This is joint work with @stwill1

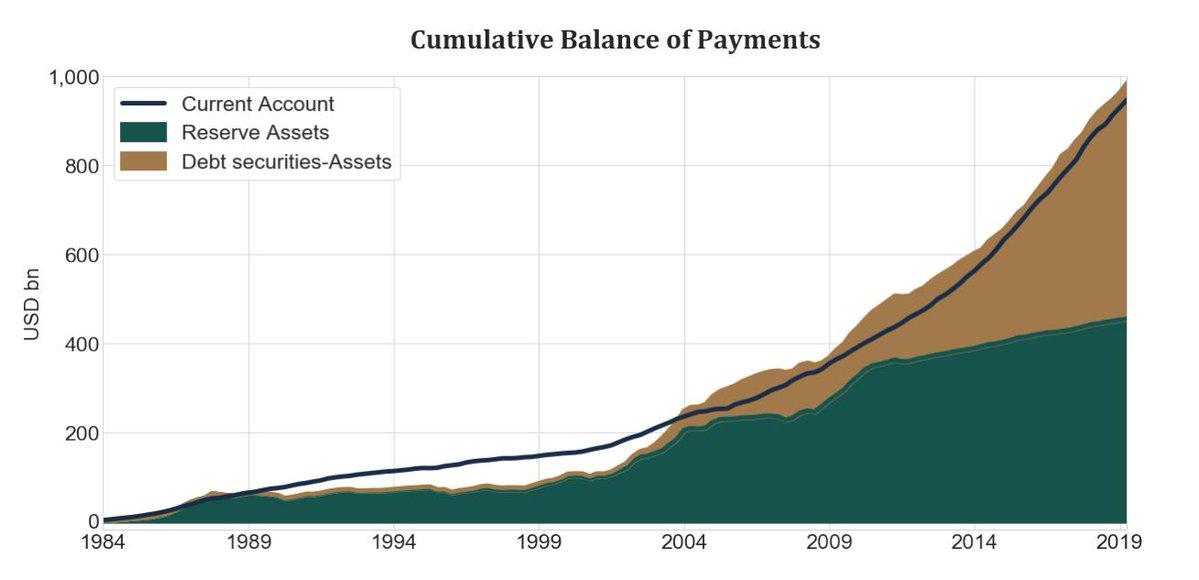

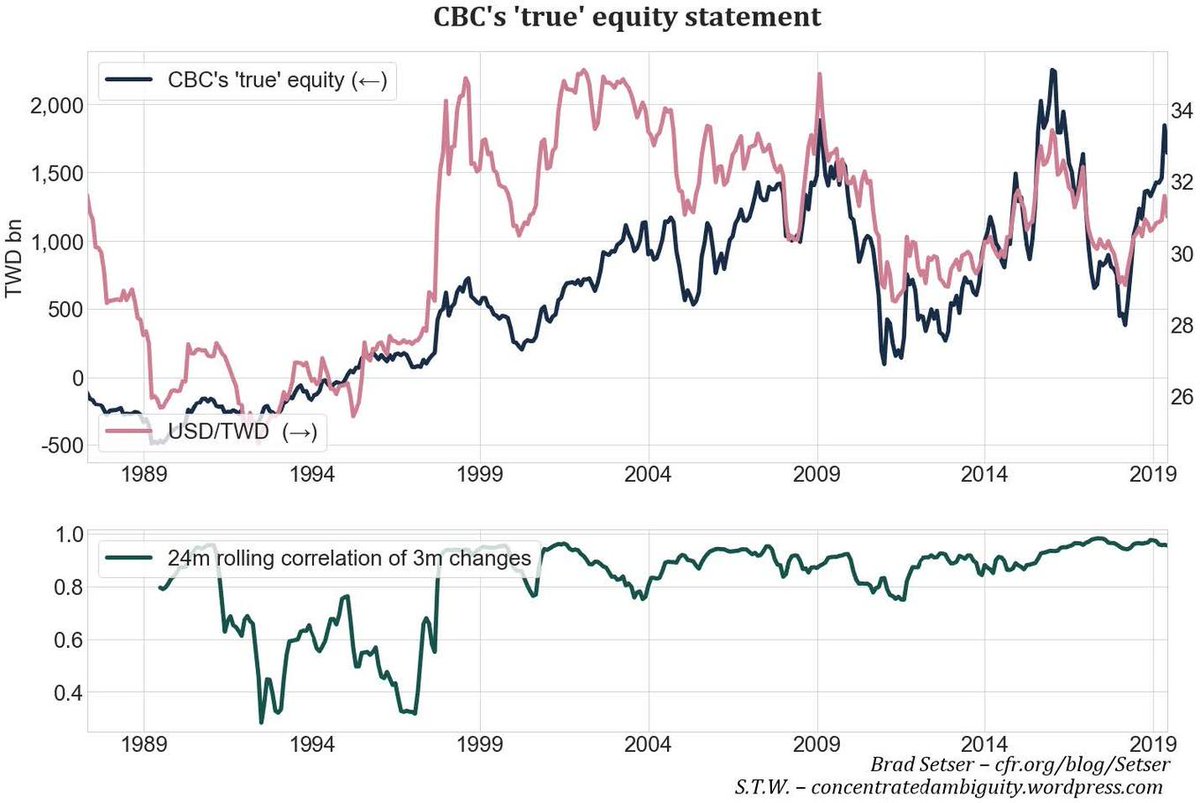

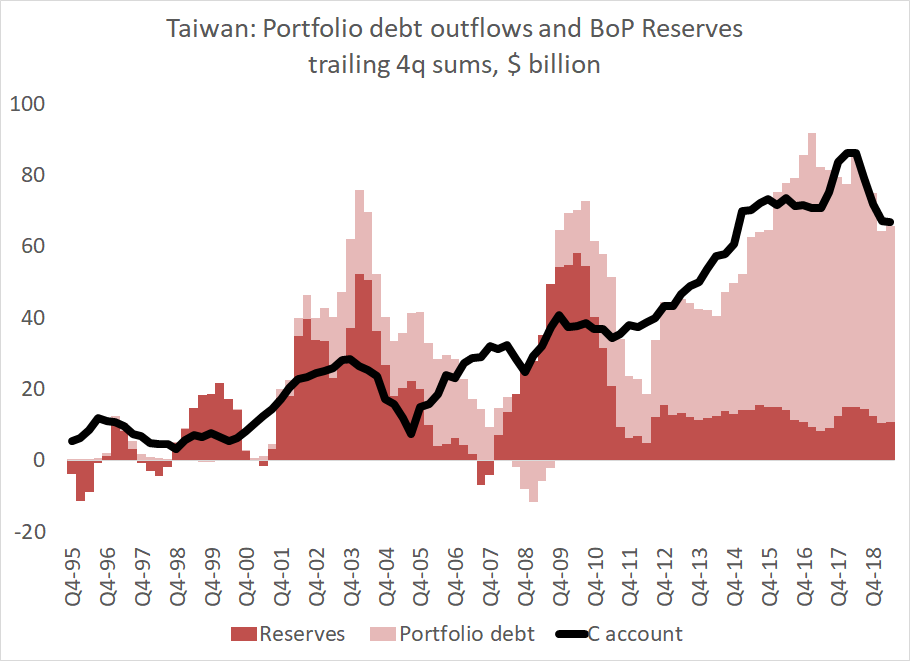

cfr.org/blog/130-billi…

I would recommend reading the .pdf available at Concentrated Ambiguity

concentratedambiguity.wordpress.com/2019/10/09/sha…

(And the U.S. Treasury made a mistake in taking the pressure off)

cfr.org/report/foreign…

(hoping there is a bit of news value in this post, once the math is digested)