(1/x)

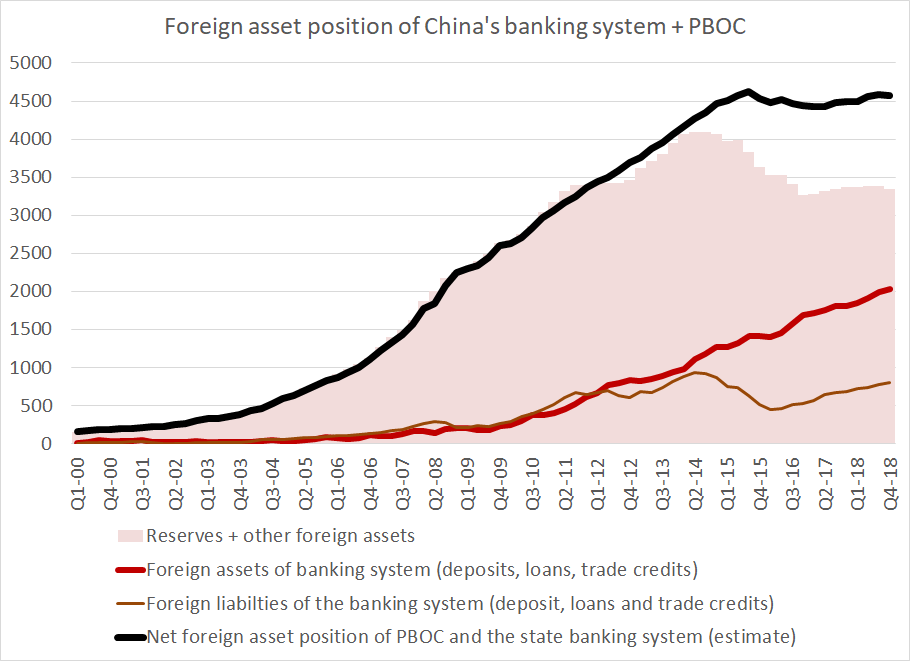

(4/x)

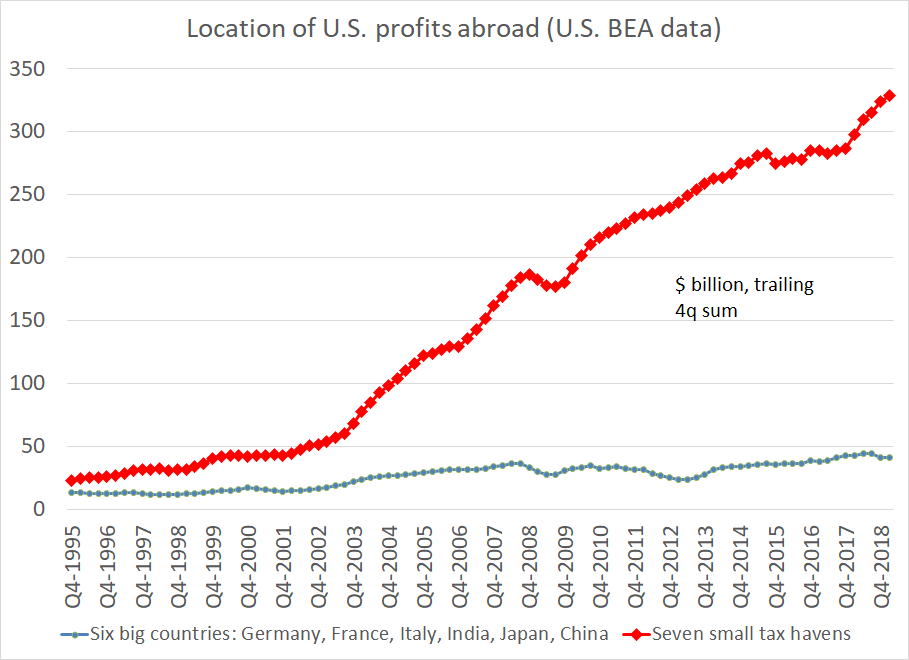

(5/x)

