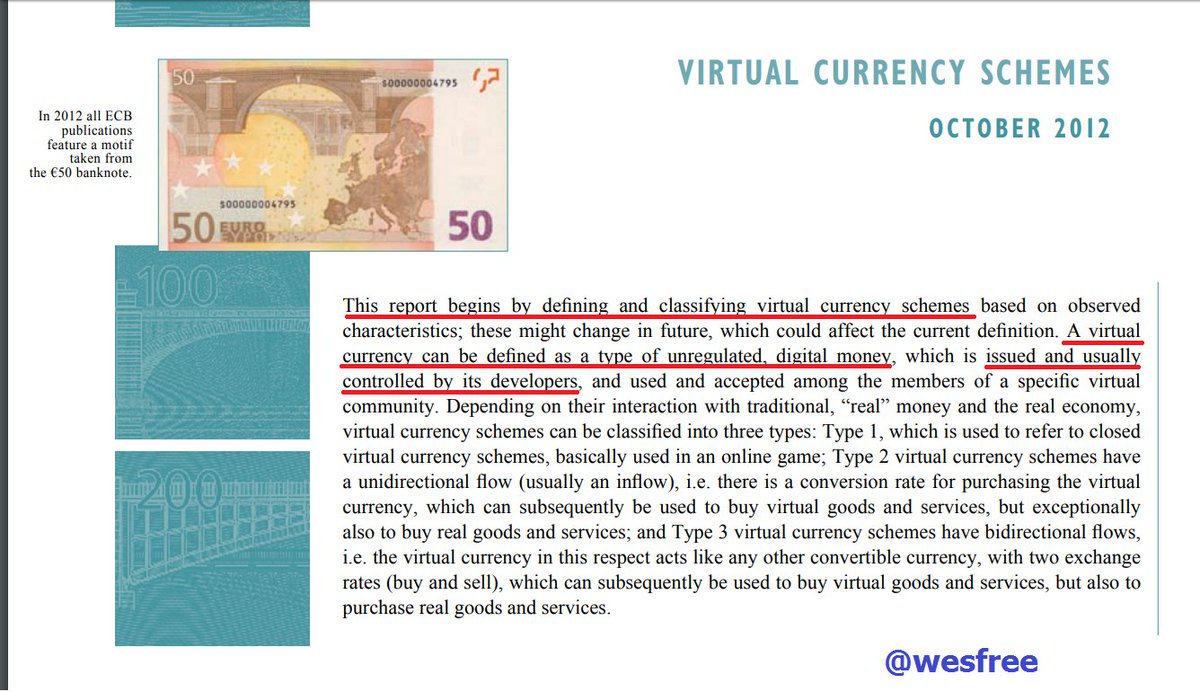

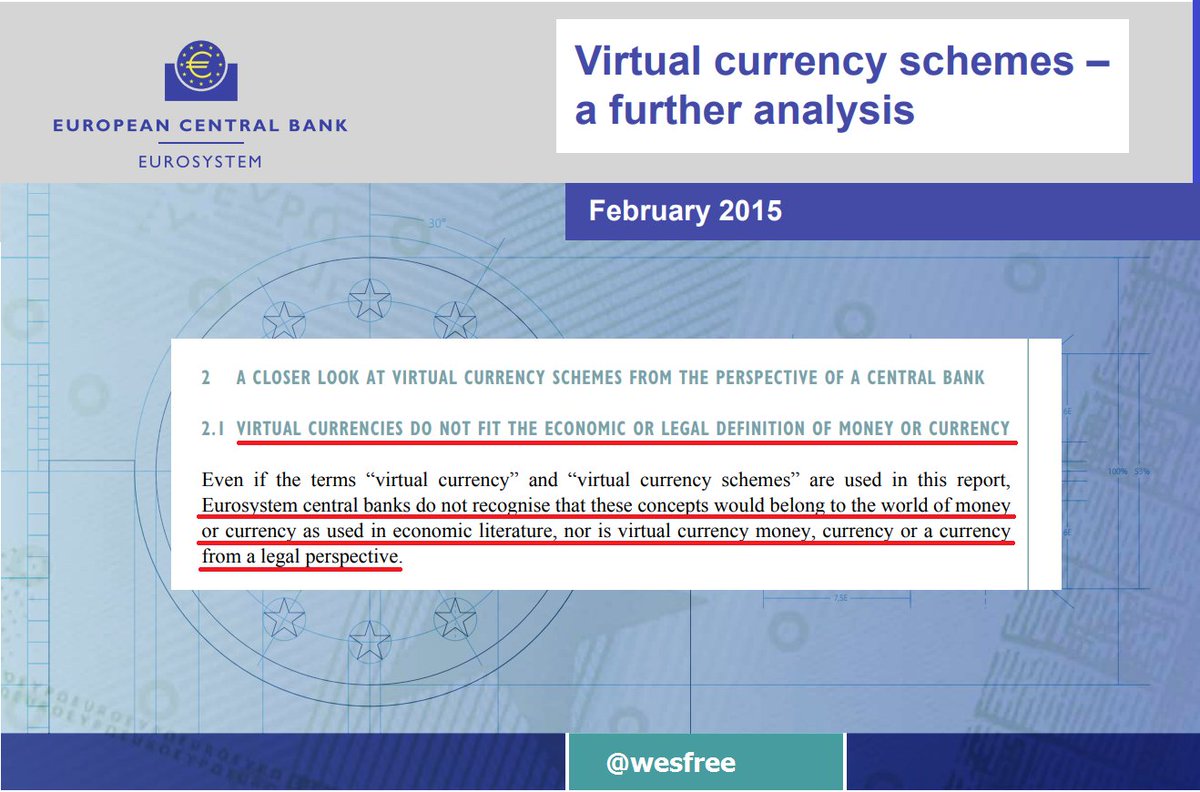

Govt control of money and the most important price in a capitalist economy--the interest rate--has caused distortions and true bubbles. Let's take a look

