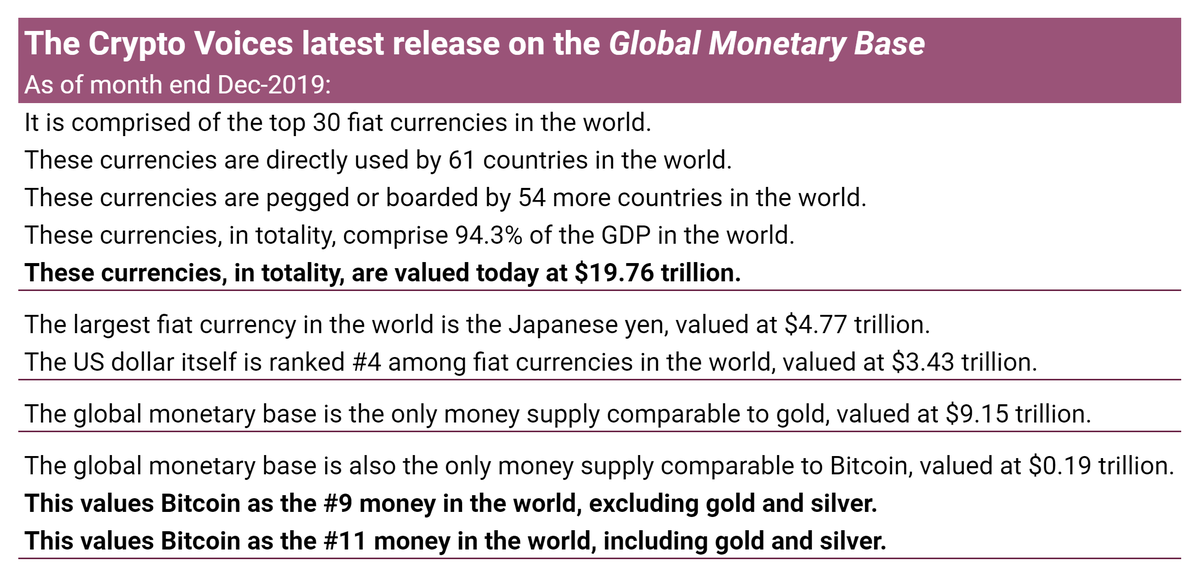

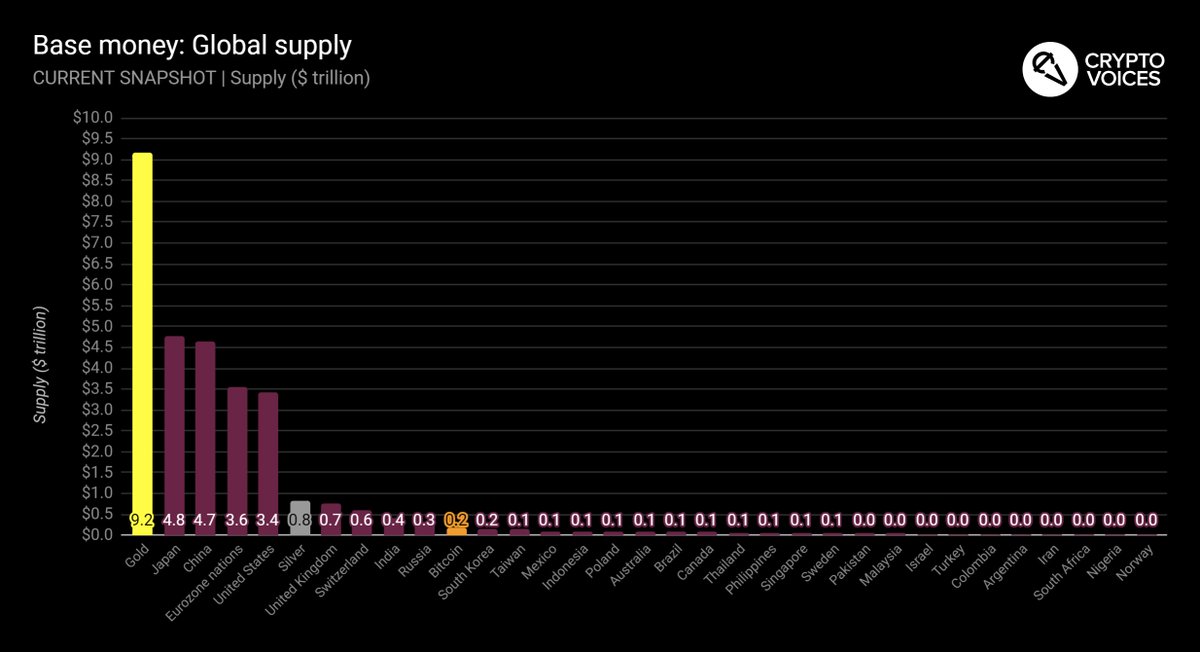

