If they can't fix this, outlook for 2019 is pretty bad.

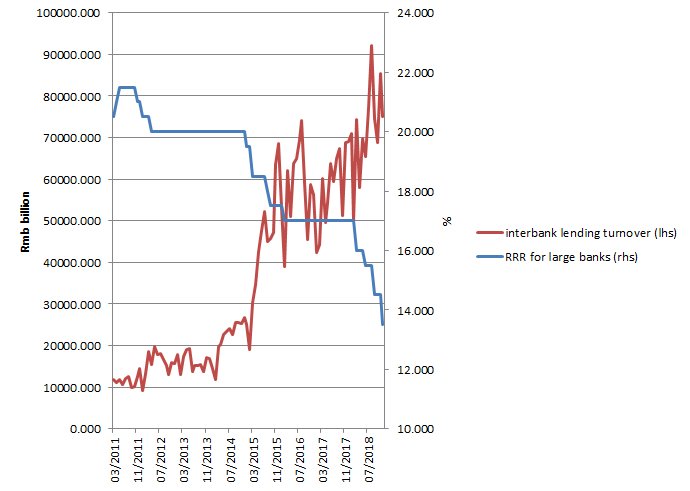

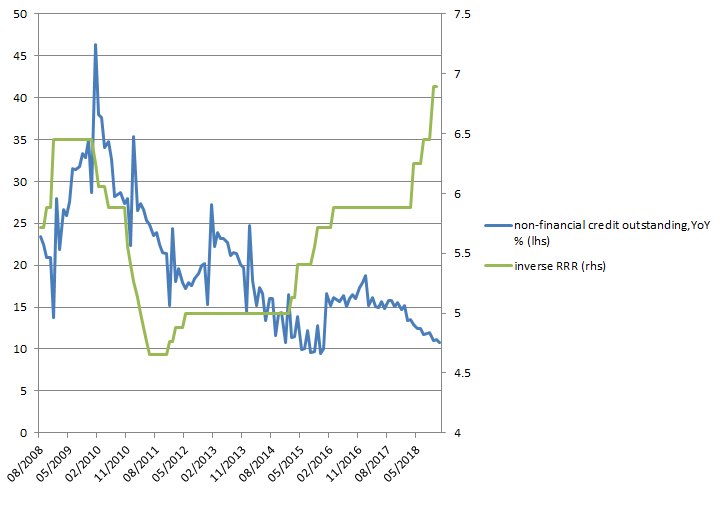

#PBOC cuts to banks' reserve requirement ratio (RRR) successfully pushes financial system liquidity back higher...

wsj.com/articles/china…

wsj.com/articles/china…

But hard to see how can be resolved without (a) letting up on shadow banking or (b) "flood-type stimulus" pushing SOE/sovereign yields so low that banks have to start pushing rates on real loans down sharply