@BBCRealityCheck says it's “hard" to describe Tory changes as "taxes for the richest being slashed”.

Really? This needs its own reality check. Bear with me.

@BBCRealityCheck acknowledges the Tories abolished the 50p tax rate for income of £150,000+.

But it measures the impact of this by using data for the top 10% when less than 1% of earners - the very richest - benefited.

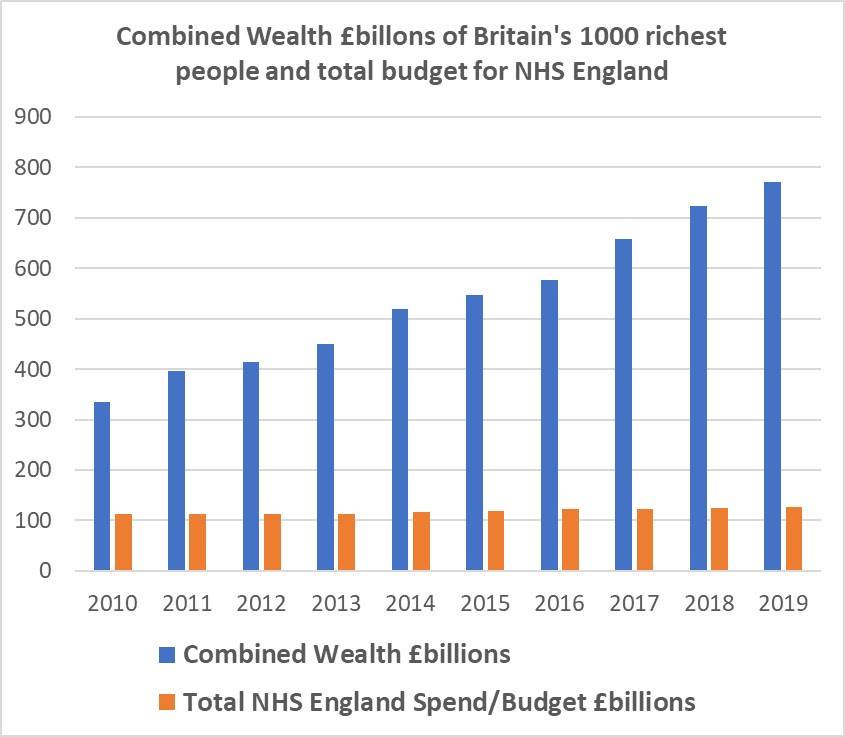

For the rich, tax on wealth gains are a much bigger deal than income tax.

The Tories have cut CGT for high earners from 28% to 18%.

That yields a £1m tax saving on an asset bought for £10m and sold for £20m.

In a blatant abuse of the term 'entrepreneur', they've opened ER to investors generally and increased the allowance from £1m to £20m.

Explained here: steve-howell.com/tax-breaks-nee…

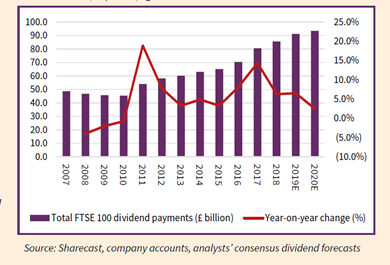

Not true. Apart from business lobbyists, no one seriously disputes that CT cuts have helped fuel a dividends bonanza.

These are giveaways beyond most people's wildest dreams: the ER changes alone yield a £3.6m tax saving on a £20m capital gain.

@BBCRealityCheck - that's the reality!