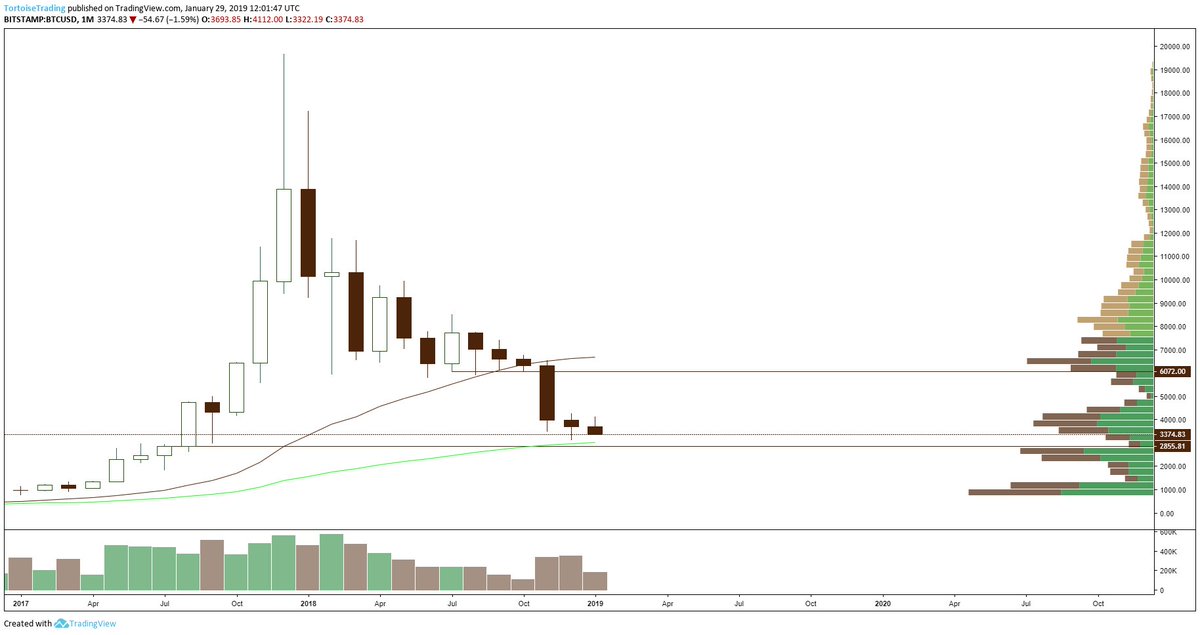

This scenario is just one I am watching. Price could also dip into the 2800 region any day now. It could even plummet down towards 1k and consolidate there for awhile...i find this scenario less likely but as always with markets, anything is possible.