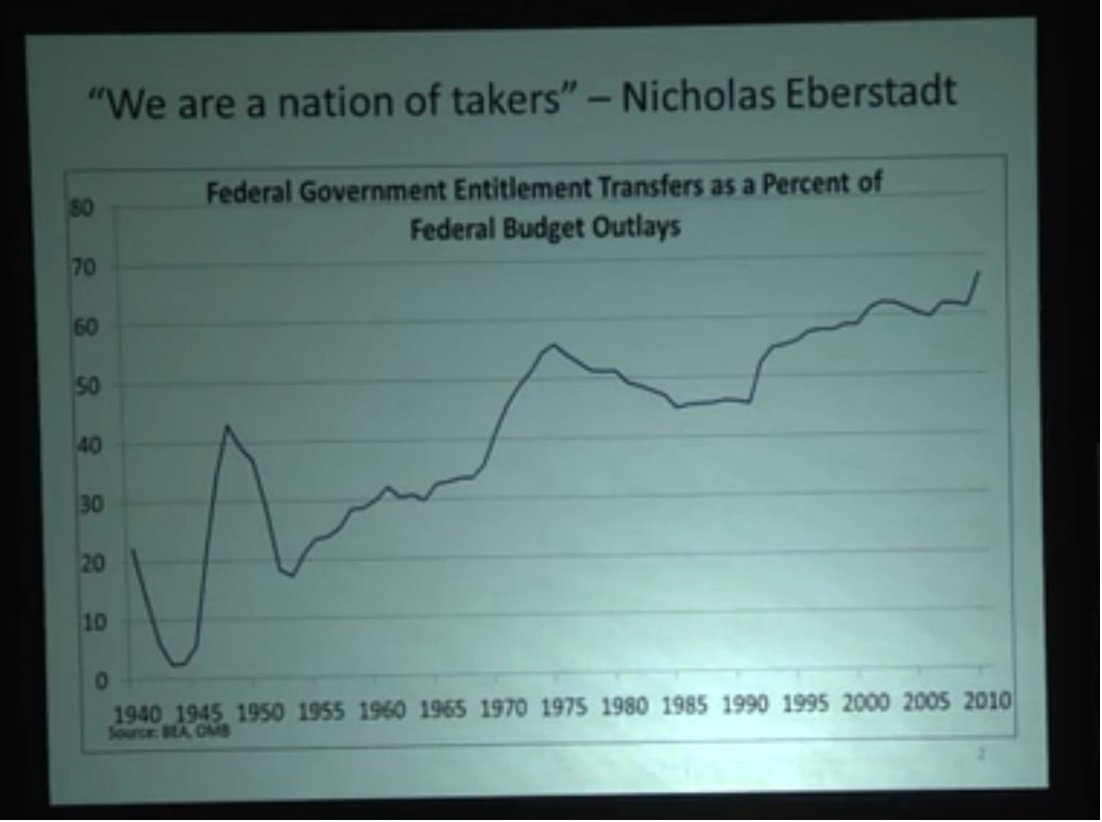

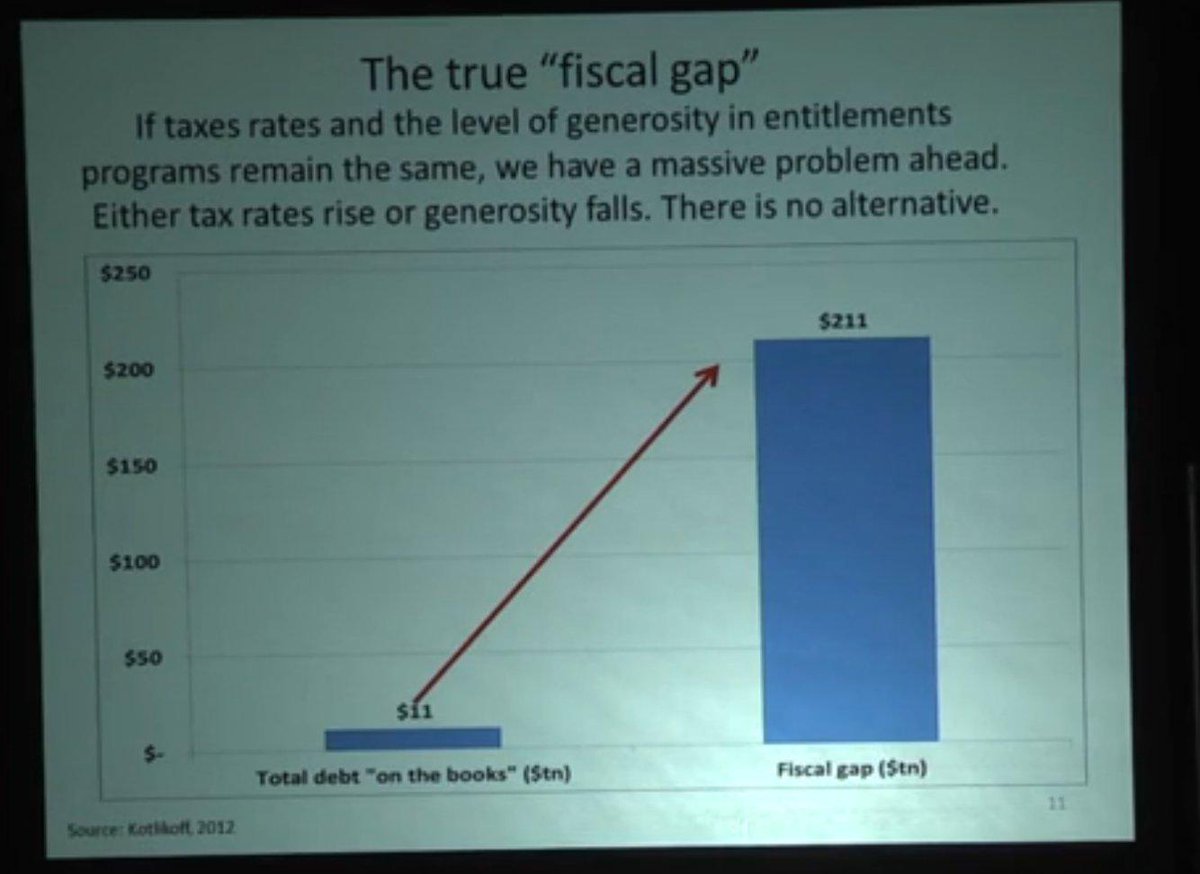

- The welfare state

- Arms race of currency devaluation

