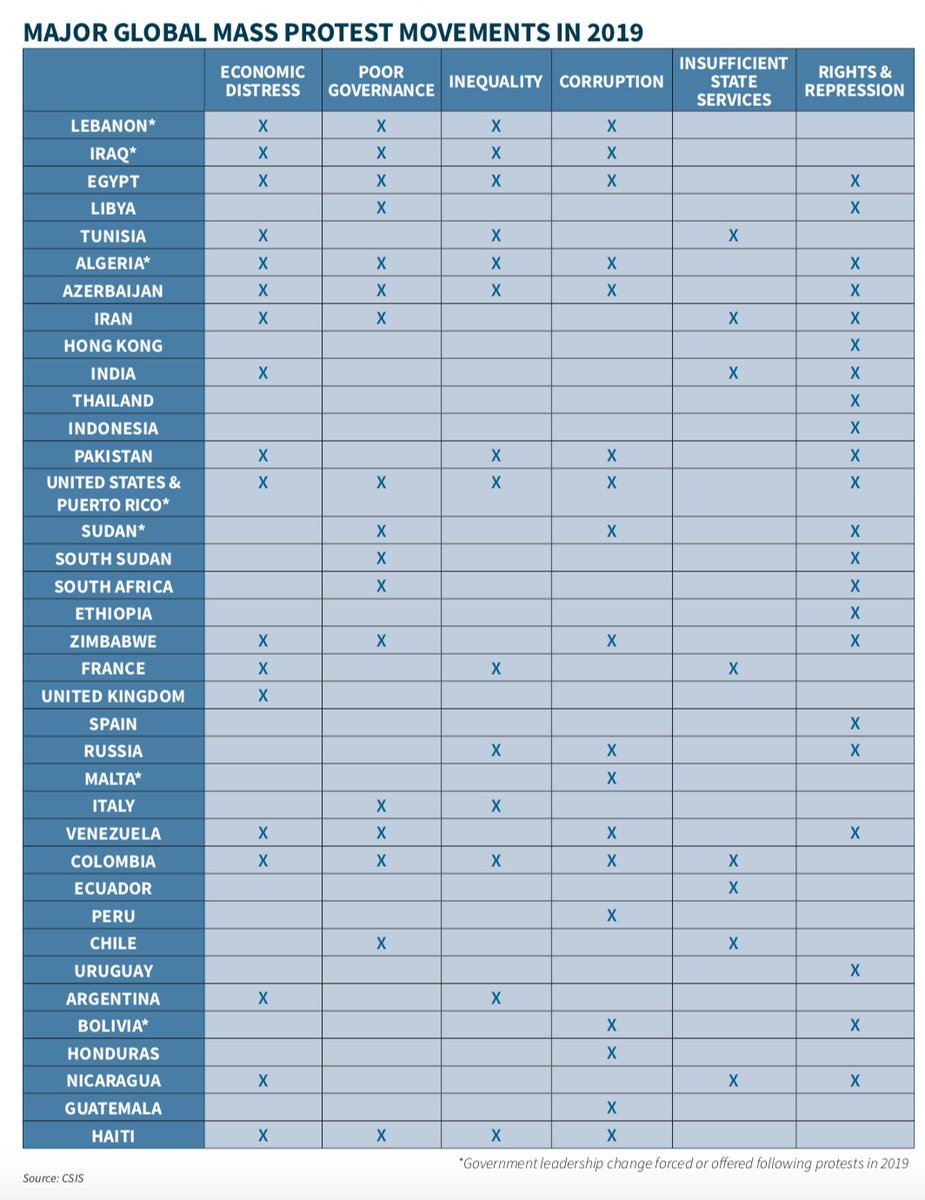

@CSIS looks a 'The age of mass #protests to understand an escalating global #trend.' It provides some good #insights & puts the spotlight on some of the common causes. Here are some takeaways...#GlobalTrends #Risks #Systems csis.org/analysis/age-m… (1/9)

