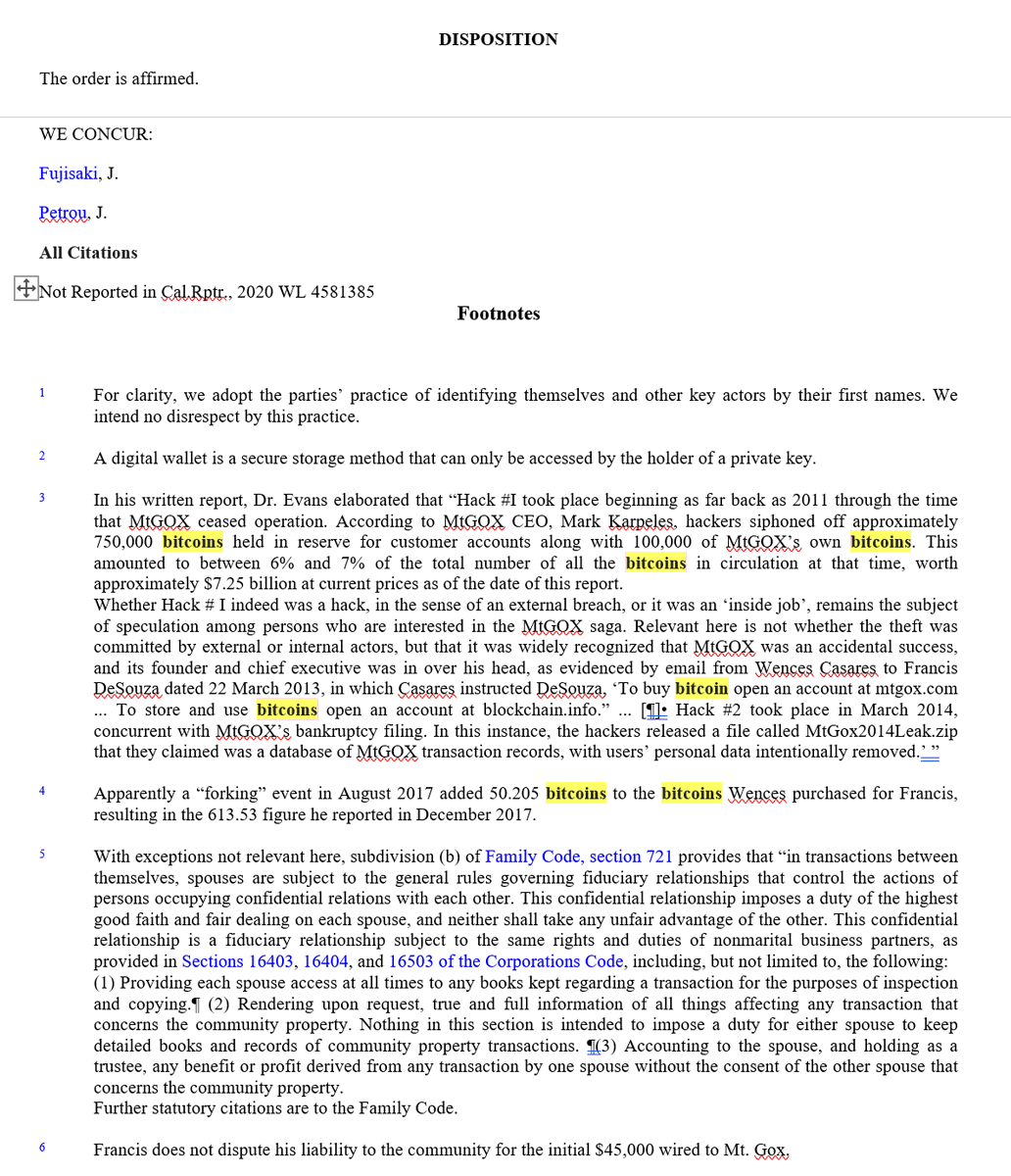

Yesterday, at the conclusion of my #NYU class discussing #Governance of #Bitcoin and #Cryptocurrencies, I posted this slide, summarizing my thoughts about what the #US can do to improve its #law and #policy related to #Crypto. A #thread on what we can and should fix:

First, establish an government wide-policy. What do we want? Are we pro -innovation? Do want to protecting consumers? Do we want to strike a balance in the middle?Do we want to facilitate experimentation? How much control will the govt take over these experiments? /2

Do we want to make it easier or harder to launch businesses/reach consumers? To make an effective policy, we either need an interagency group, or a new freestanding group focused on the subject. Whoever tackles it, step 1, what do we want? /3

Next, the #SEC should create a law for #token offerings. So far we have applied venerable precedent in settled enforcement actions, modified/added glosses to that precedent it in speeches & non-binding guidance, seen those positions supported in trial court rulings, /4

& looked to a proposed safe harbor (hat tip to @HesterPeirce) that is promising but which has not been enacted. Perhaps with the #XRP case we’ll ultimately see the 2nd circuit make the law by ruling on the positions taken by the SEC, but that might take a few years. /5

