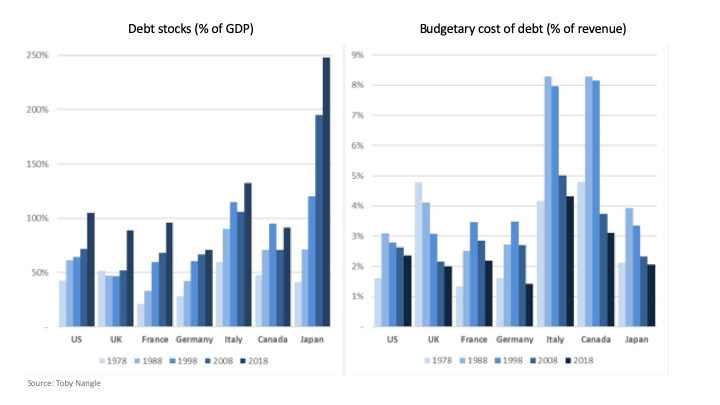

resolutionfoundation.org/publications/t…

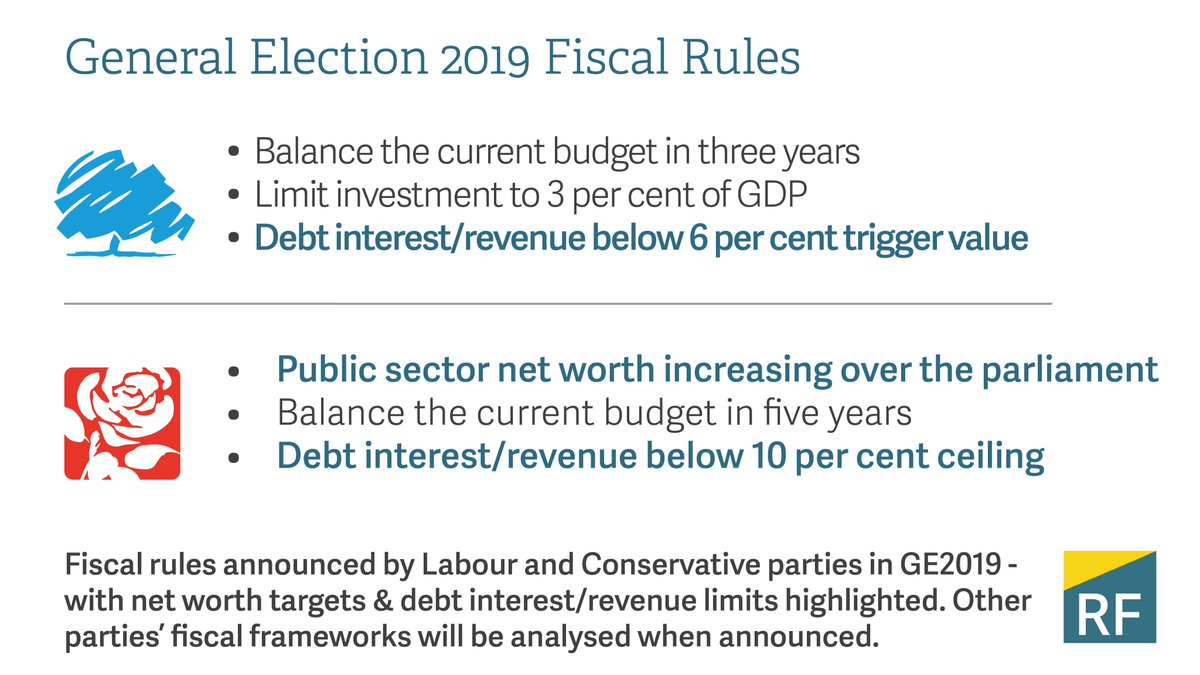

Read more @resfoundation analysis of Labour & the Conservatives’ new fiscal rules here:

resolutionfoundation.org/publications/r…