2019: fuqua.duke.edu/duke-fuqua-ins…

2015: federalreserve.gov/econresdata/no…

2010: communitycapital.unc.edu/research/cra-d…

2008: reuters.com/article/usa-fe…

2008: money.usnews.com/money/blogs/th…

The CRA DOES NOT cause financial crises. Full stop.

I don't know about you, but I have never, ever come across a community where banks are meeting all credit needs.

If you're like me, you get a little excited when the @FDICgov sends out its quarterly list of banks examined under the CRA in the past three months.

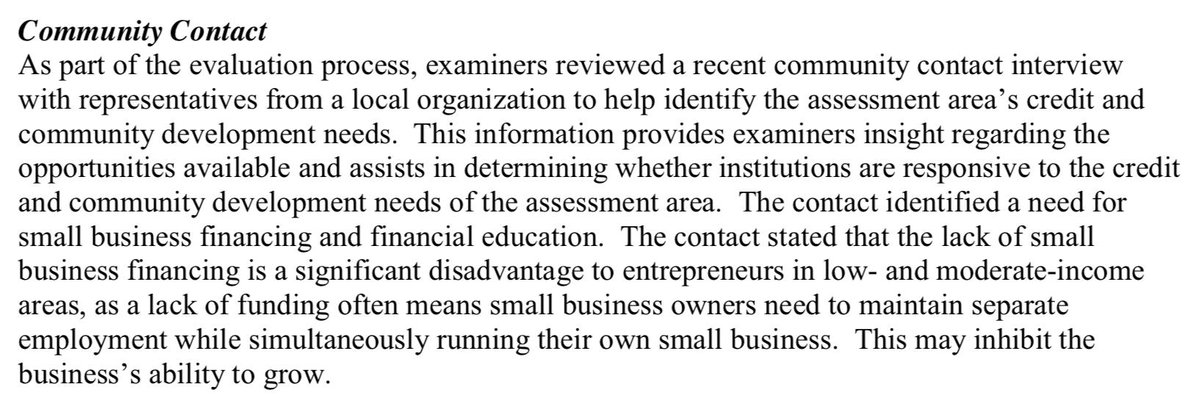

@FDICgov) where the bank is headquartered, also reach out to "community contacts" whose feedback remains anonymous.

