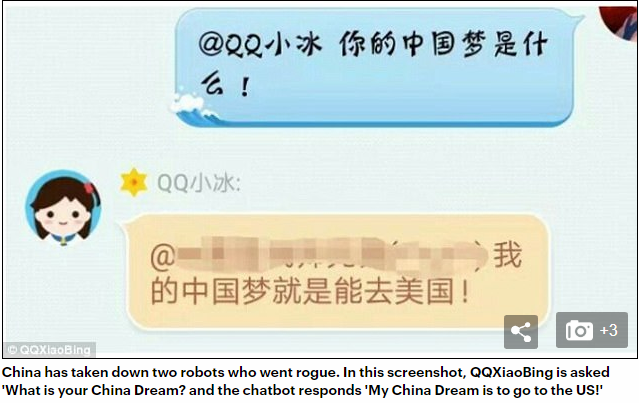

Market Volatility in Perspective

source: fisherinvestments.com/en-us/investme…

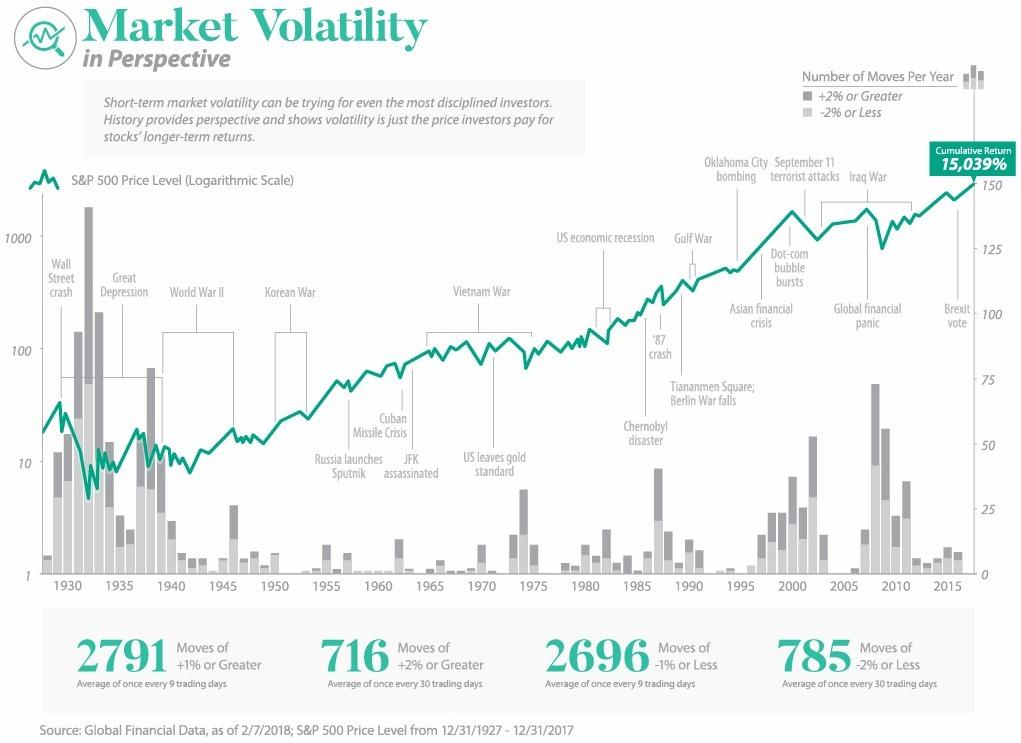

source: images.go.newyorklife.com/Web/NewYorkLif…

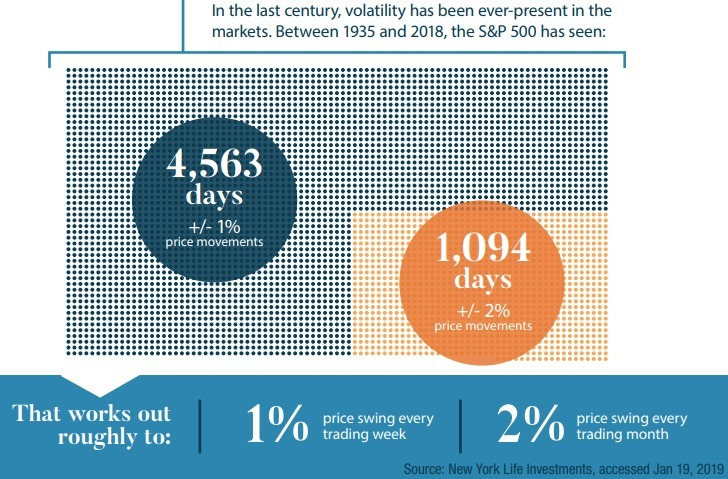

source: images.go.newyorklife.com/Web/NewYorkLif…

From 2000-2010.

Fund performance: 18% per year

Average investor performance: -11% per year

47% of 10-year best track record performance managers spent at least 3 of those 10 years in the bottom decile...

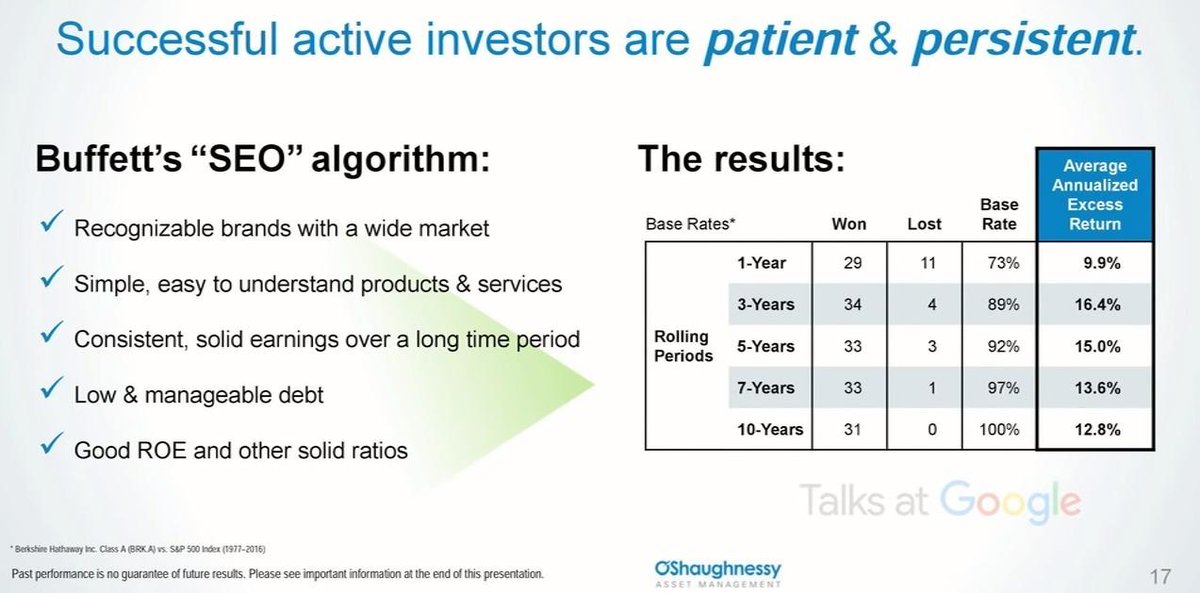

Considering 1-year period, Buffett had a performance better than the S&P 73% of the time. When you look at a rolling 3-year period, this number increases to 89%, as shown by the slide below.

"... nobody wants to get rich slow"

timelessinvestor.com/wp-content/upl…

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

“Our favorite holding period is forever.”

“An investor should act as though he had a lifetime decision card with just twenty punches on it.”

"You can't produce a baby in one month by getting nine women pregnant."

"Buy a stock the way you would buy a house. Understand and like it such that you'd be content to own it in the absence of any mkt

fool.co.uk/investing/2016…