Never Bet Against Elon™️

or,

I Promise I'm Not A Bull But We Should All Try To Think Like One Sometimes

or,

Please Don't Put Me On The BlockList This Is Just a Mental Exercise

0.1/many

$tsla $tslaq

0.2/

0.3/

0.4/

0.6

OK enough preamble lets get into it. Thoughts may jump around, apologies in advance.

0.7/

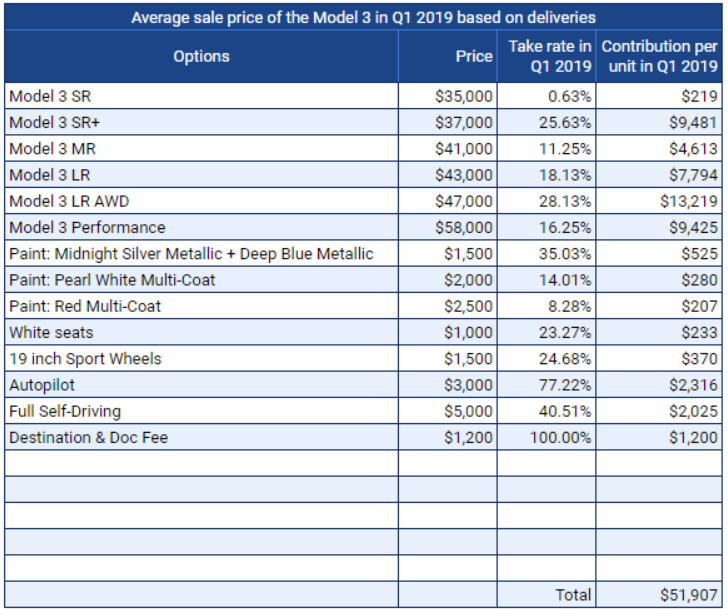

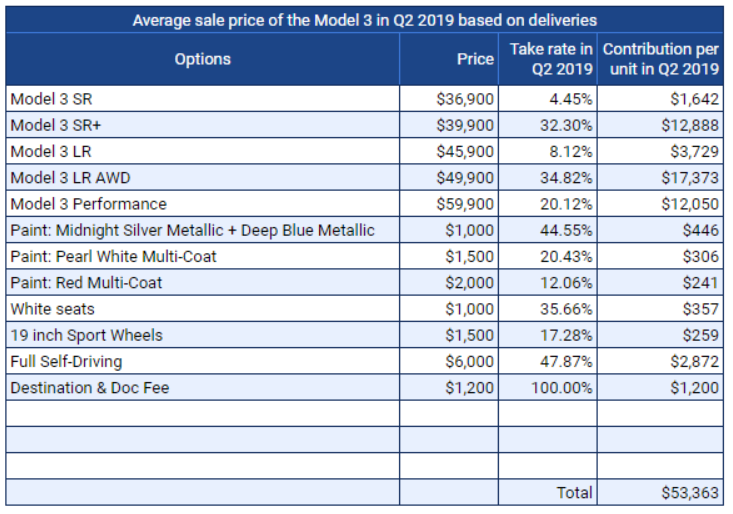

ASP may not be as bad as some think.

As noted earlier today, @TroyTeslike's Model 3 order tracker indicates that Model 3 ASP **INCREASED** from Q1 to Q2.

This is primarily due to mix and FSD uptake.

$tsla $tslaq

1a/

But that's a big honeypot that can be tapped should Elon ever want to.

1b/

Removal of MR and LR RWD means more LR AWD and P purchases.

1c/

$tsla $tslaq

1d/

S is a dog, no doubt about that. I myself was posting plenty of screenshots of LRs going for $7x,000 until they sold out.

1e/

Both models' ASPs will be hurt by the free luda promo that $tsla ran this quarter, and S was heavily discounted, but overall I don't expect a total cratering.

1f/

mitigating points on potential good ASP:

1) on-the-ground data in the US appears to show a weaker 3 mix than is reported in Troy's sheet. Many more SR+ (and also, prob a ton of those into CA since that was the moneycar in terms of incentives).

1h/

1i/

1j/

MOVING ON...

2a/

(As my managerial accounting professor said, in his opinion, the failure of managers to understand managerial accounting led to unnecessary US outsourcing).

2a.5/

I'm not going to get highly quantitative; I'd would rather keep this at a high level.