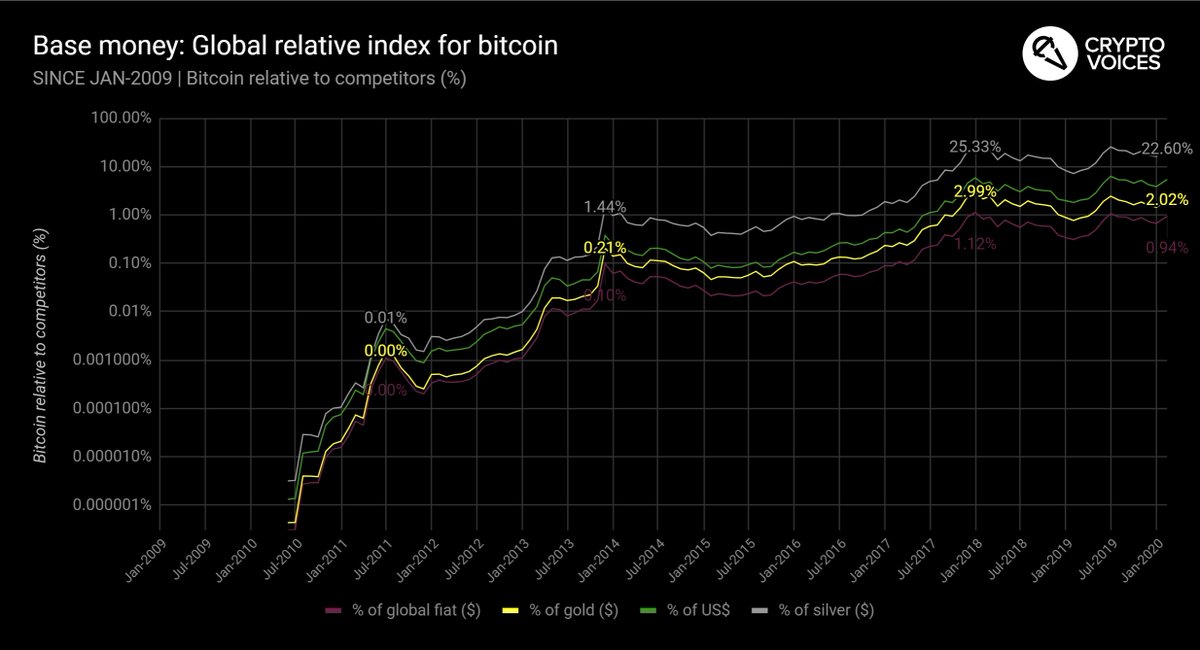

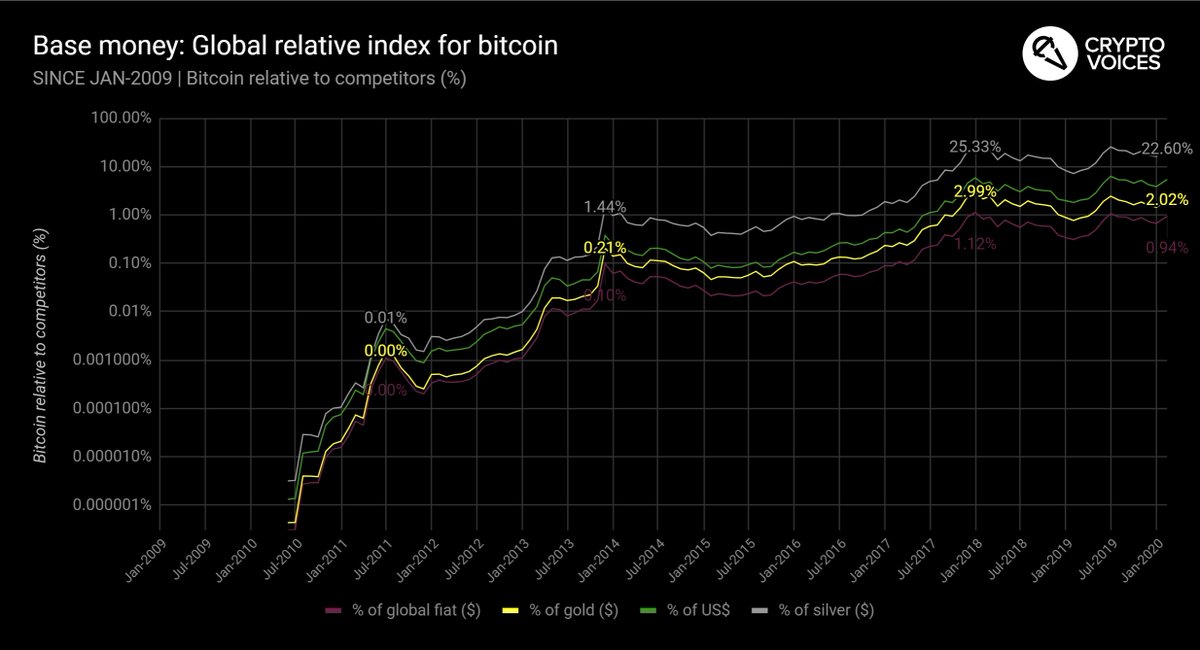

Gold: 1.8% (39 yr-doubling)

Silver: 1.5% (48 yr-doubling)

US$: 8.2% (8.8 yr-doubling)

Global fiat: 12.3% (6 yr-doubling)

