"The Ethereum tech and infra and ecosystem has come so far in the last 3 years. How is ETH-BTC trading at the same price from 3 years ago?!?!?"

Here's fallacy in the logic

(this basically assumes BTC is beta, which is a reasonable assumption IMO)

Although it's easy to trick yourself into thinking it does, especially if you're a tech-centric person (which most ETH bulls are)

There is no way in hell BTC in its current form can scale. This is pretty clear to all ETH bulls

Because the market's expectations are orders of magnitude lower.

Even though this vision is clearly stupid and assumes that technology stops moving forward

And the ETH story is pretty weak. There is not much evidence to support DeFi today is more than altcoin traders trading against themselves

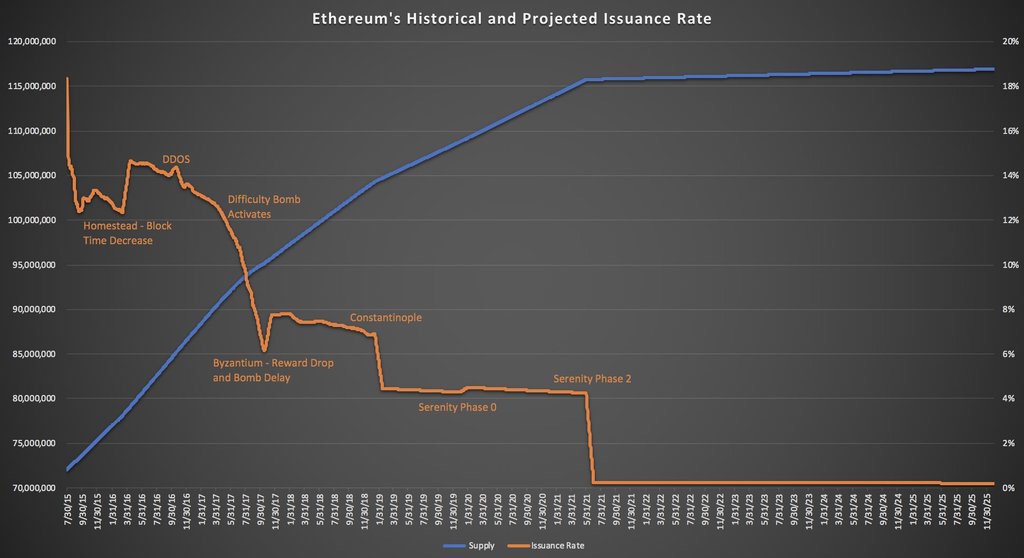

People are tired of waiting

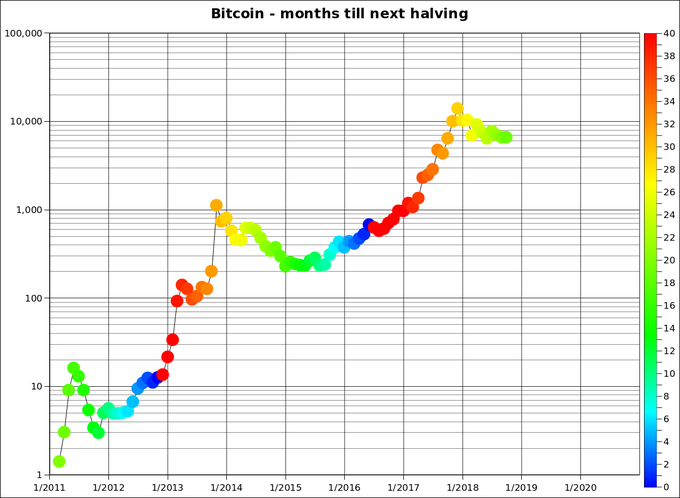

Basically all 2015-2017 era alts are going through the same problem, and they are all likely to continue to contract against BTC through this cycle, until they can demonstrate product/market fit and value capture

{fin}