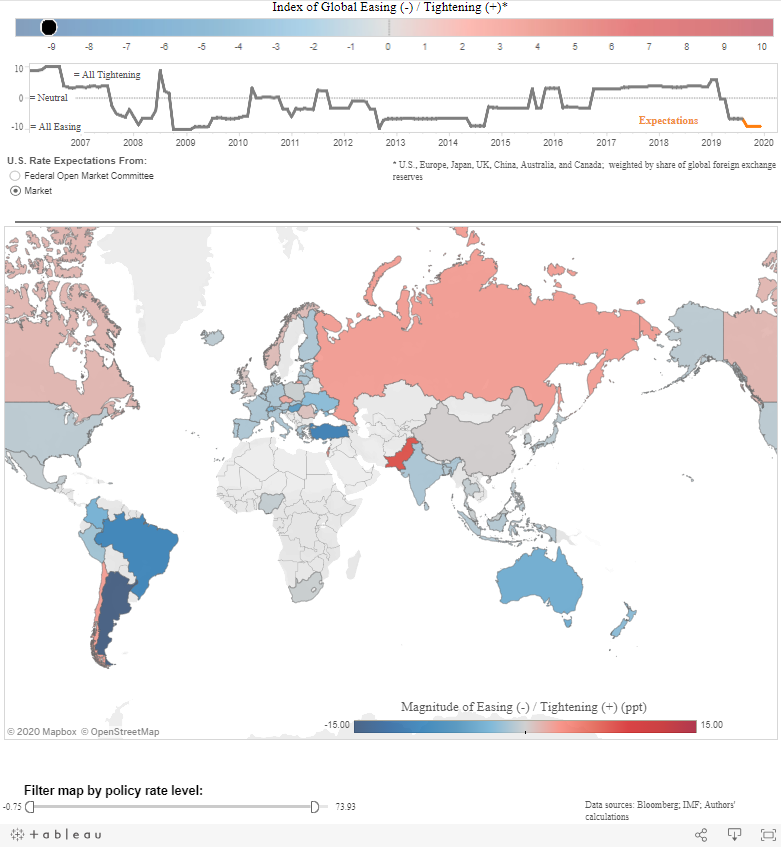

2018: 43 central banks tightened monetary policy and 32 eased, global net tightening of 11

2017: 28 central banks tightened monetary policy and 34 eased, global net easing of 6

2015: 48 central banks tightened monetary policy and 34 eased, global net tightening of 14