Sparked by their report grattan.edu.au/report/keep-ca…

200k Victorians lost power on 25 Jan and Alcoa smelter lost power the day before. Is this normal now? What are the implications?

should not target zero outages - the cost of perfection is not worth the benefit. See former SA Gov measures to respond to blackouts - $115m+, gen used for 4 hours so far

This looks concerning but is not in fact concerning. outlook only considers firm commitments for generation - very conservative take, to signal need for new inv

Gas market uncertain, but risks manageable

Variable RE can be matched with flex investment.

Climate policy uncertainty - needs resolution, NEG or similar second best can work.

Govt interventions - may exacerbate underlying uncertainty

Need for backup: RERT and variants can handle.

Rarity of load shedding events illustrates changing nature of system. NEM was oversupplied for most history. But this has changed. The system has been close to shedding several times in recent years. Risk profile has changed.

Implement Integrated System Plan - augment certain transmission, unlock renewable zones

Review Reliability Standard in light of latest Value of Customer Reliability study. What is tolerance for load shedding given greater device use etc?

Strategic Reserves

In-Market Reserves driven by contracting and risk/reward of price risks. Price signals supply to enter.

Emergency Reserve is for when market supply falls short.

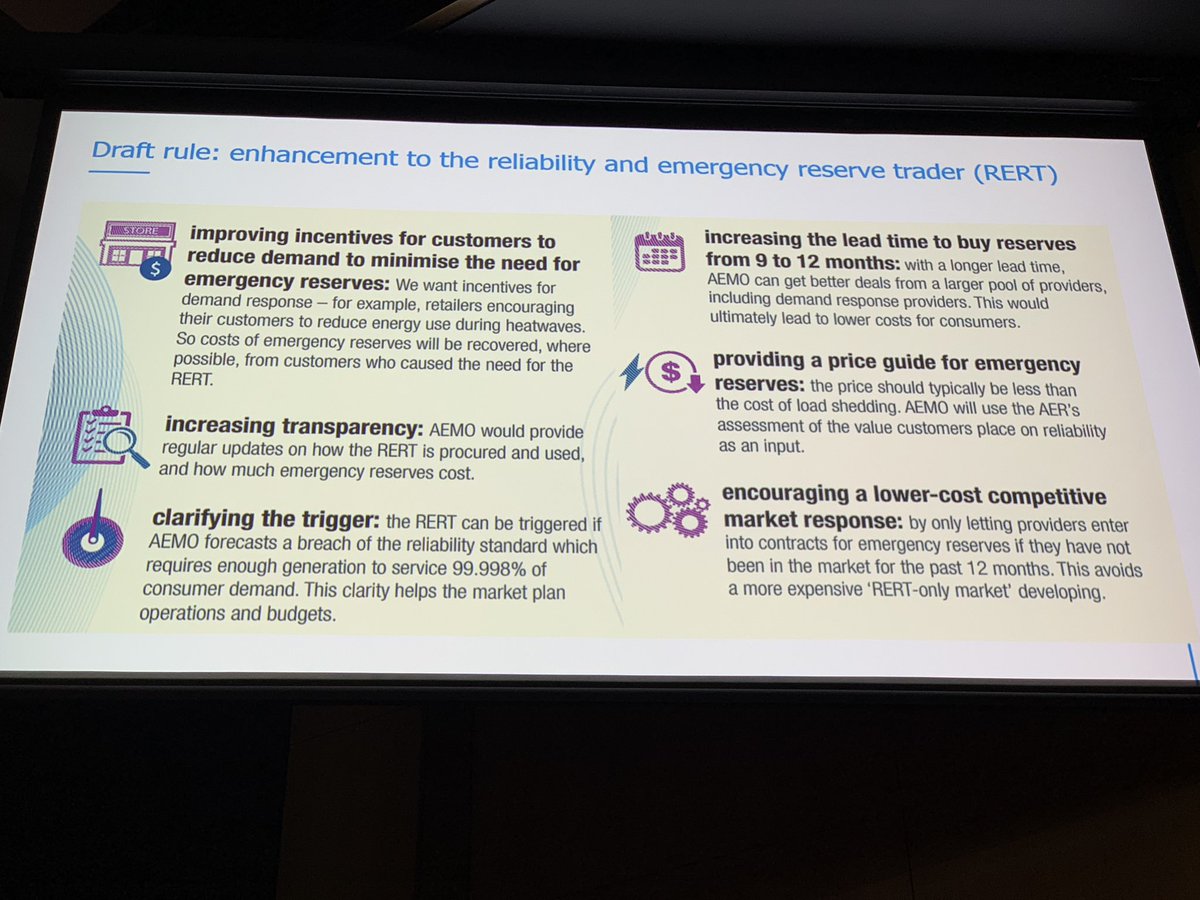

Recover costs of RERT from customers responsible for its need

Longer lead time for procurement to cut costs

Ensure price of Reserves less than cost of load shedding

Encourage market response.

Submissions due by 21 March! aemc.gov.au/rule-changes/e…

Guy Dundas: no. Our problems stem from the sudden shock of a big generator retirement. If we can get a better investment environment, we can manage.

A: Paul AEMO: SA blackout has been heavily reviewed and we’ve learned a lot. Many new initiatives to strengthen system - interventions for system strength show AEMO proactivity.

Hazelwood baseload doesn’t match well with capacity needs

We are reviewing need for updating framework to, eg, reduxe need for intervention for system security services.

Doubt we can slow the system transition - we need to keep up.

Hazelwood: 3 year notice rule will help avoid surprises

A: Paul - yes, PV reduces max demand esp during midday. But peak now comes in early evening, and solar can’t help much then.

A: Guy: remember generation investment reflects rooftop PV

A: Guy - prob is lack of transparency. If it stacks up, do it. Pumped hydro definitely has a place - But does 2GW have a place in 2024? lots of risk given rapid transition.

A: Suzanne - we are advisers to govts. Work program has been underway for a while and is unlikely to change radically. Accept rule change proposals from anyone. RRO rules are important development

A: Suzanne - no. Collaboration is needed and happening. Of course there are robust discussions about important issues. The three institutions (with AER) need to work together, and are.

A: Guy: Liddell closure will price manageable with so much notice.

A: Suzanne: we will get through current tight spots

A: Paul: investment and demand response will come through, with better coordination of distributed resources