Countries charge import duties (or tariffs) on goods that enter the country. For example the EU charges 8% per pair on some types of shoes.

(So does the UK, because all EU members have the same tariffs)

1/n

1a/n

It was a trade war. (Sounds familiar? 'Fraid so)

Rather than protect jobs, the trade war just worsened the depression.

2/n

To cut a long story short, the Second World War followed, and afterwards world leaders decided they needed to do something about it.

One thing they did was to negotiate to get rid of the free-for-all in tariffs, and to reduce them gradually.

3/n

From 1947 until now more products were brought into these agreements, and the ceilings were gradually lowered.

That's how the EU's tariff for those shoes has ended up at 8%

4/n

The others agreed in return to set lower tariffs on products the EU (and UK) wanted to sell to them.

5/n

All the negotiated rates are legally binding commitments in the WTO.

To keep it simple, the tariff rates have two legal implications in the WTO .

6/n

The EU can reduce it to, say 5% or scrap it completely without breaking its promise.

But to raise it to 20% would be breaking its promise, or violating the WTO commitment, unless ...

7/n

(There are rules about which WTO members, but I won't go into that here.)

8/n

Trade specialists talk about MFN, stands for "most-favoured-nation" treatment.

It sounds weird, but it means not discriminating between trading partners, treating them equally

9/n

10/n

The EU (& UK) has numerous "preferences" schemes for developing countries. That's it, as simply as I can

11/ends

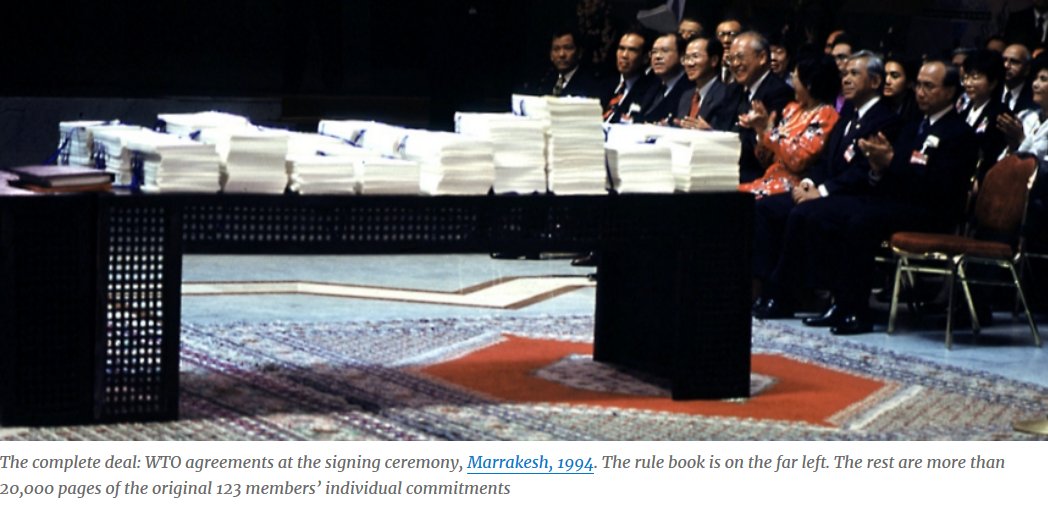

at the end of the last big negotiation (the 1986-94 "Uruguay Round", which involved over 120 countries and created the WTO, this was the entire set of agreements.

A revised rule book on the left and over 20,000 pages mainly listing the tariff ceilings each bound legally