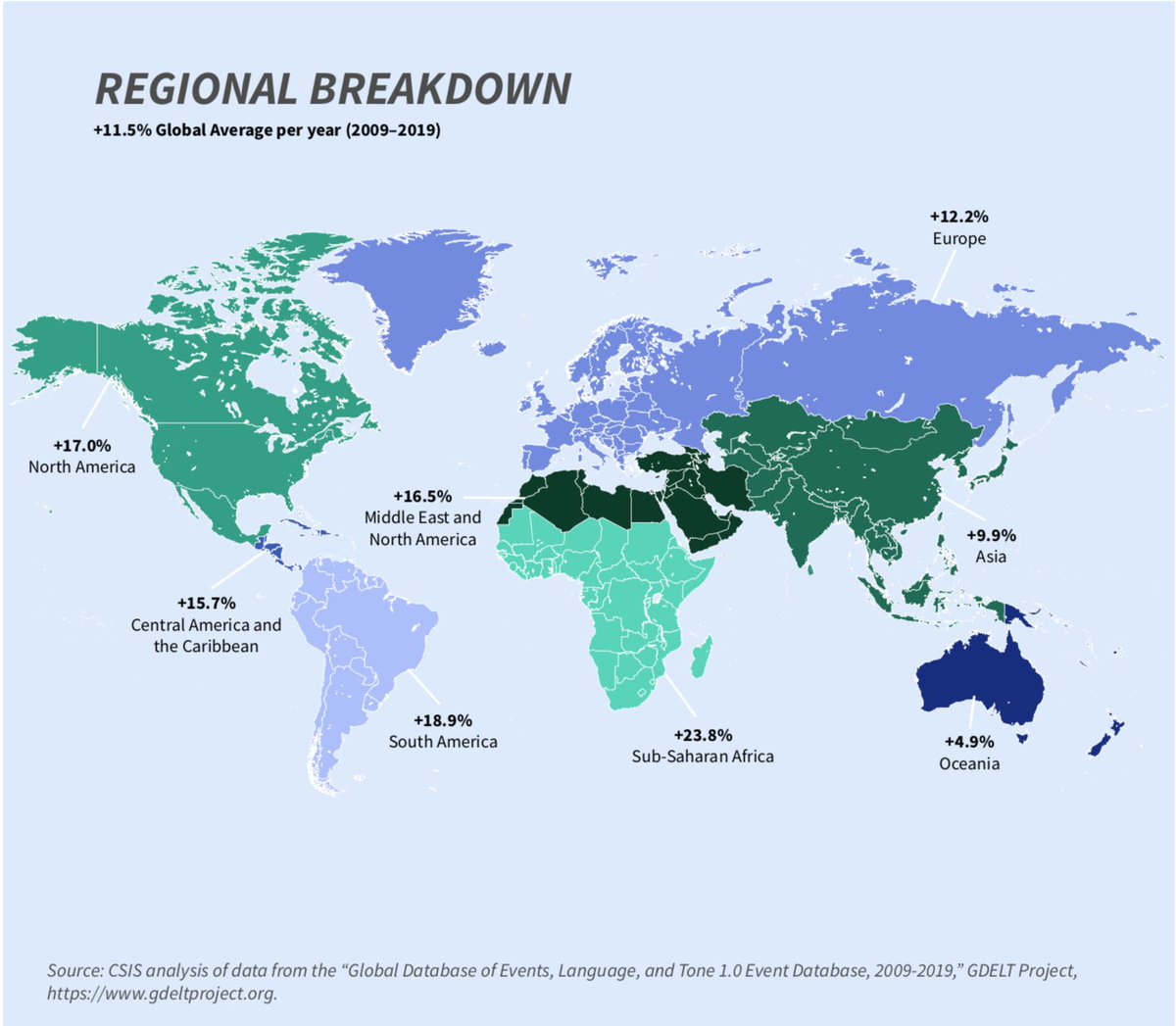

2/9 #GlobalTrends - Overview of civilian anti-government protests by region (2009-2019)...#Protests #Risks

4/9 #GlobalTrends - Factors underpinning the rising trend of mass protests: Access to global information communications #tech...#SocialMedia

5/9 #GlobalTrends - In the face of #internet access acting as a catalyst for anti-government mass protests, governments around the world are increasingly choosing to switch it off..

