#Jamaica #financialinclusion

- 65% of wage earners receive their wages in cash

- 23% of account holders do not make any deposits of withdrawals into their accounts

He asks presenters to be brief and will not call names but indicates that whoever is laughing knows who is being spoken about (Hint: Milverton Reynolds, Head of the @DBJamaica )

The IMF has also been very supportive and encouraging of the efforts - Byles

Byles says that no one has been to Jamaica more often than her.

She has a favourite jerk spot too.

Households lack suitable and accessible savings, affordable insurance and retirement products - Only 30% of Jamaicans save through a regulated financial institution 😳

#financialinclusion

Including the Informal Sector would add another 7%

That’s significant.

Dr. Uma adds that bringing Crime down to global averages would add another 0.5%, That’s how big financial inclusion is

Instead of credit scores, etc, India lenders have shifted to look at a wider range of items, not even just transaction history.

Says it’s food for thought.

He says that too many SMEs are not properly financially literate. Also highlights recordkeeping and being tax compliant

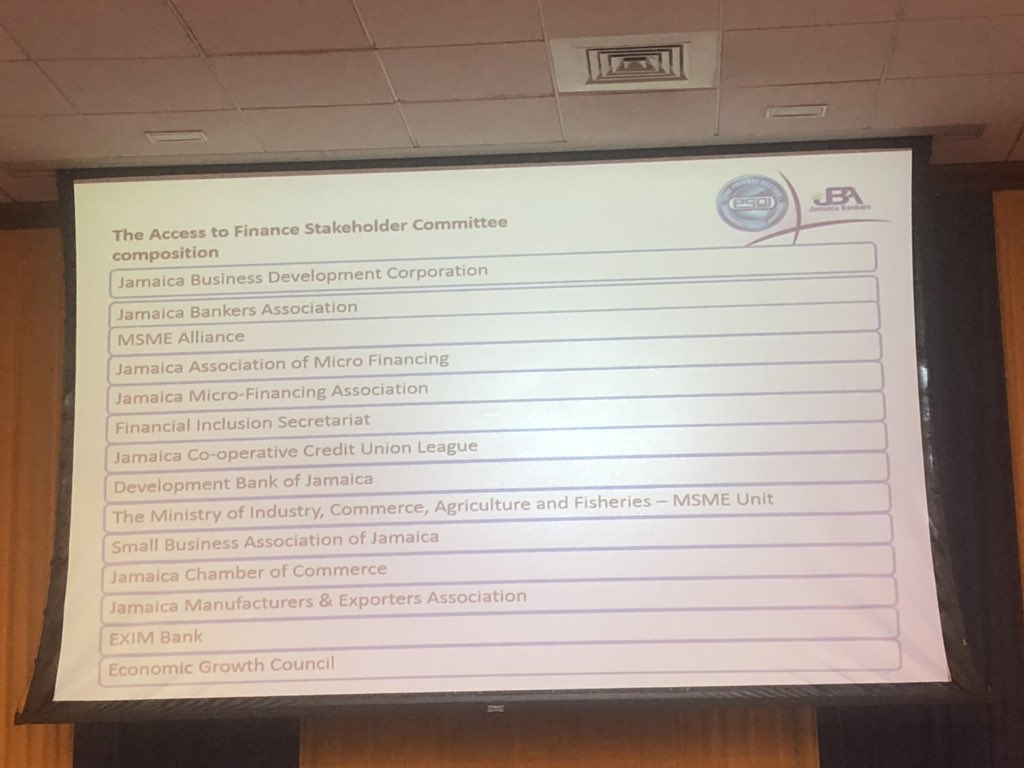

Acknowledges Dr. Uma and her team for their work over the last 4 years.

Says it’s been “totally consultative” and meeting with all stakeholders across the society.

Very “data driven”

The bankers said that the businesses weren’t providing the data to adjudicate creditworthiness.

Now the changes must take place and its slow because “they weren’t prepared” for lending to SMEs.

There has not been takeup but that is where the opportunity is in Jamaica.

“We all came together and said that we want to shift this”

They did surveys to get feedback and suggestions.

This is for Jamaica

Banking a $2M loan for an SME requires efficiency in order to be profitable. The banks need to make things scalable for smaller loans - Duncan

Separate workshops for Credit Unions and MFIs since those are more micro loans and slightly different.

