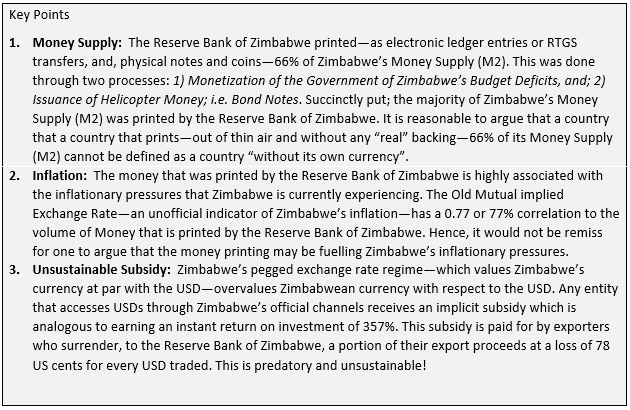

Chicago MEABF is one of the city pension funds. A 2017 stress test was done meabf.org/assets/media/5…

Not because it makes much sense for a pension fund whose promises extend decades.

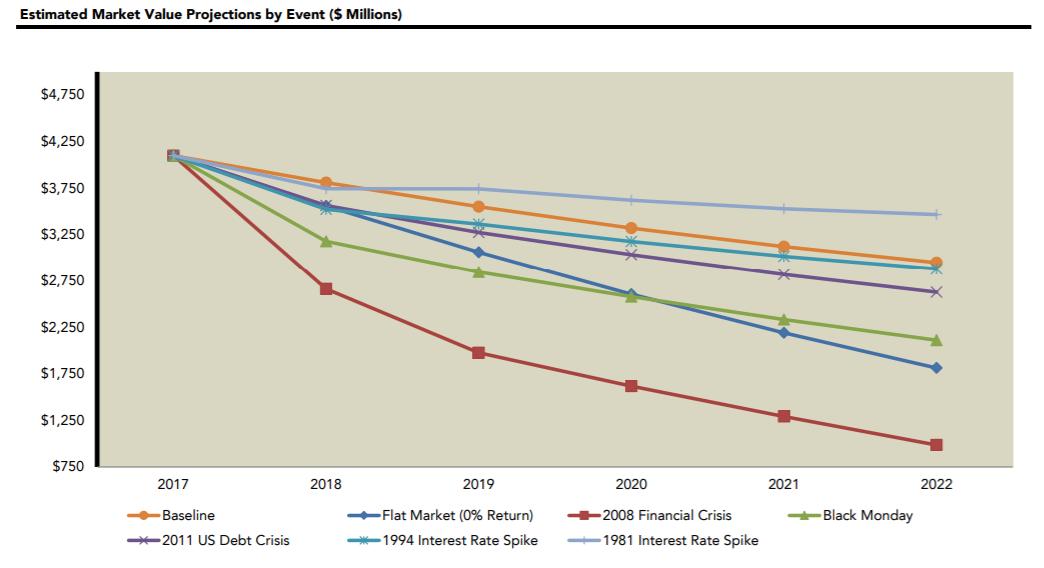

But let's see the result from some of those scenarios

stump.marypat.org/article/151/pu…

So you have to sell off assets to cover liabilities cash flows... and cannot earn out of a hole

If the liability growing, or even level, it's a horrible sign.

"- Given the negative cash flow profile of the Fund, there is a risk of severe impairment. Most significantly, a repeat of the 2008 financial crisis could reduce the assets to less than $1 billion over a five-year period. "