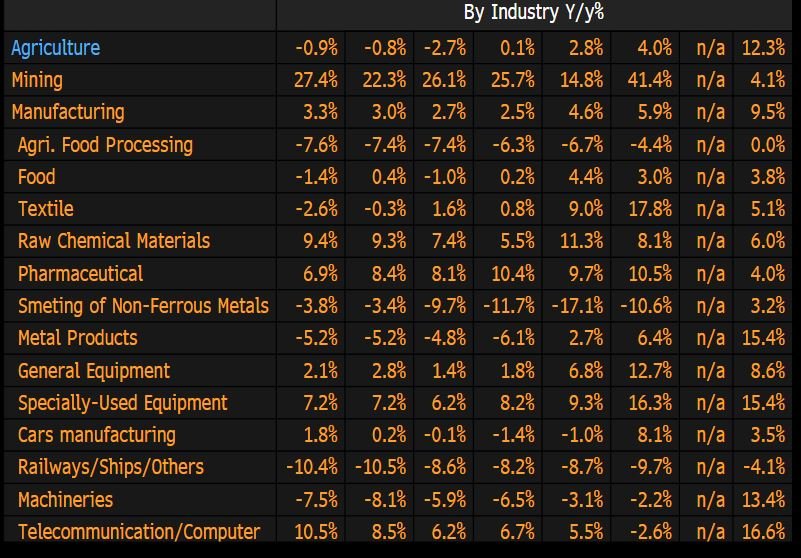

All to confirm what we know - global slowdown👈🏻

Starting H2 w/ PPI deflation, weak credit

Do you know what that means??? Cutting back discretionary & tightening purse strings 🥶.

Newton's 3rd Law: For every action, there is an equal and opposite reaction

a) High pork prices mainly due to swine fever

b) China's overall inflation is likely to be stable.

Notice what they emphasize & de-emphasize. That tells u what is coming & what they consider a hurdle to easing & not 😉.

a) Downward pressure on China's economy rising 📉

b) Faces severe external pressure

c) Rising jobless due to graduate season📉

d) Higher pork prices due to swine

e) CPI is likely to be stable ✅.

Implications?😉

Let's put this equation together

Growth down 📉 + CPI stable ✅ =Policy response❓

What to do❓🥁🥁🥁 Dun dun dun