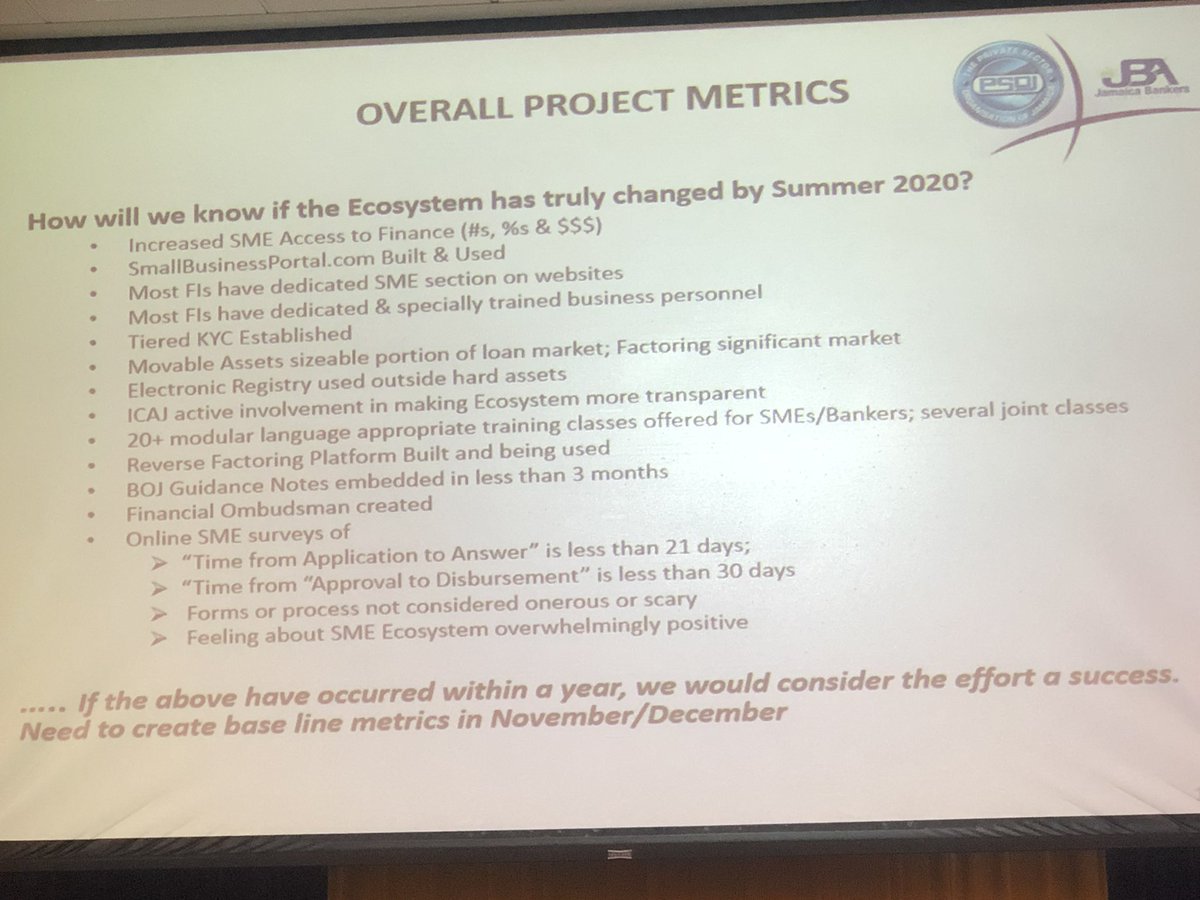

This is how they will be judging success of the first phase by Summer 2020

#financialinclusion #Jamaica

A fund was setup with J$250 million with maximum guarantees of J$15 million or 50% of the loan. Smaller loans could get 80% guarantee.

J$3.3 billion in guarantees to date and fund grown to over J$430 million

Leverage in other jurisdictions were 10 times for similar funds but Jamaica was significantly lower.

They now have a new and improved CEF that has been approved starting October

Smaller loans will benefit from 90% guarantee.

J$3.4 billion additional added to fund and leverage now 6 times so will be able to provide guanratees of up to J$25 billion for SME loans.

Well done @DBJamaica

Pressure in place and launches next month.

Currently, Approved Financial Institutions must apply for guarantees for loans individually.

Making changes...

Allowed 2 questions and 2 follow-up questions

Duncan says that this is focused on Small and Medium, not Micro, but they “need to meet the client where they are”