In the meantime, lawyers & clients are left to navigate the nebulous territory created by non-binding guidance. The cost to go to market & uncertainty of the strategies to go to market would be reduced with binding guidance, a rule, a safe harbor, or a law. /6

Third, given the cambrian explosion of #digital asset types, clarity as to which assets are regulated under which laws under which circumstances would be very helpful. We’ve already seen a bill that calls for the #SEC & #CFTC to collaborate to set boundaries. This is promising./7

Money Services Business /Money Transmission law is complicated & expensive for new companies who are required to comply with federal law & to potentially apply for licenses under 54 different state/territorial laws to serve the entire country. /8

The same activitiy is regulated differently in different states. Different states have differnt requirements to obtain licenses. These laws are important but could be standardized. Pre-emption, standardization or passporting would significantly reduce the burden on businesses./9

Next, property rights. What is a #bitcoin to the law? What legal rights does a party that controls a bitcoin actually have? Property rights are created by statute or judge-made law. Although we have a ton of state and federal laws that affect use of #digital assets, /10

only #Wyoming has explicitly classified #digital assets as property. Other jurs. may have broad property definitions (see, for ex. #California 's statute as interpreted in Kremen v Cohen) that could include these assets, but without clear property rights, /11

we are left w/ questions- can you steal a #bitcoin? Can you get civil relief for conversion of a #bitcoin? We assume yes, but the law isn’t as clear as you’d think. FYI- Most courts that have looked at the issue say yes, and get there in different ways. /12

Clarity as to property rights makes it lower risk and thus easier and cheaper to engage in transactions related to these assets and these systems. /12

This one's a pet project - thoughtfully include #digital assets in the UCC. IYDK, the Uniform Commercial Code is a comprehensive set of uniformly adopted laws governing all commercial transactions (sales of goods, lending, secured transactions, etc…) in the United States./12

As the #crypto #lending markets have exploded & many #defi projects like #MakerDao are offering collateralized transactions that look like familiar secured transactions (if you squint....), there’s a need to understand what rules apply in the absence of contracts /13

What rules? For Ex: how to encumber #crypto, how to perfect a lien against crypto, take free rules, shelter rules, etc... Its best to not force these assets into custodial/intermediated models, & ideally the rules could work cross-border. /14

Although most (properly) treat #crypto as A8 general intangibles, there are open questions as to perfection & the issues above. Some states have already started experimenting with their own laws- none are perfect or comprehensive enough, yet. The good news is that the ULC/ALI /15

is working on crafting these rules (disclosure- I’m participating) & international groups law reform groups are also looking at these issues as well. Standardizing law across states is a major challenge, but these laws work best when standard or compatible globally. /16

There is lots of thoughtful nuanced work to be done here, but “the juice is worth the squeeze”- reliable predictable commercial transactions would make #crypto "safer" to use and more available for more different types of transactions. /17

#Crypto used as a substitute for currency should be treated as much as possible like cash. We are quickly retreating from physical cash losing with it the privacy enjoyed by cash users. Efforts should be made to allow crypto to remain private until it collides with regulated /18

entities that are subject to data collection and reporting requirements. /19

The US tax approach to #crypto has made it incredibly burdensome to use crypto - many are feeling the pain as tax day approaches. A de minimis safe harbor/exception for transactional use as suggested by the AICPA would encourage/simplify use &reduce tax burden. /20

clarification of some of the forks rules would also help. There are opportunities in tax as well. Regtech built into payment systems with the cooperation of the tax authorities could be a game changer for retail, merchants and taxing authorities. Looking forward to it. /21

Finally, a court should consider limiting the 3rd party doctrine, which has eroded our 4th amendment privacy rights. The TLDR; of the 3rd party doctrine: if a person willingly gives unprotected information to 3rd parties, & those 3rd parties have a business reason to retain /22

that information, law enforcement can get that information from the 3rd party without a warrant, even if law enforcement would need a warrant to get it from a person directly. Given our increasing reliance on digital payment systems that collect & commercialize tons of data /23

about us pursuant to clickwrap & browsewrap agreements that we have no choice but to accept, the amount of data held by 3rd parties is astounding. The BSA requires data collection & applies to intermediaries serving #crypto, & the scope of data collection seems likely to grow./24

These laws serve an important purpose- money is like air to criminals, and the use of intermediaries to identify, disrupt, & prevent criminal activity is critical to our collective safety. No issue with the good work (and outstanding guidance) we have seen from FinCEN. /25

All that being said- Given that so many regulations dictate what data is collected, is a person “willingly” or “voluntarily” giving that data to regulated intermediaries so it can be provided to the govt. w/o a warrant? If it is, should regulation modify my 4a privacy rights?/26

SCOTUS had this issue before it in California Bankers but it was not addressed on the merits. This is an important issue that I'm looking forward to seeing our courts address. /27

• • •

Missing some Tweet in this thread? You can try to

force a refresh