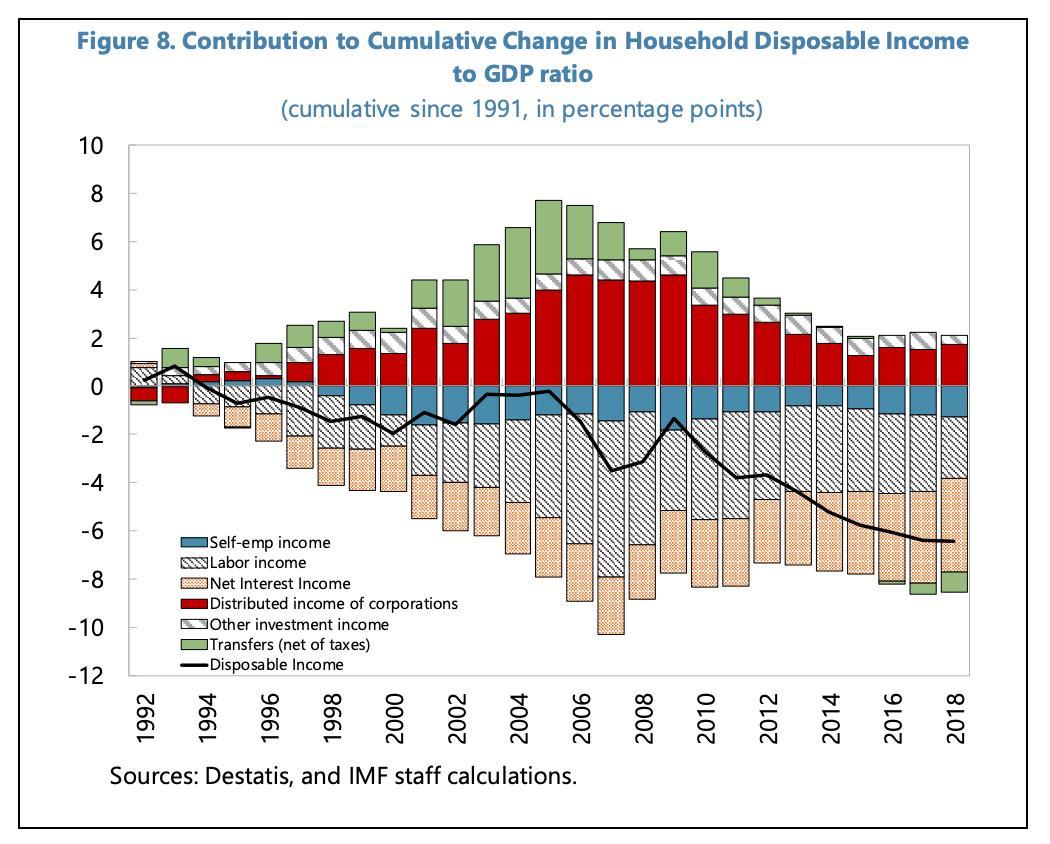

(distributed profits are taxed at a higher rate I think)

looking forward to the forthcoming IMF paper on this

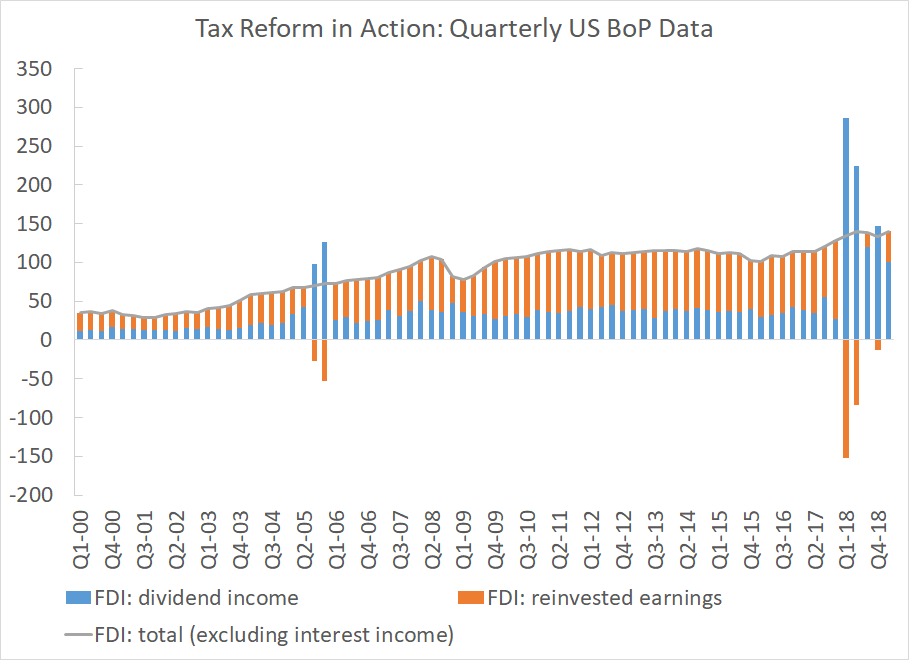

(6/x)

Directionally, that's the right advice but it is still fairly timid

(7/x)

The IMF's advice wouldn't solve the problem the FT recently highlighted

(8/x)

ft.com/content/eeadb2…

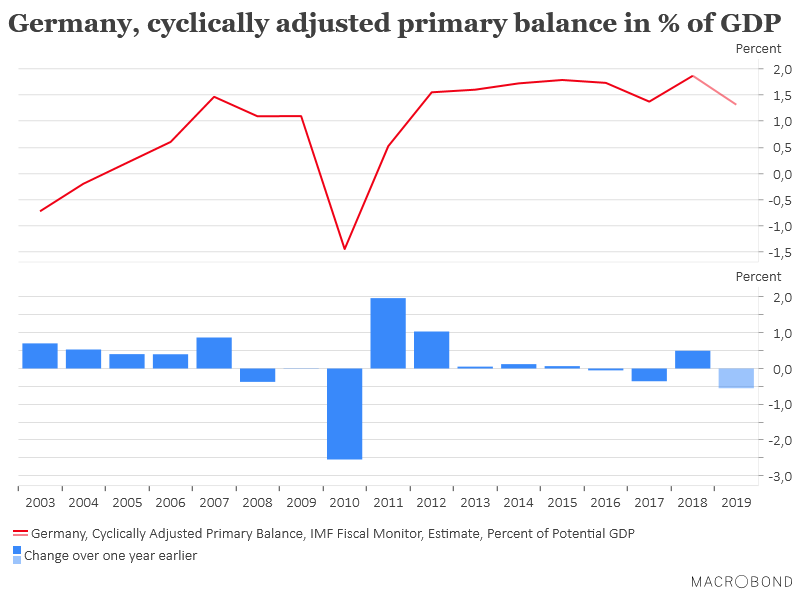

(11/x)

(12/x)

(13/x)

imf.org/en/Publication…

(14/14)