A THREAD

#NHFAct2018

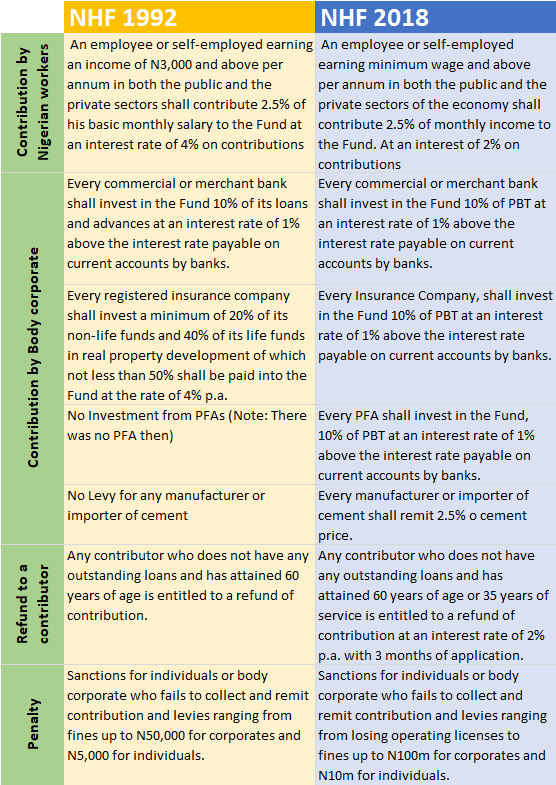

- Levy of 2.5% on each bag of cement

- Contribution of 2.5% of monthly income of all employees (Public and Private Sector) and self-employed earning from minimum wage and above at an interest rate of 2% p.a.

#NHF2018

- The FG will make “adequate financial contribution & grants” to the fund as it deem fit. #NGF2018

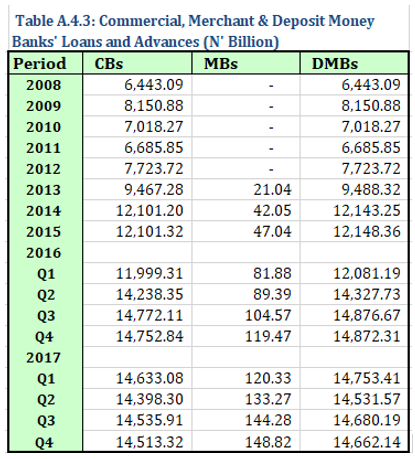

- The CBN shall collect the investment amounts from Commercial and Merchant banks at the end of each year.

#NHF2018

- The Federal Mortgage bank of Nigeria (FMBN).

How?

- Through lending to PMB (Primary Mortgage banks)

Who can access the loan?

- Individual Contributors

- Developers

#NHF2018

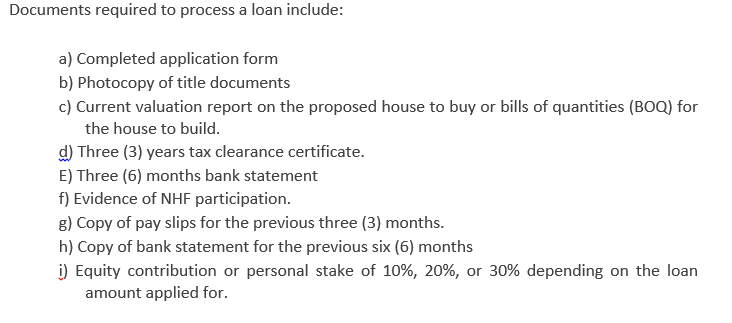

- A contributor interested in the NHF loan applies through a PMB, who packages & forwards the application to FMBN. The loan amount is determined by applicant’s affordability & not 2.5% contribution. #NHF2018

- Yes it is mandatory for everybody earning any amount from minimum wage and above. Whether you are a public worker, a private worker or even self employed. As long as you are earning any amt from minimum wage, you're mandated to contribute. #NHF2018

See attached chart.

#NHF2018

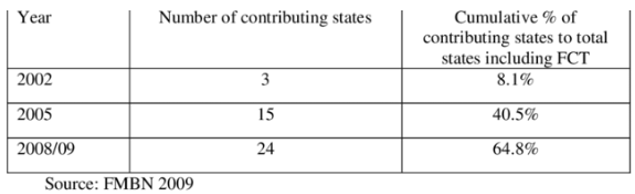

There were several reasons why the scheme was not fully implement. I will explore some of them in the next few tweets.

#NHF2018

According to FMBN MD Ahmed Dangiwa, since inception (27 years ago), the NHF has disbursed a total of N193.4 Billion loans to a total of about 23,000 beneficiaries and refunds to about 230,000 retirees. #NHF2018

sunnewsonline.com/fmbn-disburses…

@PwC Nigeria posted 10 reasons why the bill in its present form is a bad idea. I will like to highlight 7 of them for specific reference. #NHF2018

pwcnigeria.typepad.com/tax_matters_ni…

- Imposition of the 2.5% levy on cement is a tax on property dev which will make housing less affordable

#NHF2018

This bill is clearly an attempt by the NASS to mobilize more funding for the NHF which in 27 years has not been able to mobilize much in terms of finance. So clearly that is understood. However, the challenges of housing, goes beyond just funding. #NHF2018