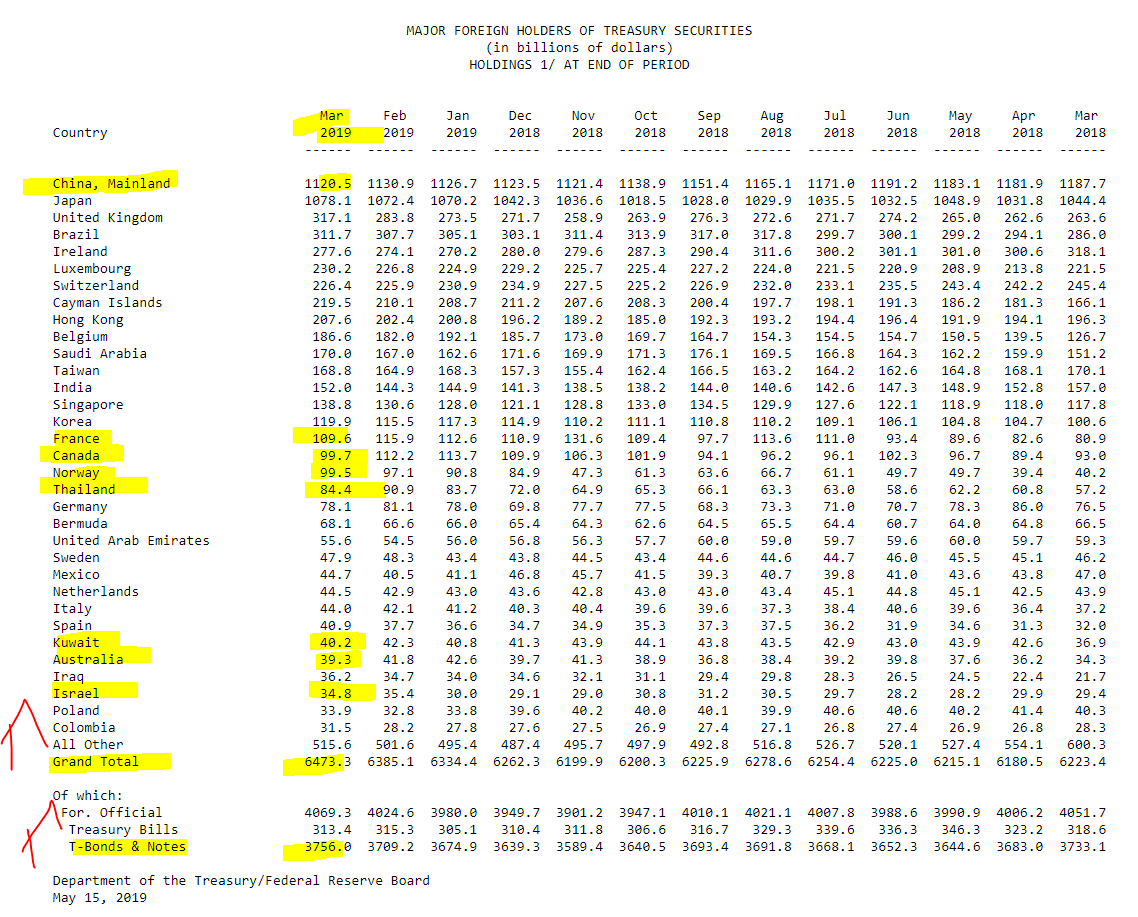

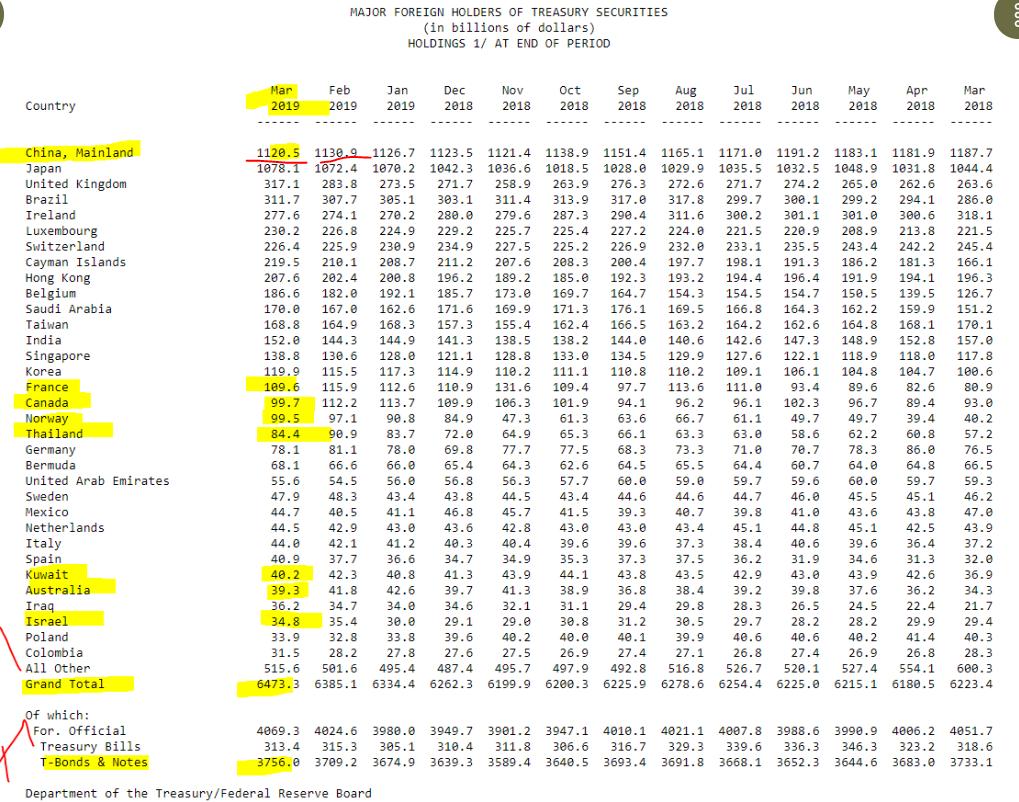

Sellers: China 🇨🇳 sold 10.4bn, France, Canada,, Norway, Thailand, Kuwait, Australia, Israel

Buyers: EVERYONE ELSE 🤗

Wut did they buy? T-bonds 👌🏻

They say foreigners are SELLING but they are BUYING MASSIVELY based on data 6473.3-6373.3 = + 88.2🤔

