-James Leigh-Pemberton, who later chaired UKFI

-Ewen Stevenson, later RBS CFO

-Sebastian Grigg, friend David Cameron

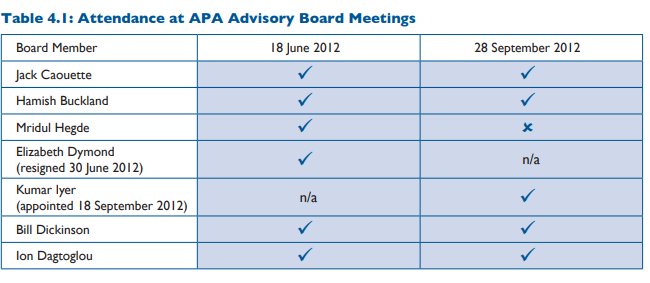

Jack Caouette (APA chair) - Citi

Hamish Buckland - JPMorgan, now CVC chair

Mridul Hegde - HMT, now HSBC

Elizabeth Dymond - PwC, 3i and HMT

Bill Dickinson - ??

Ion Dagtoglou - Goldman Sachs

Stephan Wilcke - Cairn Capital. Apax