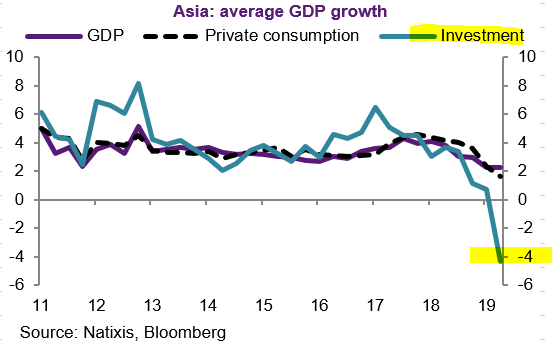

Welcome to Q3 2019 - acceptance is not easy & took us a while but here we are.

@jasonzweigwsj

😉

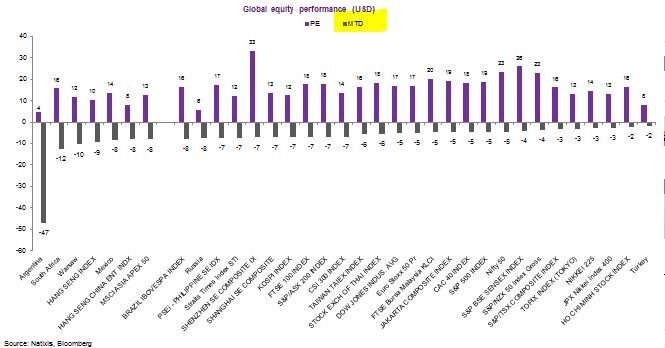

Global equities in USD month-to-date (just 2 wks😬) AUGUST SALE TOTALLY HAPPENING!🤗

Do you think the US economy will have a recession in 2020 (Pres elections Nov 3)?