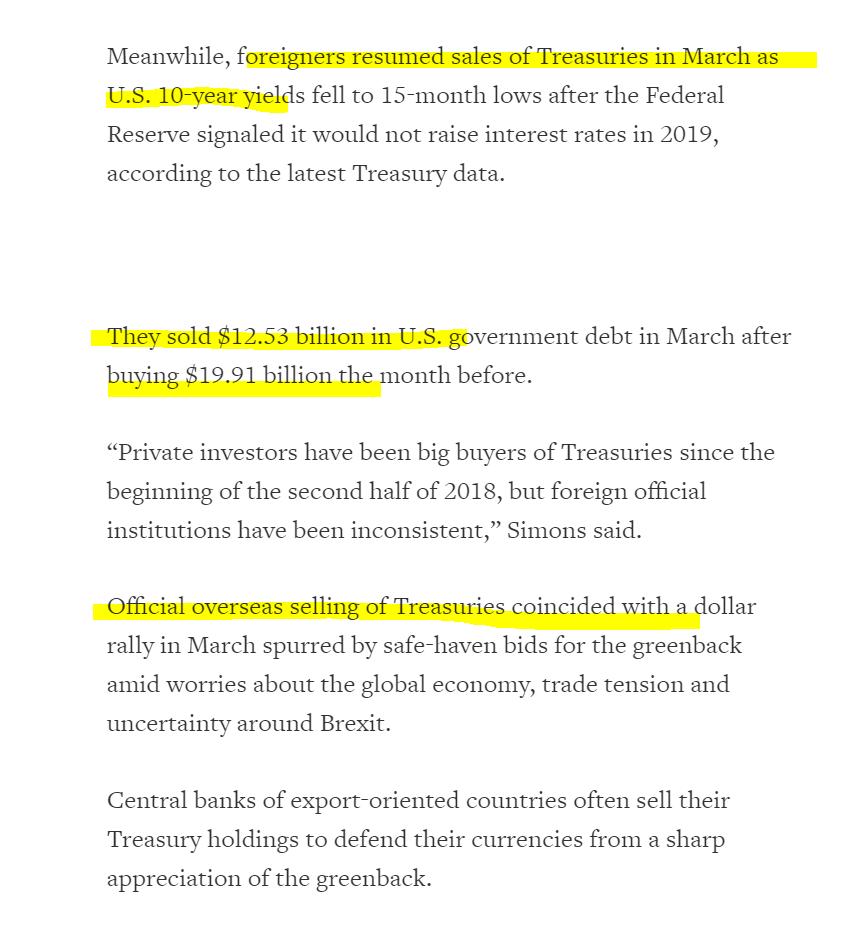

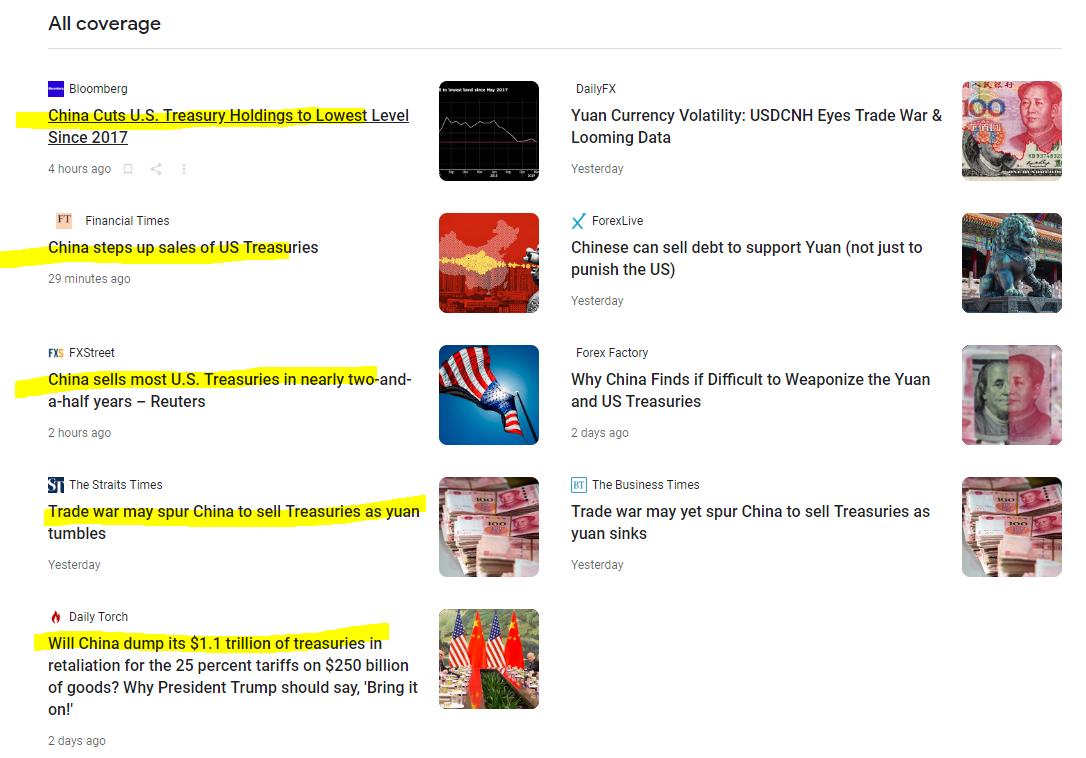

All super sensationalize to relate to trade-war (nuclear options & wut not). Foreigners BOUGHT A LOT of @USTreasury

U know wut I mean? U can give it an angle but China is free to sell & buy.

