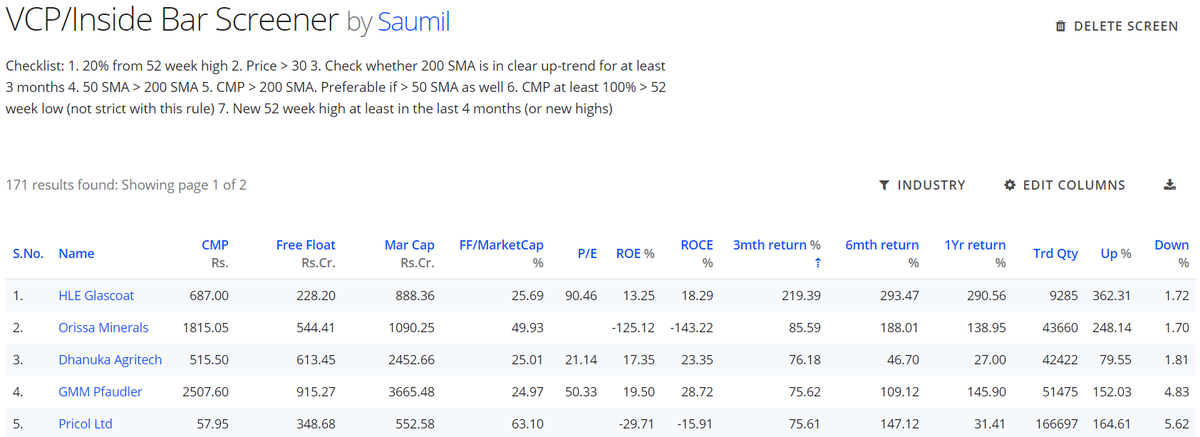

Criteria:

Stocks near or making 52 week highs,

At least 50% > 52 week low,

Free Float Market Cap < 7500 crores

(1/n)

(2/n)

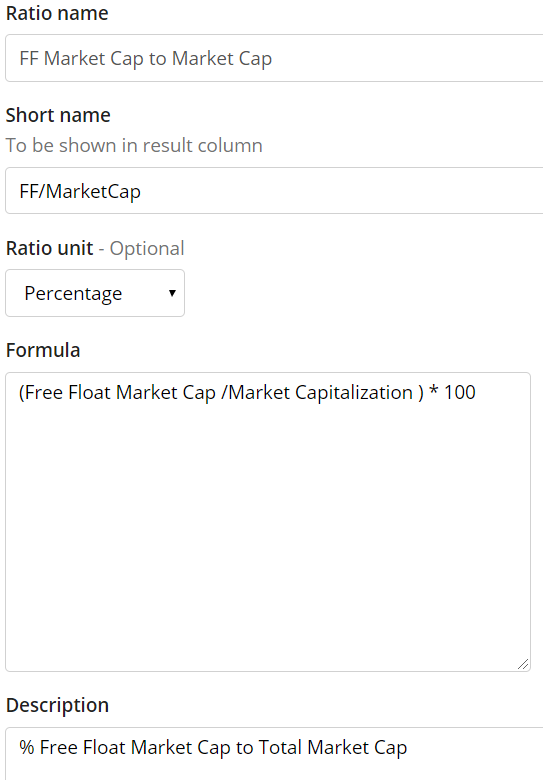

(Free Float Market Cap /Market Capitalization ) * 100

Thanks to @swing_ka_sultan for this ratio's significance.

(4/n)

Up from 52w low > 50 AND

Down from 52w high < 20 AND

Current price > 30 AND

Free Float Market Cap > 200 AND

Free Float Market Cap < 7500 AND

Volume > 5000

(6/n)

Chart Checklist:

200 Day Moving Average (DMA) in an up-trend for at least 2 months;

50 DMA > 200 DMA;

Price > 50 DMA

(7/n)

(8/n)

(9/n)