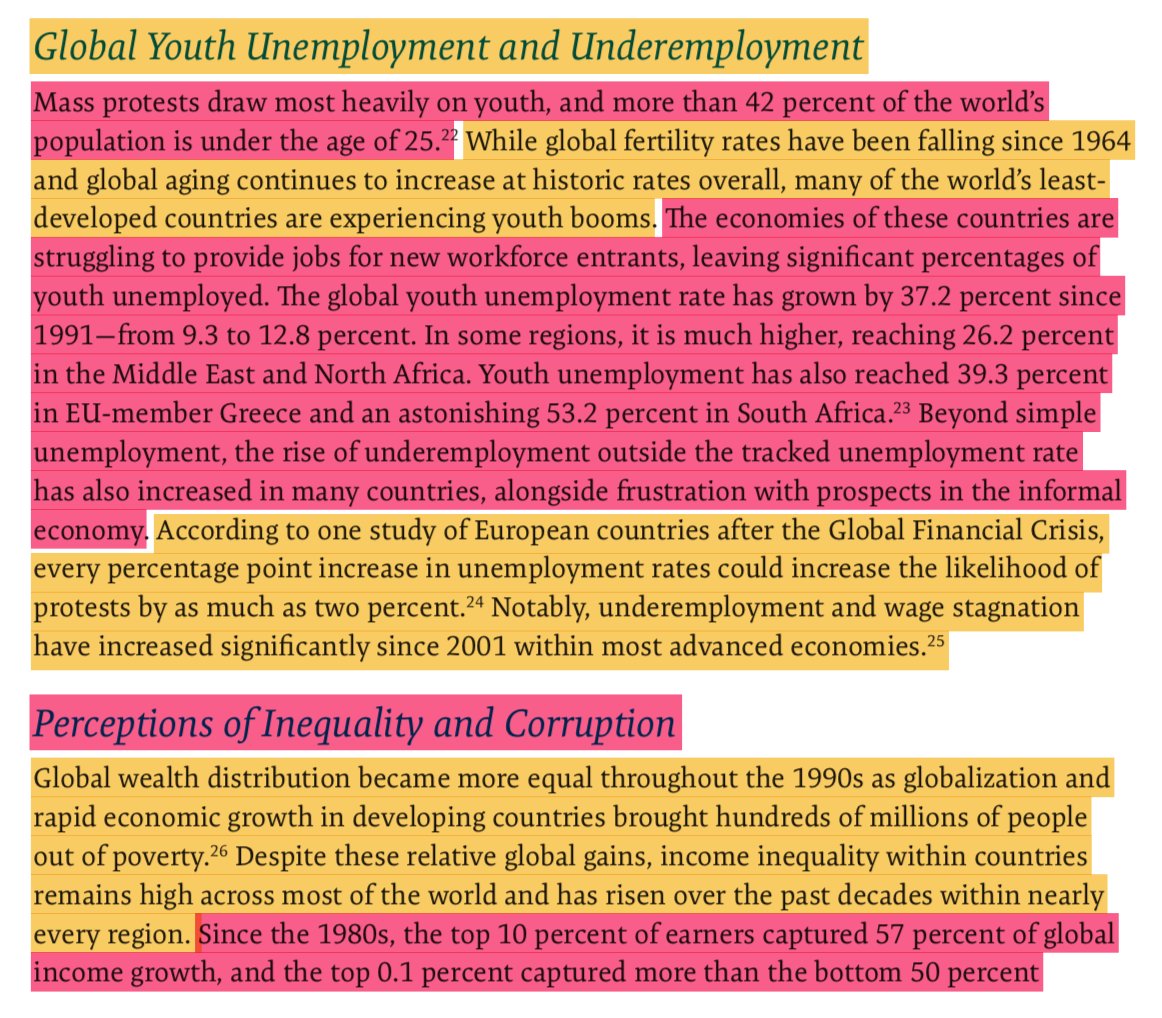

6/9 #GlobalTrends - Factors underpinning the rise in mass #protests: Youth #unemployment and general lack of economic opportunity in areas with large youthful populations...Plus Perceptions of #inequality & #corruption.. #Risks #Conflict #Migration