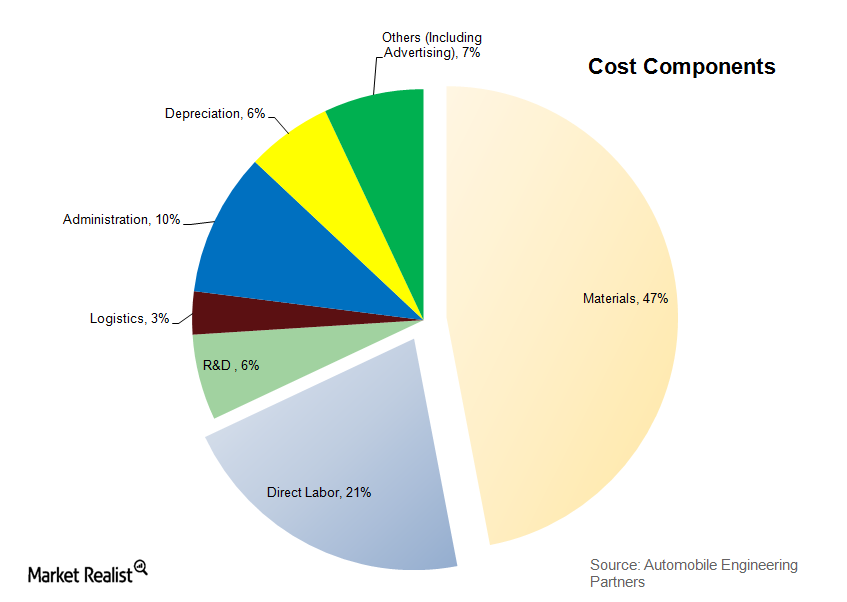

Attached is a chart on auto industry costs from marketrealist.com/2015/02/raw-ma…

2b/

Because, when you go from making 63k Model 3's in Q1 to 73k Model 3's in Q2, fixed costs per car decline by ~15% (all else equal), which is going to provide a nice healthy margin boost to Tesla.

$tsla $tslaq

2d/

2f/

Enjoy this part 1 while I compose Part 2 (and 3 and 420?)

We shall resume at 2g, will try to figure out the best way to do this.

$tsla $tslaq

Lets say the average all-in comp exp of those 4k laid off workers was $75k/yr (mostly plant, some white collar).

That's $300m/yr, $75k Q.

needle moving.

2h/

That saves a lot of direct labor expense (which may happen not via layoffs but less OT).

$tslas $tslaq

2i/

2j/

2l/

I'd expect that auto GM clocks in at at least 20% this quarter. @DeanSheikh1 wanna bet?

2n/ NEW TOPIC

we at $tslaq love to laugh at the lemmings suffering but there's a reason for the madness.

Tesla, despite just raising $2b, is pinching every penny right now.

Is it bc they're short on cash? no.

It's because god-king wants to burn shorts.

3a/

3a.5/

1) start making people pay for diagnosis of issues during warranty period. ~$1-200 a pop.

2) Refuse to replace yellowing S/X screens.

3) hit the credit cards of people who are supposed to have unlimited supercharging

4) not improve parts waits.

3b.1/

3b.2/

It's because the god-king thought that profitability may be possible.

I have no idea if they're close.

But so much nickle and diming (when cash is relatively flush) means that the focus finally *IS* on accounting profits.

3b.3/

$tslaq

3b.4/

end of 3/getting to the end

$tsla $tslaq

4.0/

I think @elonmusk f'd up in a big way in his lil cute quarterly deliveries release.

$tsla $tslaq

4a/

because there's no way that the number is impressive.

If we're talking S/X/3 orders, (imo) the number is probably like what, 10 or 15k absolute max? cool, 1 month of orders bro.

If that number gets stated, LOL.

4c/

So, in the immaculate Q pt 2, that's one big mistake to harm story.

4d/

Tesla has always been a contrarian's play.

Who were the bulls who *REALLY* made money?

The ones who bet on a balding @elonmusk talkin crazy stuff about EVs taking over the world in 2012. he looked destined to fail but (kinda) came through.

5a/

Those who shorted 1) after @elonmusk committed the most egregious securities fraud in history and 2) after the magic Q3 deliveries print.

So what does that mean for today?

5b/

Analysts are largely still negative.

$tslaq is highly negative.

( $tsla bulls of course still are extremely rose-glassed for both near-term results and The Story).

But if we/analysts are expecting the worst, that means there's upside potential.

5c/

POINT 0: This is a thought exercise of what could go right for god-king.

Point 1: ASPs may be better than $tslaq expects.

Point 2: Efficiencies from higher volume.

Point 3: other cost cuts signal desperate profit drive.

(continued)

FIN 1/3

Point 5: the overall bearishness of the $tsla/ $tslaq environment right now worries me a bit and is really the motivating factor for me to throw this bullish spaghetti at the wall.

FIN 2/3

$tsla $tslaq

DUN