Recap in progress... #FinanceMinister

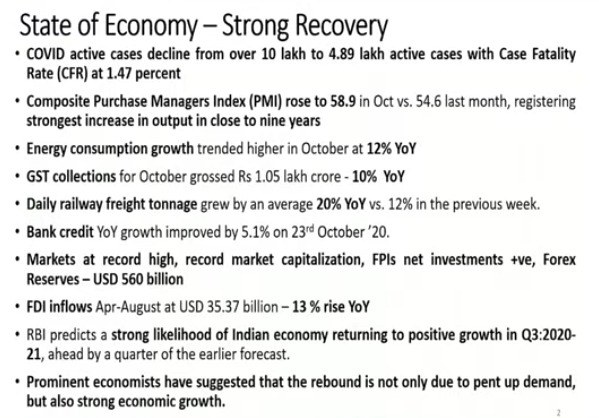

There is strong recovery in economy

Covid cases, fatality rate easing

Stock market capitalization at record high

Forex reserves at $560 bn

Energy consumption see 12% growth in Oct

Note: Only English notes will be provided, no translation😎

There is strong recovery in economy

Covid cases, fatality rate easing

Stock market capitalization at record high

Forex reserves at $560 bn

Energy consumption see 12% growth in Oct

Note: Only English notes will be provided, no translation😎

GST collections good, Bank credit improves by 5.1%, FDI inflows see 13% rise.

RBI predicts the possibility of a strong recovery by Q3, 1 quarter ahead of expectations.

Moody's revises India GDP forecast for:

CY20 to -8.9% from -9.6% earlier.

CY21 to 8.6% from 8.1% earlier.

RBI predicts the possibility of a strong recovery by Q3, 1 quarter ahead of expectations.

Moody's revises India GDP forecast for:

CY20 to -8.9% from -9.6% earlier.

CY21 to 8.6% from 8.1% earlier.

Progress of announcements made during #AtmaNirbharBharat 1.0, 2.0

Recap on important ones only😀

- Inter-state portability of ration card achieved, covering 68.6 cr beneficiaries, across 28 states

- 1.5 cr monthly transactions on intra-state portable ration cards

Img: CNBC TV18

Recap on important ones only😀

- Inter-state portability of ration card achieved, covering 68.6 cr beneficiaries, across 28 states

- 1.5 cr monthly transactions on intra-state portable ration cards

Img: CNBC TV18

- Kisan credit cards: Credit boost achieved to 2.5 cr farmers, banks issued 157 lakh credits issued

- Matsya Sampada yojana: sanctioned 1681 cr.

- 25,000 crore to be distributed for preparation for Rabi sowing facilitation.

#economy #AtmaNirbharBharat

Img src: CNBC TV18

- Matsya Sampada yojana: sanctioned 1681 cr.

- 25,000 crore to be distributed for preparation for Rabi sowing facilitation.

#economy #AtmaNirbharBharat

Img src: CNBC TV18

- ECLGS: Sanctioned amount = Rs.2.05 lakh cr of 3 lakh cr provided, to 51 lakh borrowers, including MSME's, professionals, of which 1.52 lakh cr disbursed.

- Partial credit guarantee scheme: Bought portfolios worth 26,889 cr

- Special liquidity scheme for NBFCs: 7227 cr disbursed

- Partial credit guarantee scheme: Bought portfolios worth 26,889 cr

- Special liquidity scheme for NBFCs: 7227 cr disbursed

2.0

- Festival advance: good progress (no numbers) SBI issued utsav card, LTC voucher scheme.

- 25,000 cr in addition for Capex for road transport & defense is issued

- 11 states sanctioned 3621 cr interest free loans for Capex. Add 450 cr for Bihar.

- IT refunds: 1.32 lakh cr.

- Festival advance: good progress (no numbers) SBI issued utsav card, LTC voucher scheme.

- 25,000 cr in addition for Capex for road transport & defense is issued

- 11 states sanctioned 3621 cr interest free loans for Capex. Add 450 cr for Bihar.

- IT refunds: 1.32 lakh cr.

Today's announcements: #Atmanirbhar 3.0

- PM Rozgar Yojana: 8300 cr disbursed till Mar 2019

- New scheme called Atmanirbhar Rozgar Yojana🙄: new employee (sal: < Rs.15,000) not covered by EPFO earlier will be benefitted.

- Effective: 1st Oct 2020 and covers for 2 years.