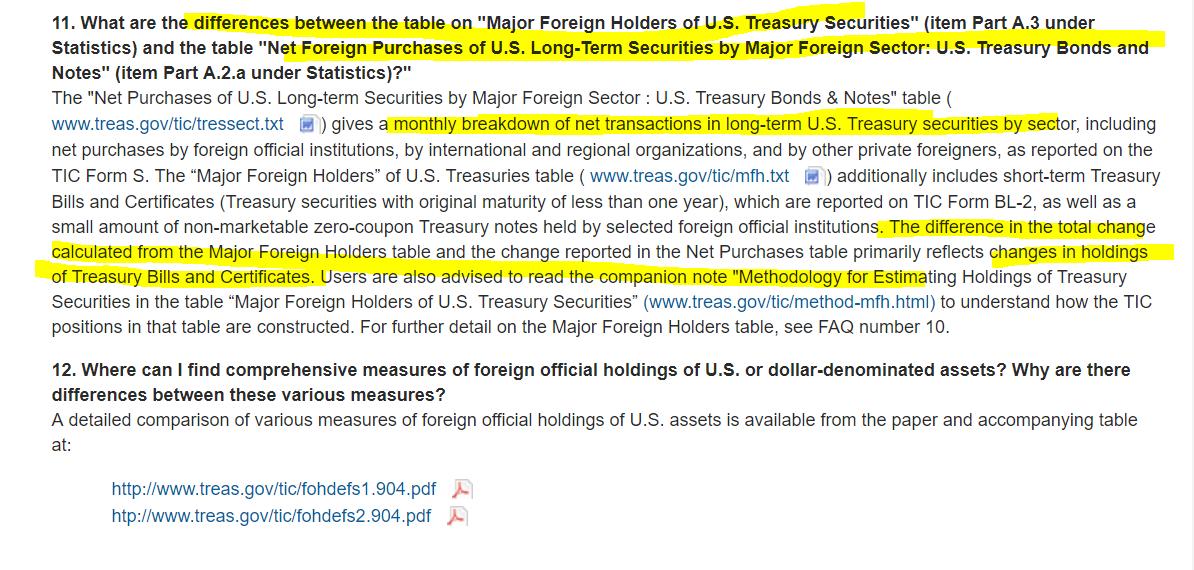

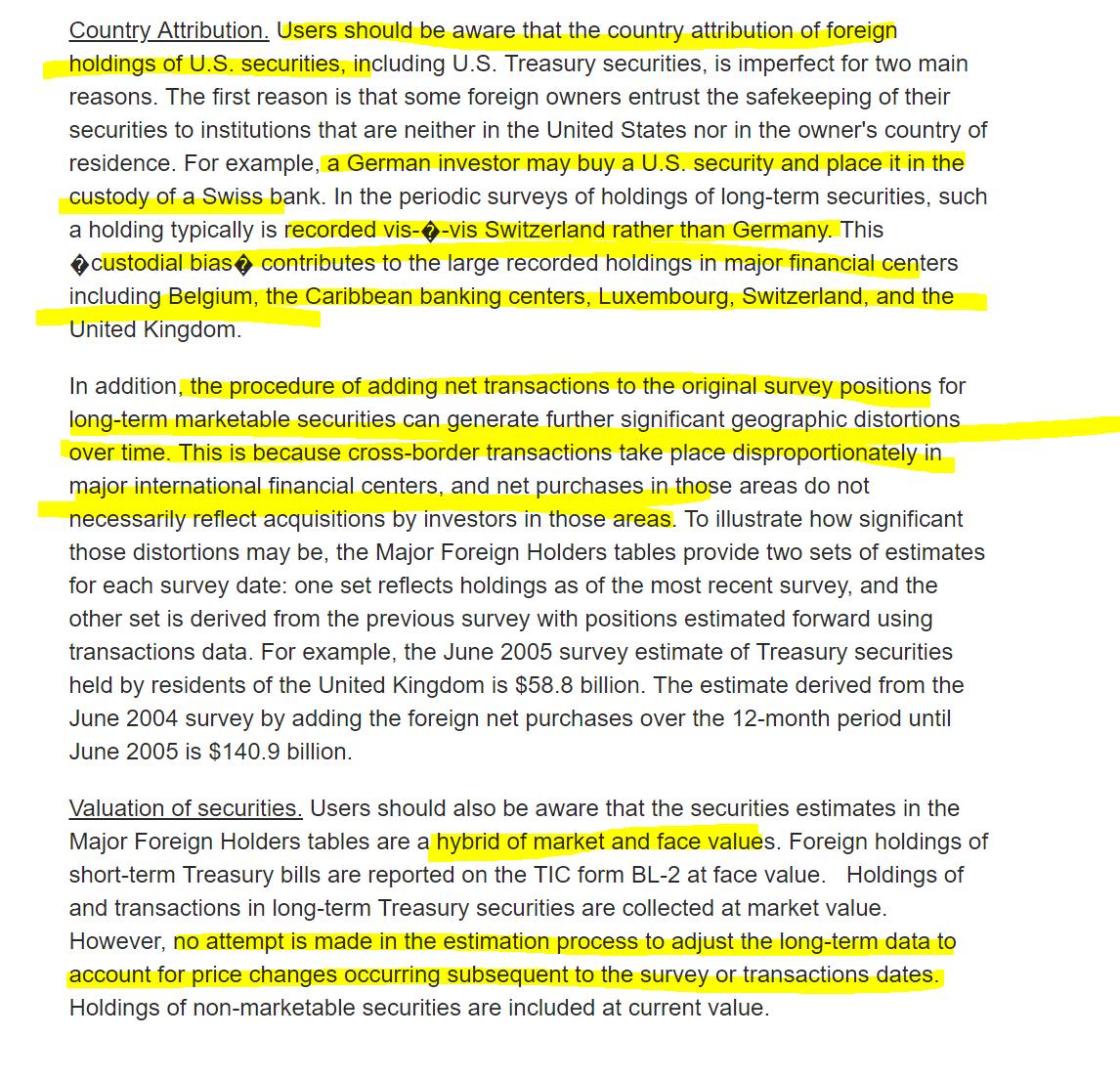

a) Net purchases only have net transactions;

b) Total CHANGE calculated on STOCK reflects CHANGES IN HOLDINGS of Treasury Bills & Certificates.

Link 👇🏻

