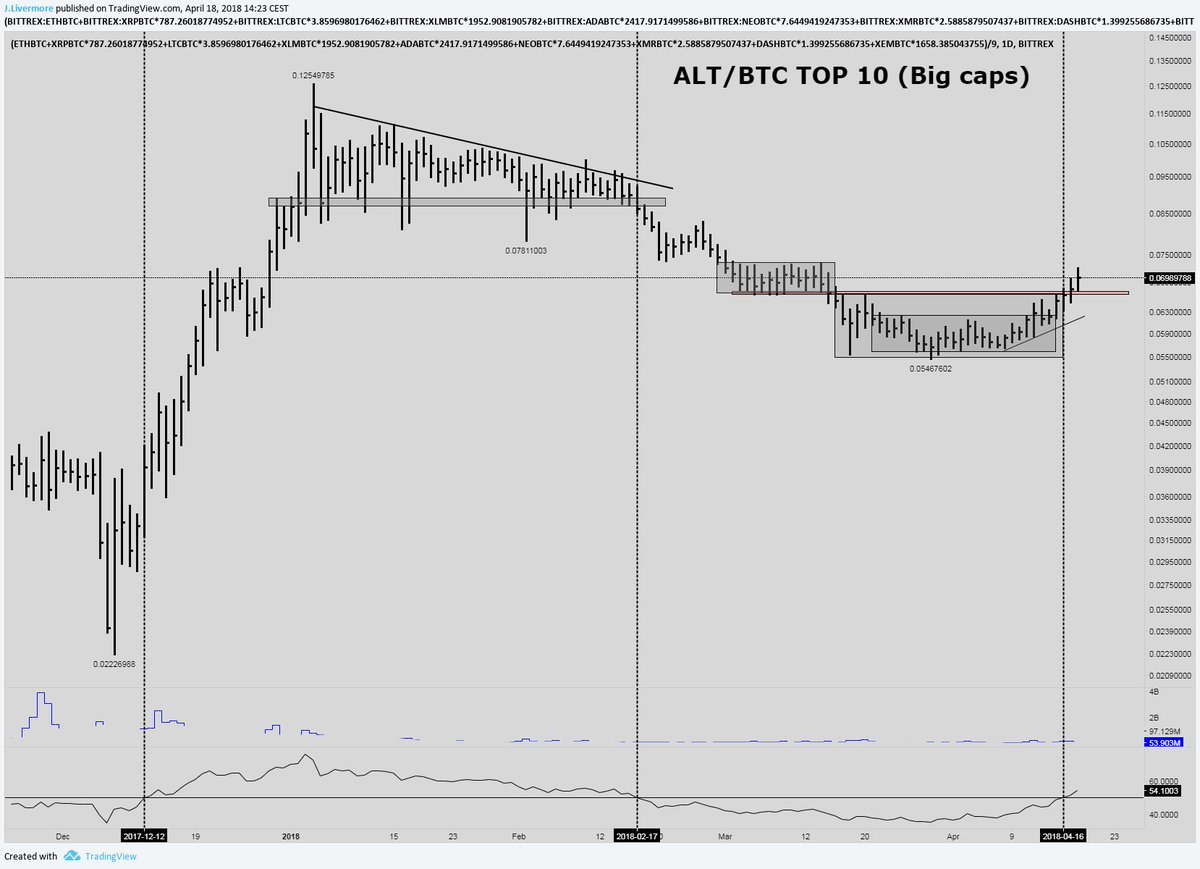

this is called a "contrarian" strategy. what might that look like in crypto?

- the other people who hold it

- the mentality and investment strategy of those holders

- your entry price, and target exit price (moon isn't a price fyi)

- crypto market impacts on liquidity

- macro market impacts on liquidity

this letter on liquidity, from 2015: oaktreecapital.com/docs/default-s…

all of his letters: oaktreecapital.com/insights/howar…

one of my favorites is 2017's "There they go Again... Again": oaktreecapital.com/docs/default-s…

enjoy!