- MPC advanced its mtg, evaluated macro economic conditions

- Voted for a 75 bps repo rate cut, 4-2 majority

- 5.15% to 4.4%,

- Reverse Repo rate reduced by 90 bps to 4%

- done this imbalanced cut for banks to support lending

#economy #Markets

- Need to support growth considering economic conditions

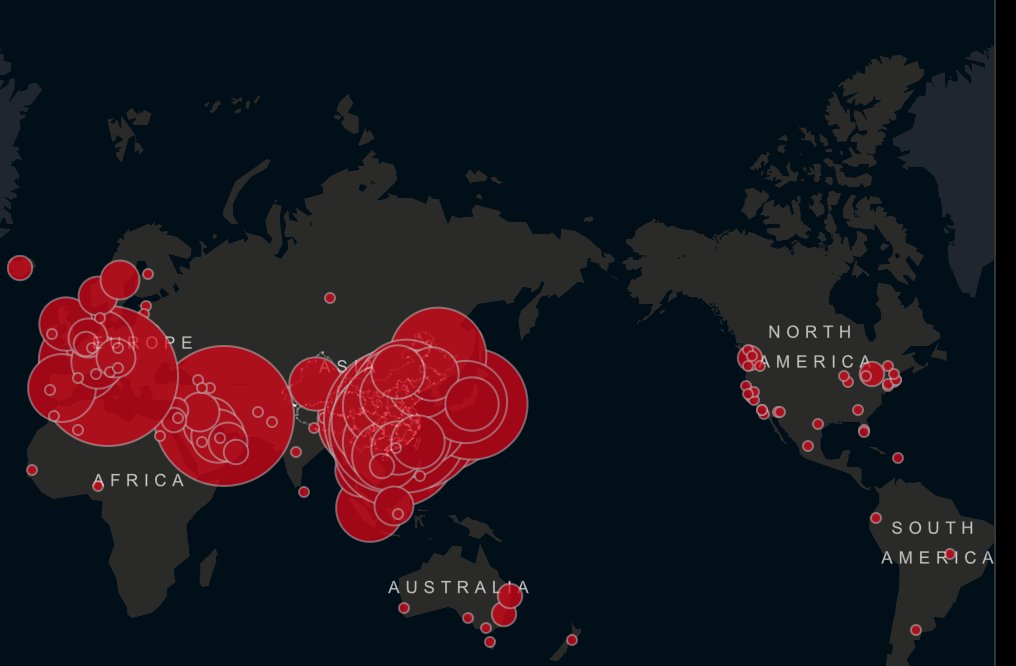

- Will fight #COVIDー19 with measures available

- RBI is at work and in mission mode, monitoring financial conditions, will provide additional liquidity support

- will work for financial stability

#rbigovernor #RBI

- FY20 GDP estimates given by CSO is at risk 🙄

- To contain intensity, spread of #CoronavirusOutbreak

- FY21 estimates at great risk

- Risk factors: Supply chain disruptions too high, upside growth impulses through fiscal & monetary policies

- Food inflation to soften.

- With situation fast changing & outlook uncertain, no projections for inflation or GDP

- Pls follow guidelines & advice given by govt

- Demand, supply side risks too high

- Injecting substantial liquidity in to system

- RBI, SEBI to function supporting capital mkts

1. Measures to expand liquidity

2. Steps to reinforce monetary transmission

3. Efforts to ease financial stress by relaxing repayment

4. Proper functioning of markets

- CLTRO: Auction of long term repos of 3 yr tenor for total amount upto 1 lakh cr. at floating rate linked to repo rate

- Banks to deploy liquidity accordingly

- Primary mkt and secondary mkt purchases are included.

- 25,000 cr auction today

- Reduction of 100 bps for all banks for a period of 1 yr.

- to release Rs. 1.37 lakh cr across banking system

- to reduce daily CRR balance from 90% to 80%; 1 time dispensation till Jun 2020.

Total liquidity 3.74 lakh cr will be injected into the system.

- Moratorium on term loans: All comm. banks & NBFCs, FIs etc are being permitted to allow a 3 month moratorium on payment of term loans as on 1 Mar 2020

- Deferment of interest in WC facilities: deferment of 3 mths on payment of interest on 1st Mar.

changes in WC terms will be ok; no qualification as NPA or downgrade, no impact on credit history.

NSFR: Deferring by 6 mths to 1 Oct 2020.

CCB: last tranche of 0.625% deferred to Sep 2020.

#RBI #rbigovernor

- RBI liquidity injection works out to 3.2% of GDP with current measures announced.

- All instruments - conventional and unconventional - are on the table;

- NO link of share price of banks to safety of deposits👍

concluding: RBI governor is optimistic; current situation much better than 2008 crisis

- This too shall pass, need to be careful and continue with precautionary measures.

Stay safe, stay clean and go digital! #rbigovernor

End🙏