A short thread.

jeromeroos.com/cms/wp-content…

1/8

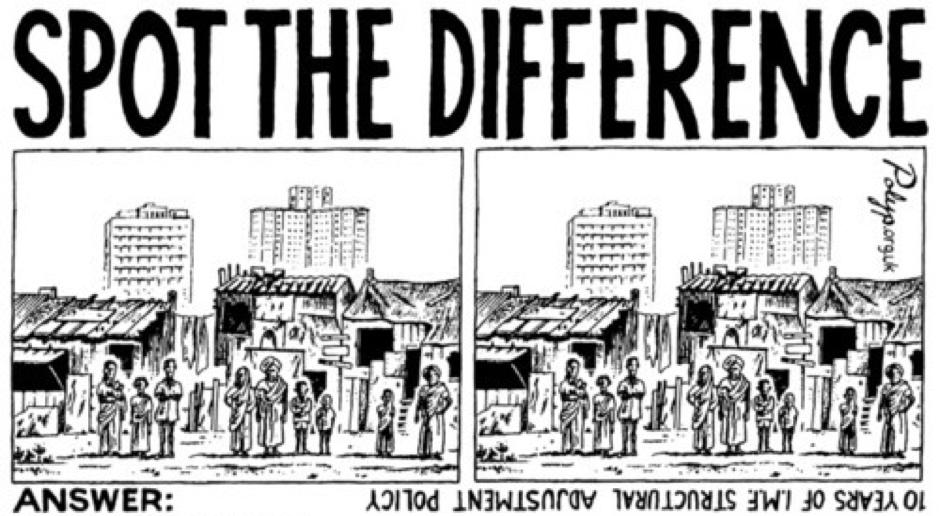

These interventions were underpinned by the principle that repayment was sacrosanct.

Why?

3/8

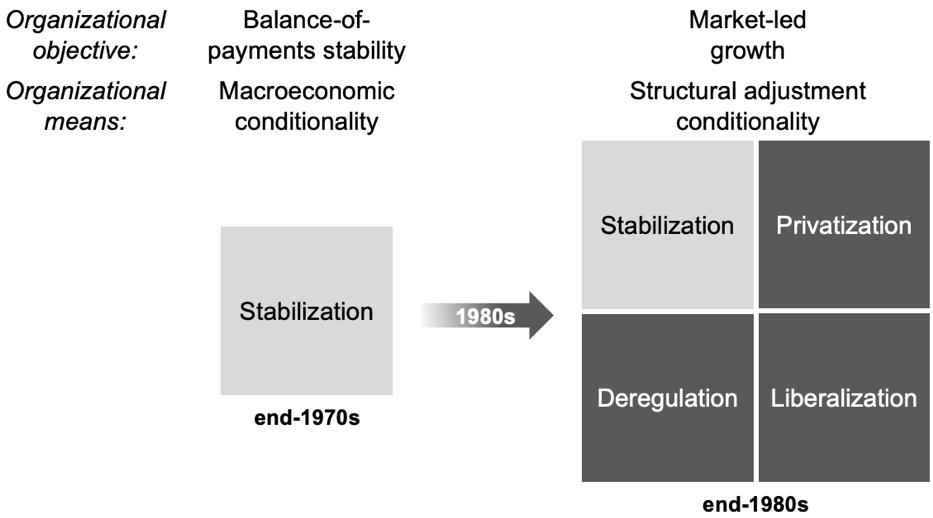

Sarah Babb and I have written on that issue elsewhere:

5/8

Just look at Greece’s recent experience.

Or cross-national quantitative evidence by Forster et al here:

sciencedirect.com/science/articl…

7/8

It exists because of financialized globalization and its underlying power politics.

Read the paper! An instant classic.

jeromeroos.com/cms/wp-content…

8/8