Poor countries have no resources.

Emerging markets lack resources, PLUS many are at a crossroads policywise for a couple reasons(1/11)

1. How do we cover the increase in the demand for liquidity in both poor and EM?

2. What is the best monetary policy response when on the one hand you need to provide liquidity but on the other you might be facing inflationary pressures? (2/11)

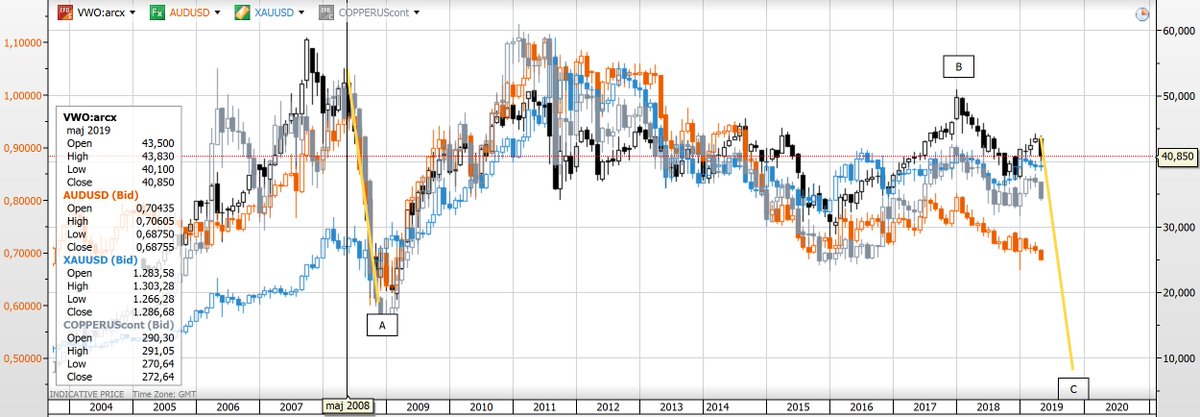

a. they are experiencing a sudden stop of capital flows

b. they are highly oil dependent. And Oil prices are way down.

(5/11)

Given the world's financial situation, I don't really see the pattern reverting. So add that loss in output to the drop that is coming from #COVID! (6/11)

If we can't restart the world economy soon, dramatic drops in the demand for oil will only push prices down further. (7/11)

Those depreciations have historically generated inflationary pressures, causing central banks to keep interest rates high and liquidity low amid an economic downturn (i.e. 2007/08) (8/11)

If we think that the drop in demand is sharp enough to counterbalance the inflationary pressures from the currency depreciation, then this is not a problem policywise... (9/11)

They need to be able to provide the liquidity today, without compromising their mandate to keep inflation under control tomorrow (10/11)