Rates going lower in China despite rising CPI & that means the gov is more worried about growth 🇨🇳👈🏻

HK is 6/65 or 9%

Yesterday, there was +108 deaths in Hubei.

According to NDRC, >50% industrial enterprises in Guangdong, Jiangsu, and Shanghai resumed production (that means the hit ratio is still low & question of what capacity)

Global tourism is taking a hit & thus all sectors related to this.

Reduced demand =???

SHCOMP price/earnings = 14.3

HSCEI (hang seng Chinese firms) = 8.7

Interesting right? 🤗 Sectors are similar so diff is onshore/offshore!!!

ft.com/content/2362a9…

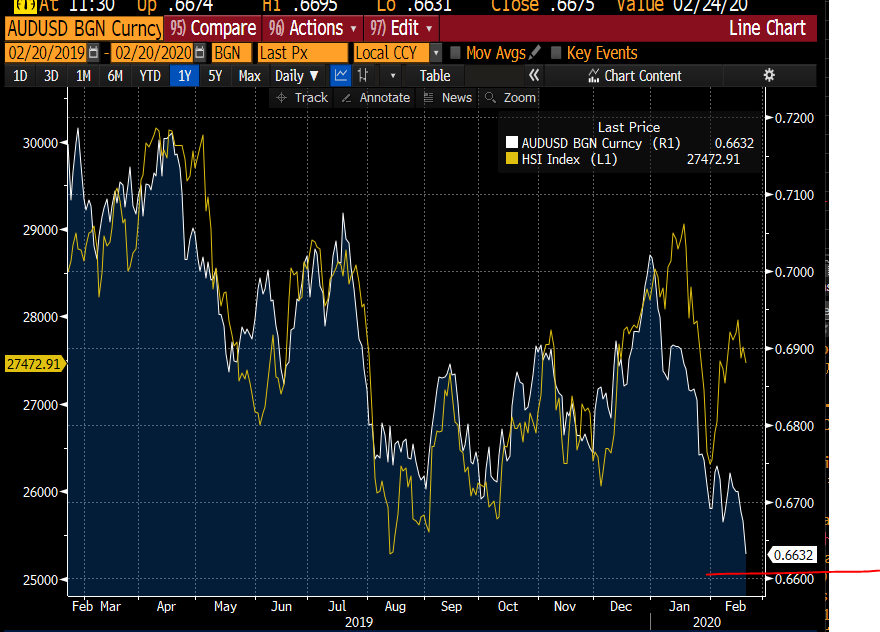

Pricing in DIRECT EXPOSURE VIA CHINESE DEMAND & INDIRECTLY VIA COMMODITY PRICES.

This is now an Asian story & not just a mainland China story.

Watch this virus if u trade commodities. Demand is key (obvs supply too) but demand not doing well now...

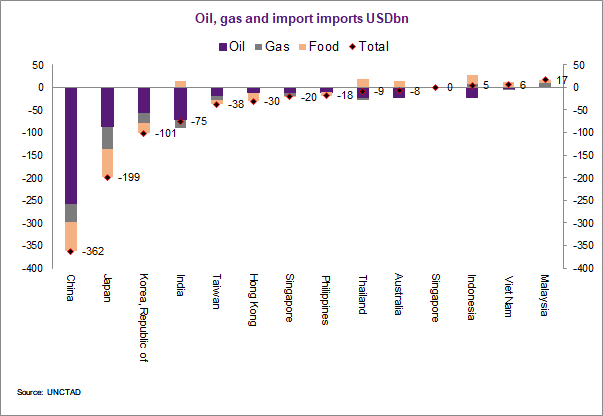

And it just so happens that the virus hits China, Japan & Korea, the epicenter of commodity demand👇🏻👇🏻👇🏻😬

Why? Big customers getting infected by the corona virus & that has downward implication for demand.

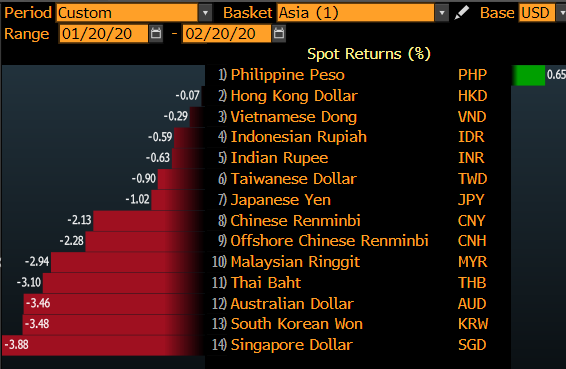

Biggest losers: SGD, KRW, AUD, THB (losses greater than -3

Winners: PHP 🙇🏻♀️🙇🏻♀️🙇🏻♀️

a) Japan is increasingly becoming a worry so that means canceled conferences (I'm due there in 2 wks) & cautious people = DECLINE IN DEMAND

b) Summer Olympics even if on likely weak.

So? Asian growth is increasingly infected by the virus & not contained to China alone

Why? Because commodity prices & linked assets are 1st hit w/ the decline of demand so PRICING IT IN MORE.

Begs the question, can equity be divorced from earnings?

To keep this lofty valuation (SPX), firms inside SPX have to be somehow SHELTERED from decline of demand in Asia (as in very US centric).

So, earnings. Watch earning forecasts..

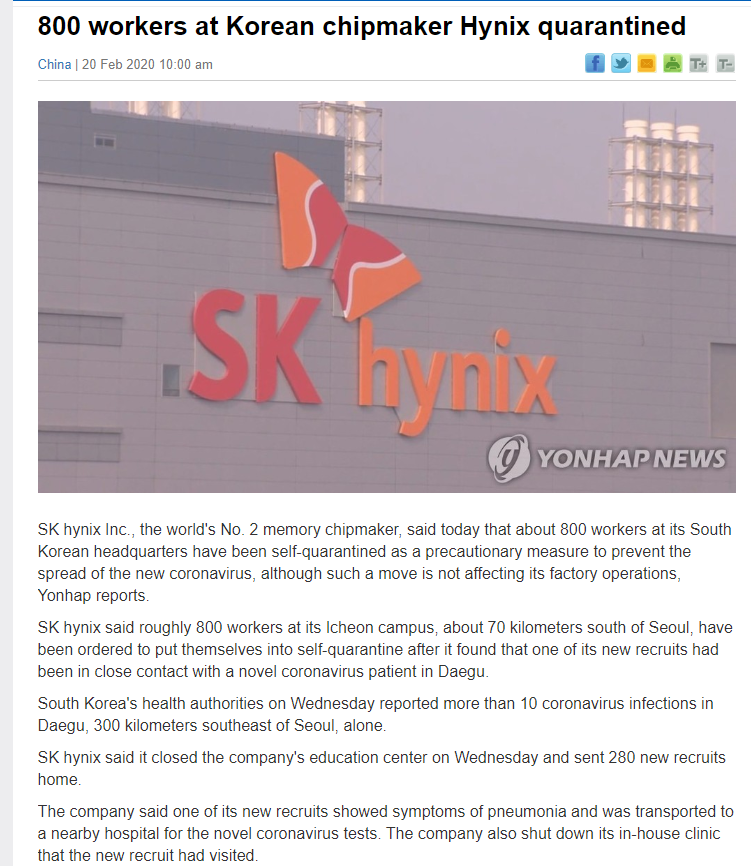

Talk about supply chain disruption for electronics by the corona virus 🇰🇷😬

😬🇰🇷

AUD lost almost 6% ytd 👇🏻👇🏻

IDR still strong at +1% & best in Asia. Look at the ASEAN FX - very resilient, esp IDR, PHP & VND.