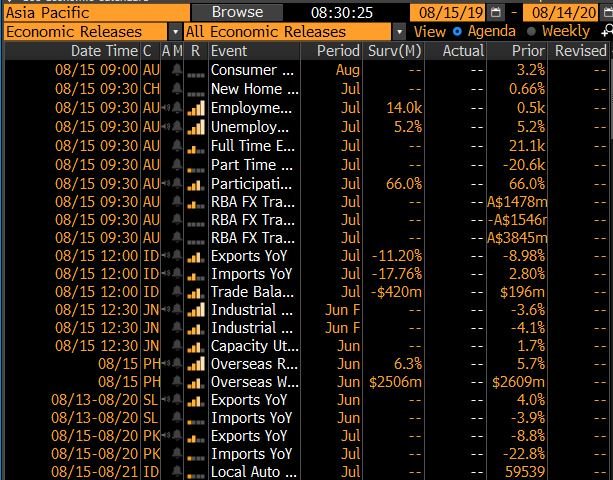

Singapore just reported non-oil domestic exports and that's down -11.2%YoY from -17.4% in June. Electronics fell -24.2% from -31.9% 🇸🇬😬.

That's a wrap - Asian exports 📉& u know what that means

🇸🇬Singapore -11.2%

🇰🇷Korea -11%

🇮🇩Indonesia -5.1%

🇹🇼Taiwan -0.5%

🇮🇳India +2.3%

🇨🇳China +3.3%

🇻🇳Vietnam +9.3%

What do u see? Clearly the biggest losers of weak trade are Korea & SG😱. Why? Exposure to tech & China 👈🏻

EU 🇪🇺28 -2.5%

Japan 🇯🇵-44.2%

Malaysia -23.3% (Q2 GDP today)

India 🇮🇳-18.5% (likely petrol related)

USA 🇺🇸is BEST & positive driver of Singapore's exports 👏🏻

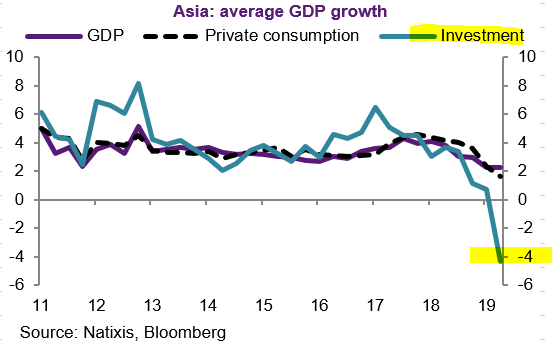

The world is still buying more Chinese goods (or shall I say more integrated with China) while China is becoming more local👈🏻

The world is more integrated with China via China's export prowess & meanwhile China is becoming less integrated with the world with its decreasing imports/dependence on others👌🏻