a) Labor lost & Conservative won in 🇦🇺 (good in my book)

b) Trade-war tension ratcheted up a notch w/ Google suspends some biz w/ Huawei.

This wk, we got Fed mins & Korea 1st 20-day of exports🤗

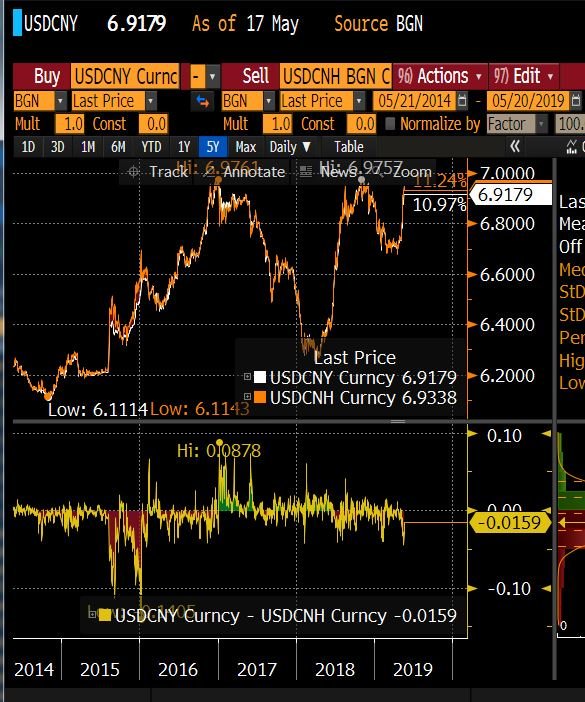

Hence China needed to add counter cyclical factors

a) India exit polls - Modi once more until 2024 seems as indicate his coalition will rule once more (risk assets rallying of continuation of status quo);

b) European Parliamentary elections coming up (23-26 May)