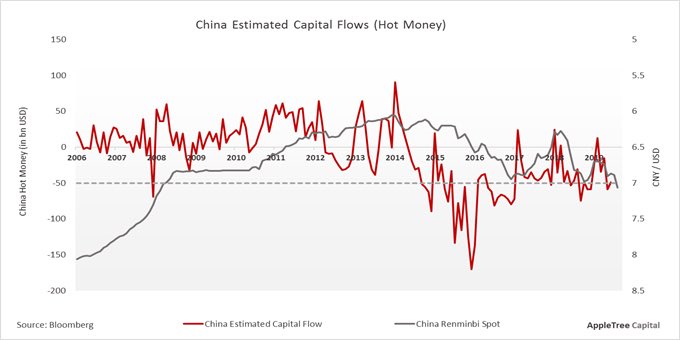

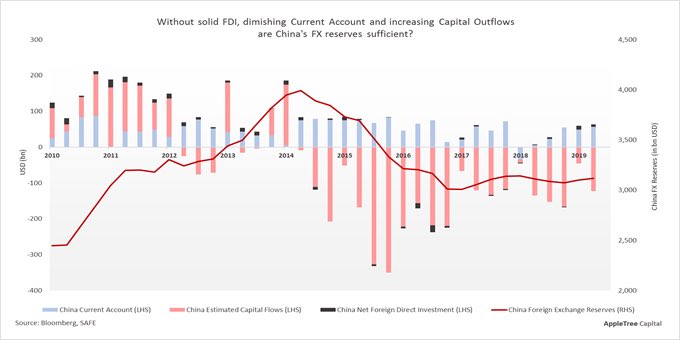

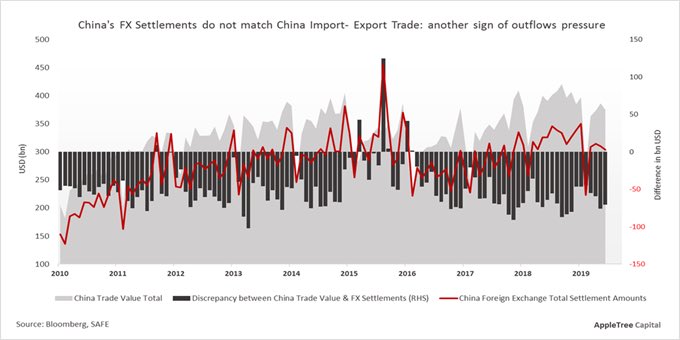

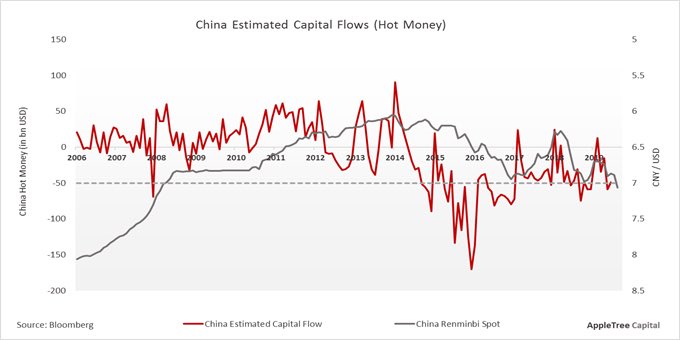

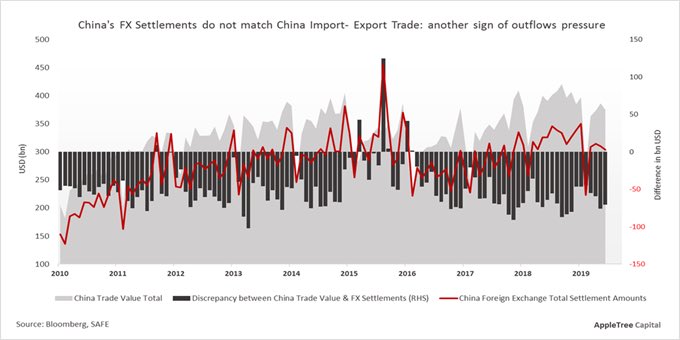

#China clamps down on capital flight risk as #yuan weakens asia.nikkei.com/Business/Marke…

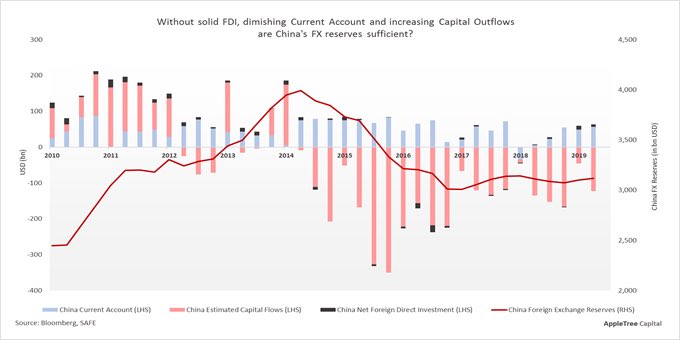

Given that #China has been giving reassurances about the financial health of tis economy and its adequate FX reserves this should not be necessary. But,

Get real-time email alerts when new unrolls are available from this author!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!