Still, Japan Reuters Tankan manufacturing mood improved 1st time in 7 months. But I worry that it'll encourage the bad-idea VAT hike 🙄🇯🇵

Why? Because it lubricates not just global finance but also global economics. There are 800trn transactions of USD so that is 3200 times the amt affected by tariffs

1st, it make funding costs higher so TIGHTEN FINANCIAL CONDITIONS (yes, leveraged firms & households & gov, ur interest expense 📈) - also Trump reduced interest expense deduction tax incentives.

a) When the USA is growing strong, rates go up & earnings go up & $$$ chases higher return;

b) Capital becomes SCARCE IN EM;

c) HURT THOSE WHO ARE SPENDING ABOVE MEANS.

So TRY, PHP, IDR, INR

That's part 1. Financial conditions. Let's talk about ECONOMICS. Why EM doesn't like a strong USD. Remember the J-curve?

Reason why it does that is assuming demand inelastic at 1st but FX weakness should help after.

TRADE FINANCING is impacted by the rise & fall of assets & liabilities. Let me explain why a weaker FX may not be helpful

Markets (global econ&EM) praying 🙏🏻JPO to show signs of LOWERING price of the USD. Why? Can't handle a strong USD. A strong USD➡️Tighter financial conditions, which hurts those too leveraged most➡️Tighten trade financing, causing investment 📉

Sincerely,

@Trinhnomics

This is why markets ROSE IN Q1 as JPO whispered sweet nothing to markets' ears 👂🏻

He said, "DO NOT BE AFRAID, I WON'T HIKE" 😉

& Maybe, I'll ✂️

BIS paper 🤓: bis.org/publ/work695.h…

Speech: bis.org/speeches/sp190…

by one of my favorite economists (if not my most fav) 👉🏻@HyunSongShin 👌🏻

The bad Asian exports you saw reflect INVESTMENT 📉📉. Meaning, we want the USD to be softer for respite🙏🏻

True story.

Thailand -2.6%

Japan -2.4%

China -2.7%

India -0.6%

Indonesia -13.1%

Singapore NODX -10%

Korea -2%

Taiwan -3.3%

Vietnam 7.5% 👏🏻

It's April guys. CNY was like so 2 months ago 😉 & let me tell u, it's down 📉(not just China, everyone)

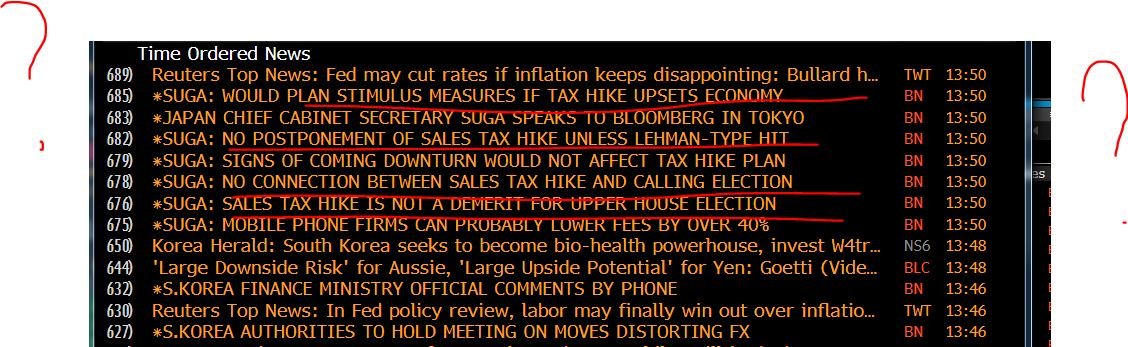

Wait for it: Plan stimulus measures if tax hike upsets econ👌🏻