treasury.gov/resource-cente…

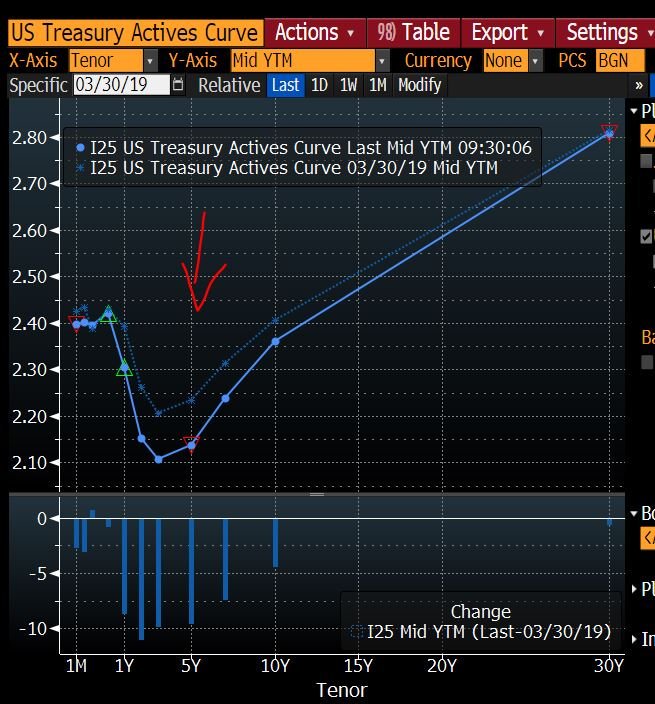

The Nike sign has moved downward since end of March & that means people have been BUYING more UST (markets pricing in lower growth in the future & Fed cuts). 10-yr 2.357%