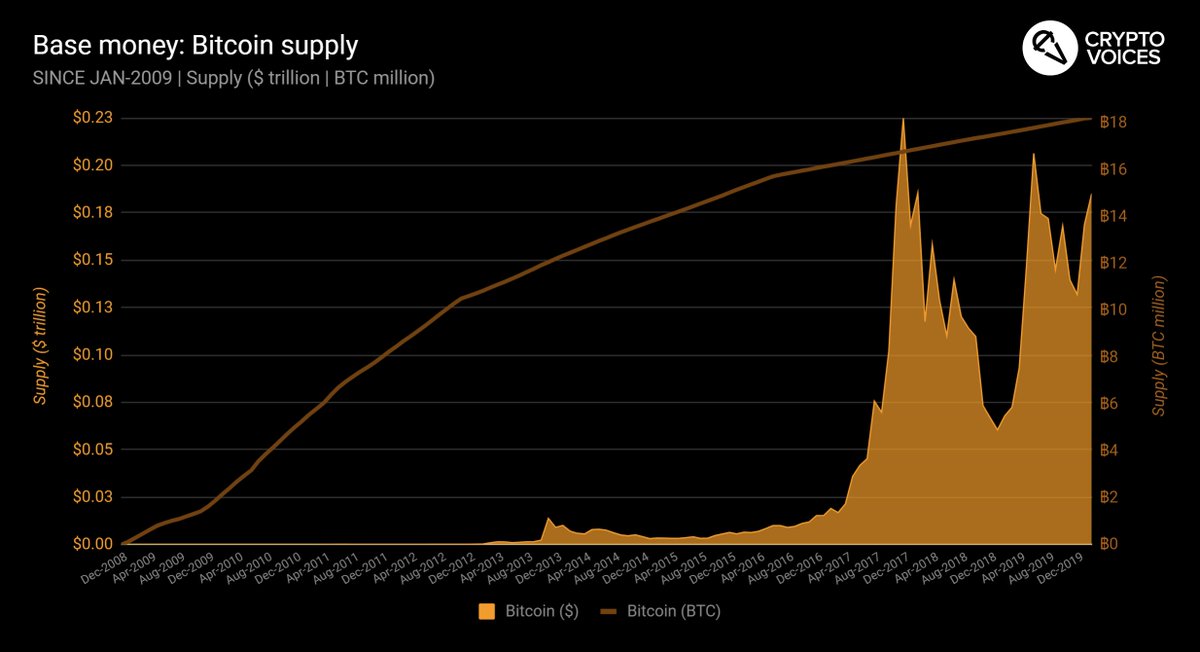

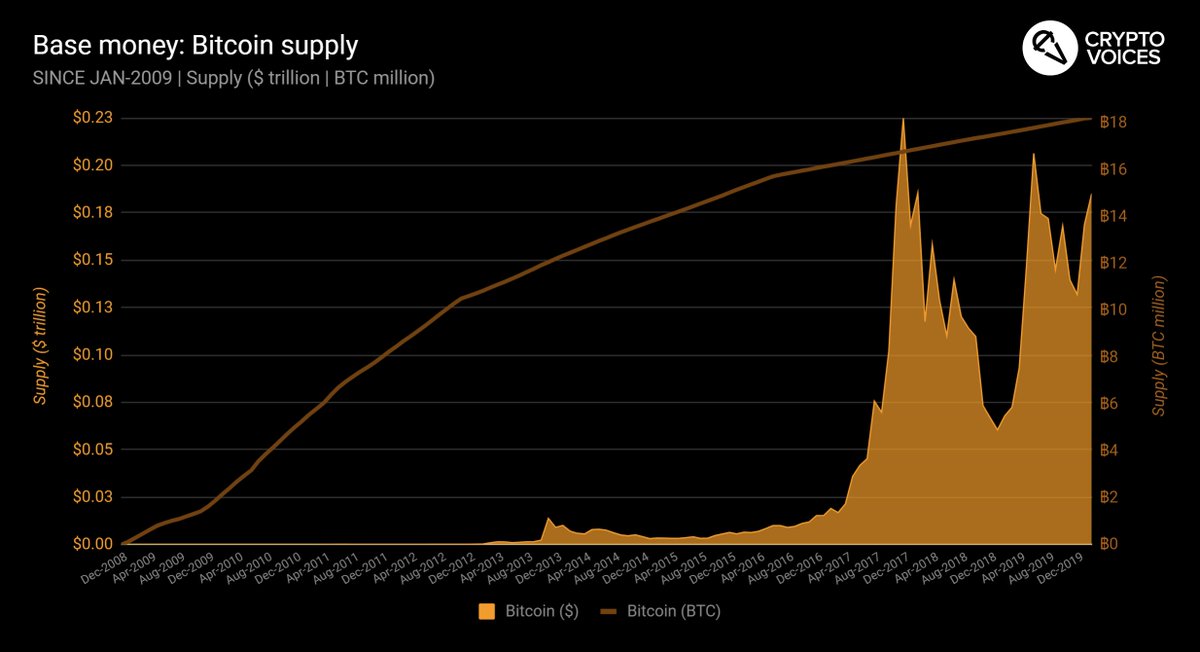

50 BTC (2009) to 21 million BTC (2141): 10.4%

/fin

Keep Current with Crypto Voices

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!