- USD hegemony

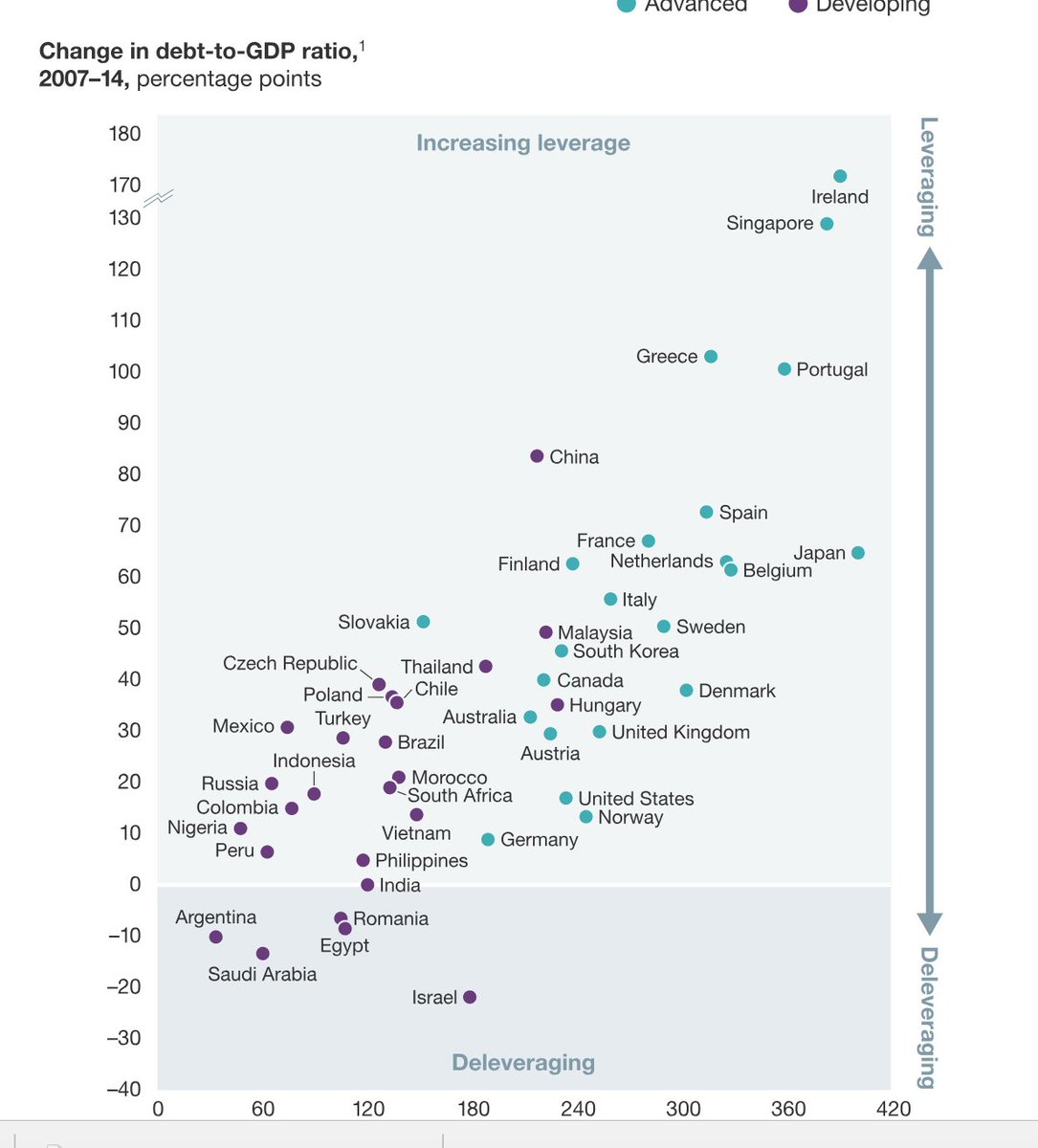

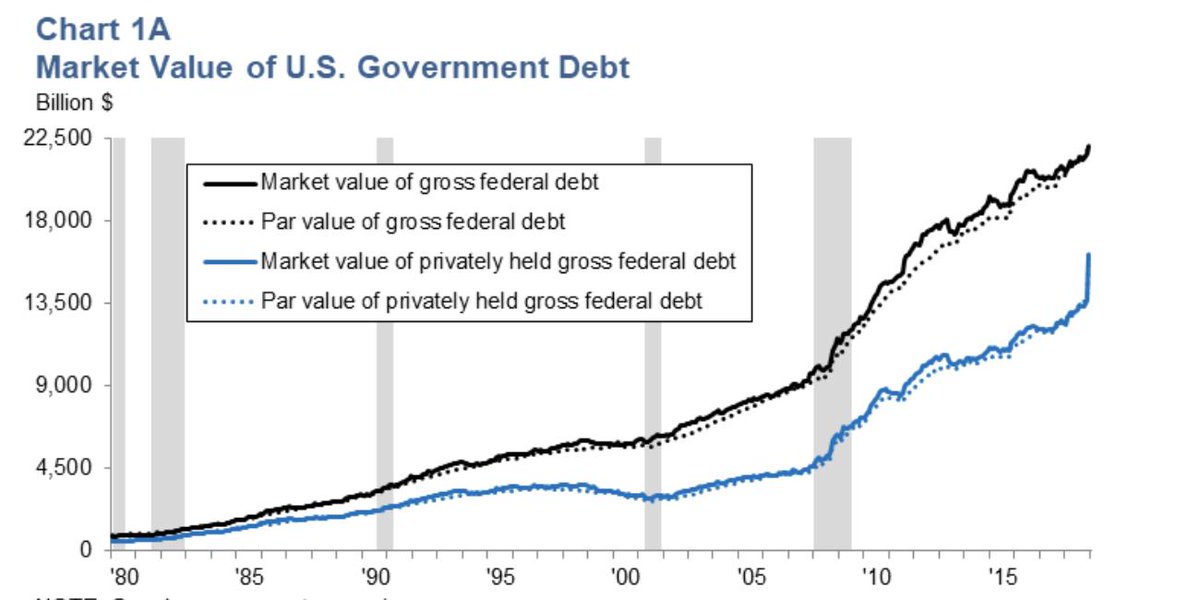

- Global debt

- Bond prices

- S&P 500 prices