- PM Rozgar Yojana: 8300 cr disbursed till Mar 2019

- New scheme called Atmanirbhar Rozgar Yojana🙄: new employee (sal: < Rs.15,000) not covered by EPFO earlier will be benefitted.

- Effective: 1st Oct 2020 and covers for 2 years.

- Benefits: Subsidy for 2 yrs, for Cos with <1000 employees but salary less than Rs.15000 per month , 24% (EPF portion) to be borne by central govt. 65% of formal sector employees

for Cos with >1000 employees, only EPF of 12% will be borne by central govt, Adhaar accounts needed

for Cos with >1000 employees, only EPF of 12% will be borne by central govt, Adhaar accounts needed

- ECLGS Scheme: extended to 31 March 2021, fully guaranteed and collateral free loans. (Delight for borrowers)

- Additional credit of 20% of outstanding loans as of Feb end.

- 2.05 lakh cr sanctioned...(😜check bank nifty)

- Additional credit of 20% of outstanding loans as of Feb end.

- 2.05 lakh cr sanctioned...(😜check bank nifty)

ECLGS 2.0

- Launching a credit guarantee support scheme for 26 stressed sectors identified by Kamath Committee.

- 1 yr moratorium + 4 yrs of repayment & servicing

- to be available upto 31 Mar 2021, benefits MSME providing goods, services to eligible entities.

(#banknifty 😱)

- Launching a credit guarantee support scheme for 26 stressed sectors identified by Kamath Committee.

- 1 yr moratorium + 4 yrs of repayment & servicing

- to be available upto 31 Mar 2021, benefits MSME providing goods, services to eligible entities.

(#banknifty 😱)

#PLI Schemes:

- Champions 10 sectors, incentives offered yesterday, covering sunrise & labor intensive sectors

- 51,355 cr received by 3 sectors from earlier PLI schemes.

Src: Siddharth Zarabi

- Champions 10 sectors, incentives offered yesterday, covering sunrise & labor intensive sectors

- 51,355 cr received by 3 sectors from earlier PLI schemes.

Src: Siddharth Zarabi

- PM Urban Aawaaz Yojana: 18,000 cr to be provided in this year for 12 lakh houses to be grounded, 18 lakh to be completed, over & above 8000 cr given in budget

- To support core sectors like Steel, Cement & provide jobs in const. sectors.

#construction #steel #cement #economy

- To support core sectors like Steel, Cement & provide jobs in const. sectors.

#construction #steel #cement #economy

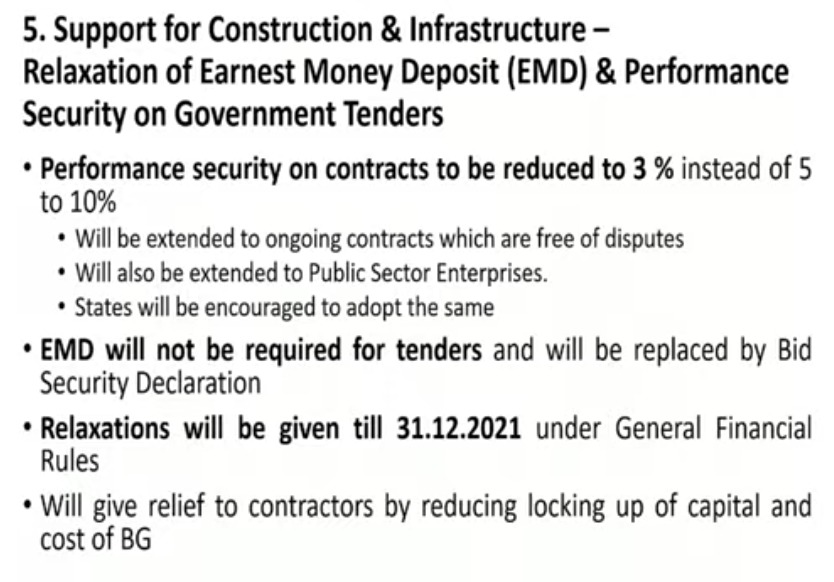

- Performance security on contracts to be restricted to 3% instead of 5%; Earnest money deposit not required for tenders.

- Will be given upto 41 Dec 2021; burden on contractors to be reduced and give flexibility for construction & infra.

- Will be given upto 41 Dec 2021; burden on contractors to be reduced and give flexibility for construction & infra.

