expanding on my thoughts shared with @MelissaLeeCNBC and crew @CNBCFastMoney👇

✅ legacy finance players are legitimizing the asset class

✅ new consumer touch points are expanding access

✅ new platforms and services are enabling institutional investment

- @NYSE @Bakkt announced $182.5M raise for bitcoin exchange, clearing & custody services

- @DigitalAssets bitcoin trading & custody set for launch

- @TDAmeritrade launching bitcoin futures

not to mention ppl like @jack are #stackingsats

- it’s easier than ever to buy bitcoin with @CashApp

- @fold_app and @FlexaHQ make it easy to spend bitcoin at your favorite stores including @Starbucks, @WholeFoods & @Nordstrom

- get sats back when you shop at over 500 retailers w/ @trylolli

- at least 8 cryptos are represented on traditional exchanges now (@xbtprovider, @GrayscaleInvest, @AmunAG)

- @Bakkt physically-settled futures *supposedly* coming in july

- @CoinbaseCustody continues to expand access

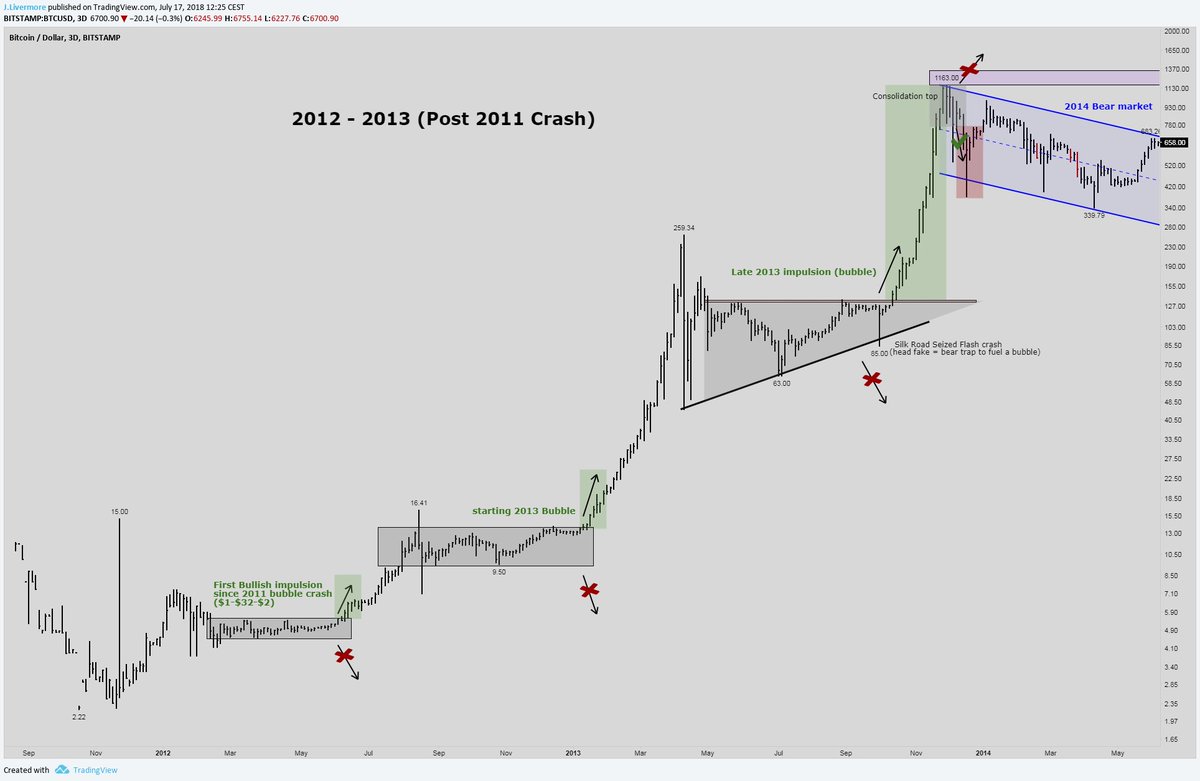

but crypto winter did what it does best - froze out the 💩, drove consolidation , and generally flushed out the market 🚽

➕ bitcoin dominant once again (>60%)

➕ finance media refers to it as an “asset” now

➕ world’s most valuable co. (@microsoft) is building digital id services on top of it

➕ cos. like @square are investing in products for it

but if the ETP’s on the market do act as punxsutawney phil as @fundstrat & @spencernoon have suggested before (), then things might just be trending up... 🌻☀🚀