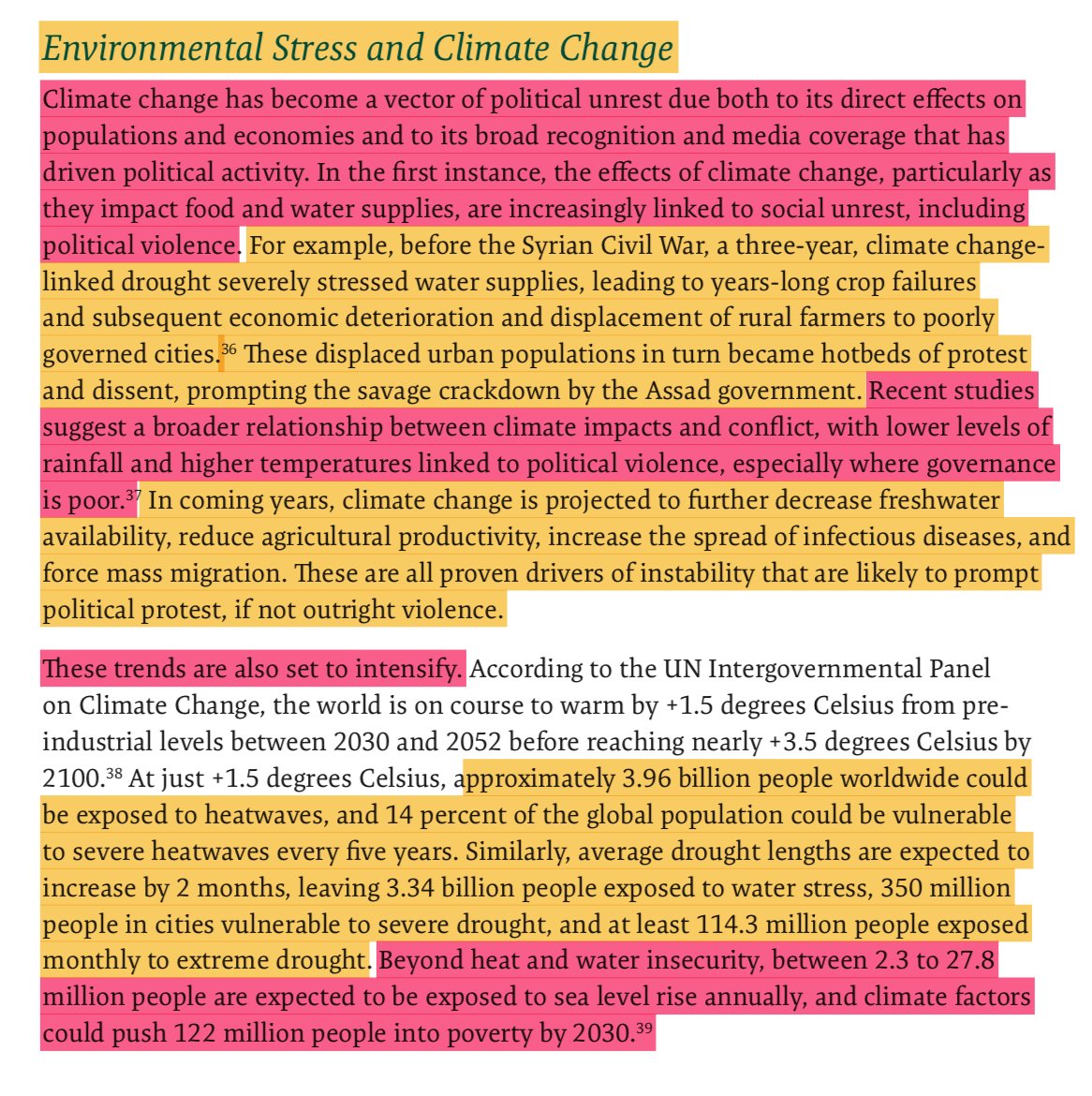

7/9 #GlobalTrends - Factors underpinning rising levels of mass #protests: #EnviromentalStress & #ClimateChange... #Risks #FoodInsecurity #WaterStress #Migration

8/9 #GlobalTrends - Factors underpinning the rising levels of mass #protests: Rising #literacy and #education levels brings expectations of better opportunities that will need to be met...

9/9 #GlobalTrends - Factors underpinning the rise in mass #protests: Rapid & continued #urbanisation across the developing world, as ppl seek better economic opportunities & often try to escape from #FoodInsecurity brings extra pressure on weak #infrastructure & #governance...

• • •

Missing some Tweet in this thread? You can try to

force a refresh