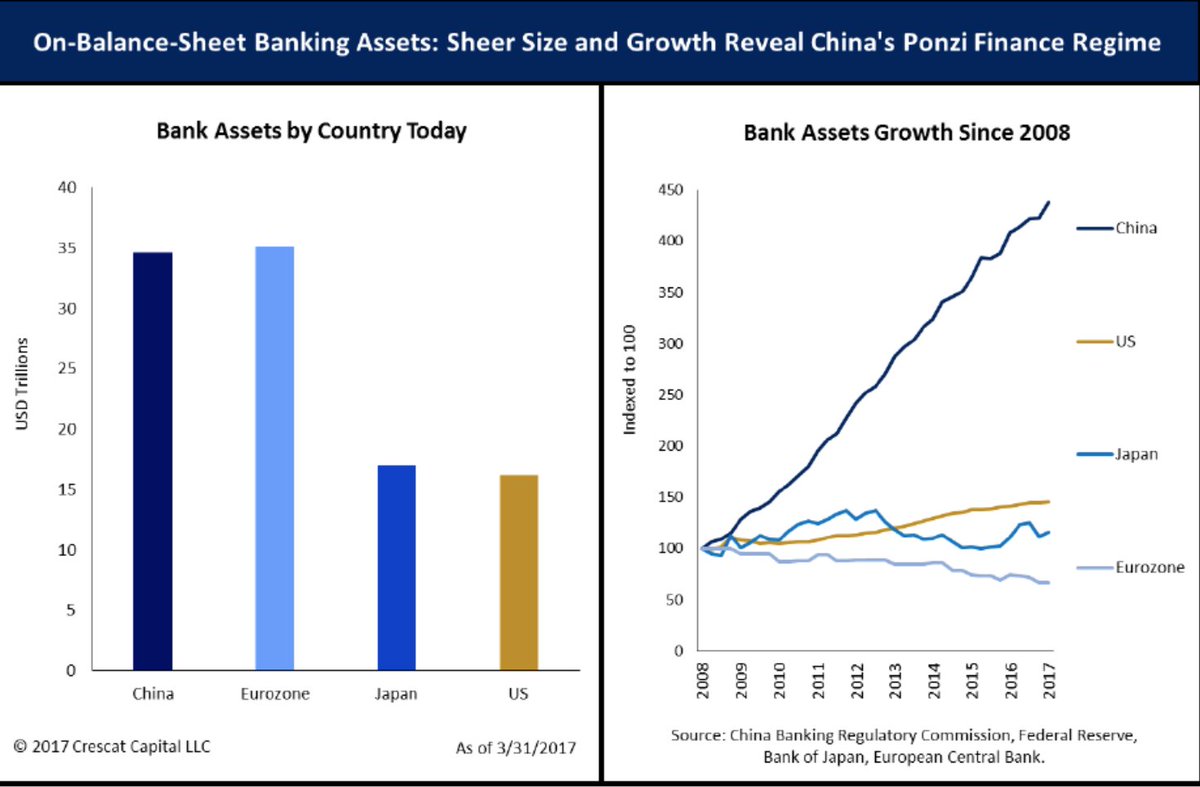

- China debt

- Global peace

- Low volatility

- Political chicanery and micromanagement

The world is in search for a safe haven -- a hedge from the central bank and political micro management and BS we've seen since we've come off Bretton Woods.