Income tax relief for developers & home buyers:

- To increase differential from 10% to 20%, from today till 30 Jun 2021, only for primary sale of residential units, valued upto Rs. 2 cr., Both developers & home buyers to get this benefit & clear inventory.

- Changes to IT rules.

- To increase differential from 10% to 20%, from today till 30 Jun 2021, only for primary sale of residential units, valued upto Rs. 2 cr., Both developers & home buyers to get this benefit & clear inventory.

- Changes to IT rules.

Equity Infusion of 6000 cr to NIIF debt platform.

- Investment in infra related activity to get boost.

- Investment in infra related activity to get boost.

65,000 cr for fertilizer subsidy for farmers

- crop sowing area increased and farmers need fertilizers, 140 million farmers to benefit.

(Agri and related Cos to be in focus)

#agriculture #stock

- crop sowing area increased and farmers need fertilizers, 140 million farmers to benefit.

(Agri and related Cos to be in focus)

#agriculture #stock

Informal employment scheme:

- Garib Kalyan Rozgar yojana numbers...

- 61,500 cr for MNREGA, 40,000 cr additional given in 1.0, of that 73,504 cr spent, 251 cr person days of employment generated.

- additional 10,000 cr for informal sector to get opportunities in rural areas

- Garib Kalyan Rozgar yojana numbers...

- 61,500 cr for MNREGA, 40,000 cr additional given in 1.0, of that 73,504 cr spent, 251 cr person days of employment generated.

- additional 10,000 cr for informal sector to get opportunities in rural areas

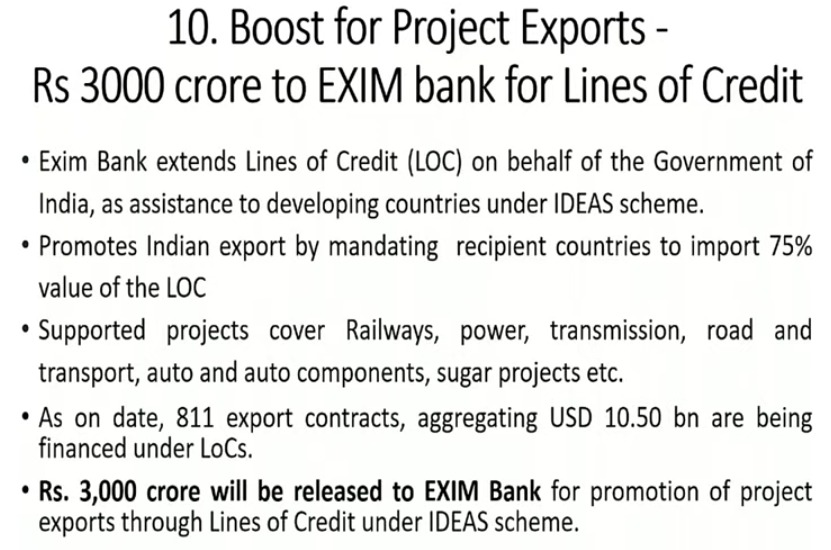

Item 10: Exports:

- Additional 3000 cr to EXIM bank for promoting exports through lines of credit.

(Just two more left, please bear with the three of us - FM, MoS FM & me)

#investors

- Additional 3000 cr to EXIM bank for promoting exports through lines of credit.

(Just two more left, please bear with the three of us - FM, MoS FM & me)

#investors

Item 11:

10,200 cr additional for industrial and capex for defense equipment; This is in additional to all provided in budget.

(Note to self: Check defense Cos - PSUs as well as Bharat Forge, Ashok Leyland, L&T, Tata etc)

#economy

10,200 cr additional for industrial and capex for defense equipment; This is in additional to all provided in budget.

(Note to self: Check defense Cos - PSUs as well as Bharat Forge, Ashok Leyland, L&T, Tata etc)

#economy

Item 12:

900 cr for Covid vaccine research, going to Department of Bio-technology;

Actual cost of vaccine or logistics cost is not being discussed; when time comes will provide as required.

The End!🙏

#stockmarket #investors #investing

900 cr for Covid vaccine research, going to Department of Bio-technology;

Actual cost of vaccine or logistics cost is not being discussed; when time comes will provide as required.

The End!🙏

#stockmarket #investors #investing

• • •

Missing some Tweet in this thread? You can try to

force a refresh