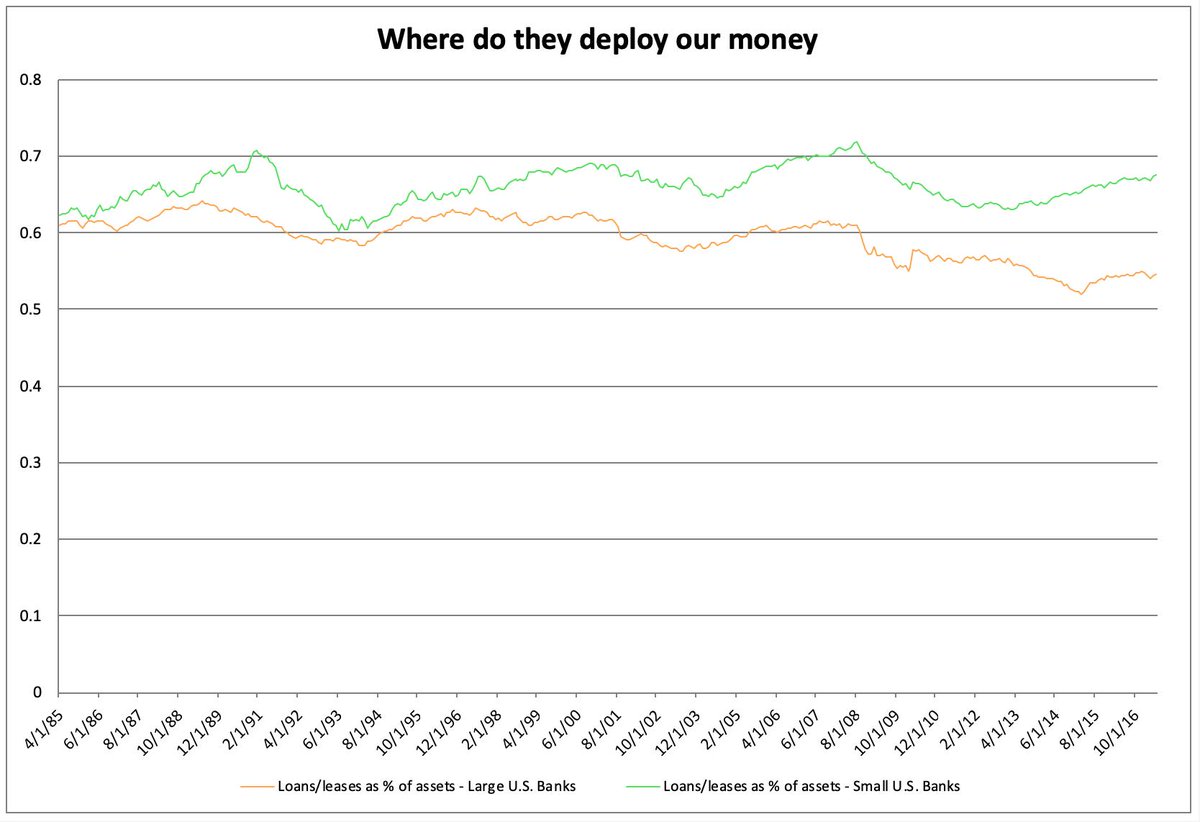

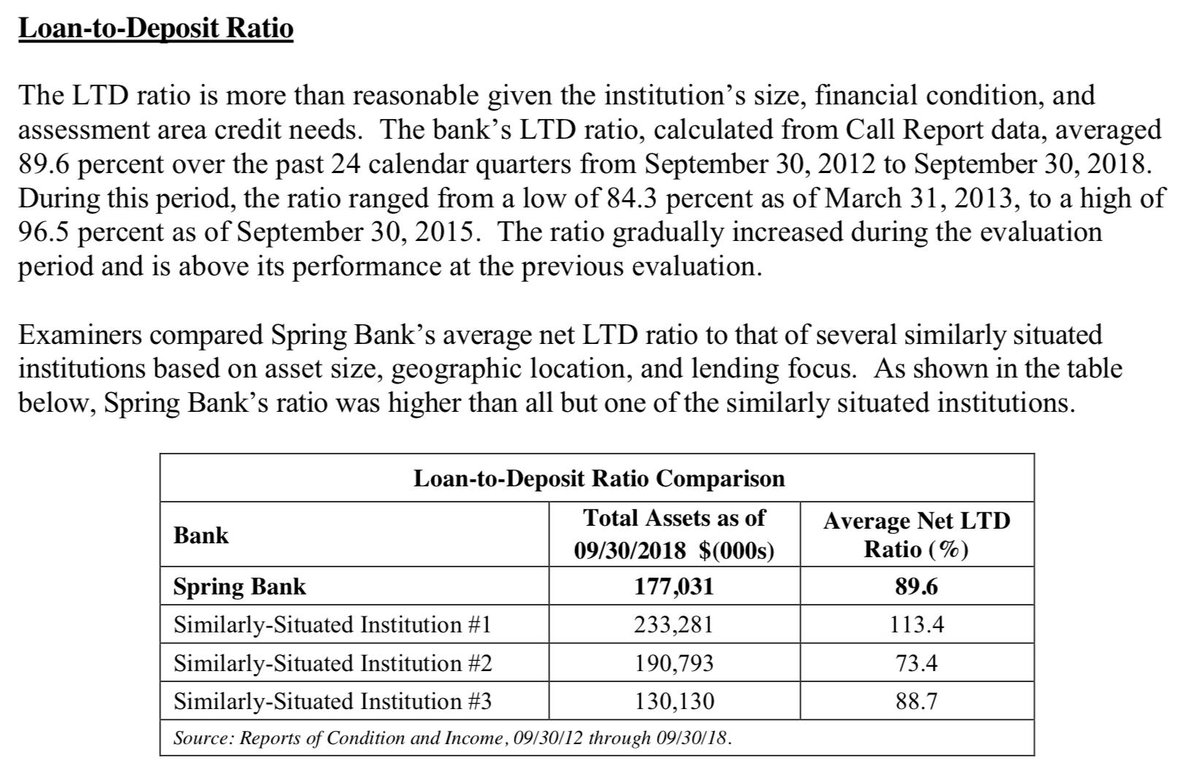

Let's start with something comprehensive, the bank's loan-to-deposit ratio. Examiners want to know what proportion of deposits are being loaned out instead of placed in more exotic investments.

At Spring Bank, that ratio is 89%.

89 percent!!!!