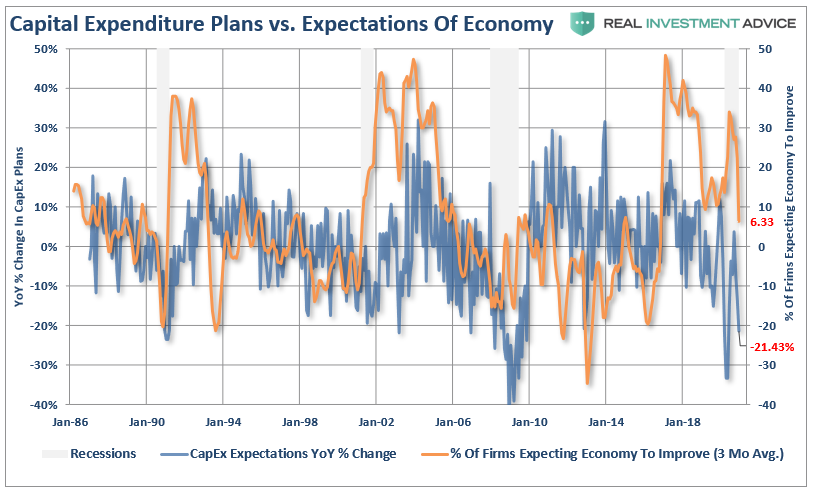

#TechnicallySpeaking - Signs of #exuberance warn of a #correction.

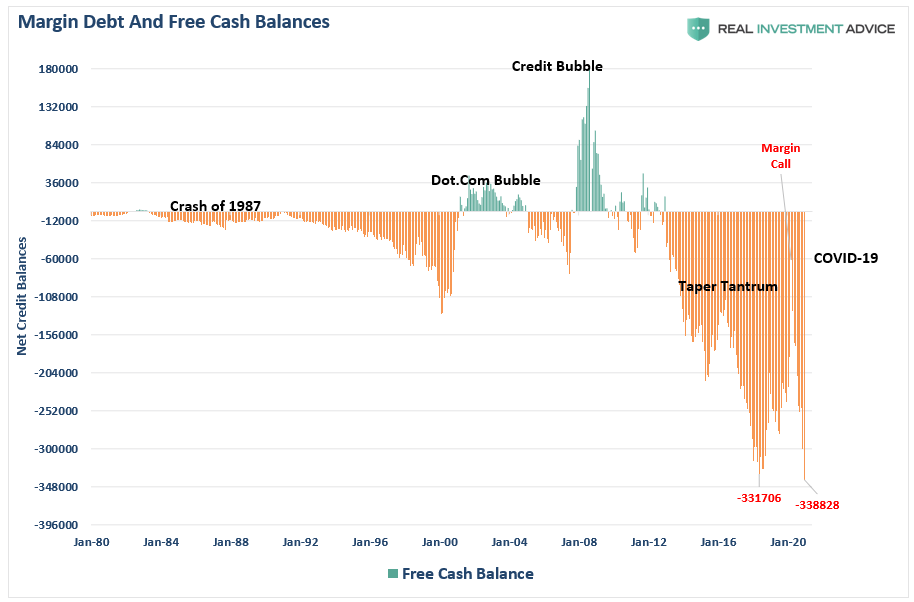

An update of #margin #debt is sending off warning signals that we haven't seen since the last corrective cycle. Also, why this is NOT a #new #bull #market.

realinvestmentadvice.com/technically-sp…

An update of #margin #debt is sending off warning signals that we haven't seen since the last corrective cycle. Also, why this is NOT a #new #bull #market.

realinvestmentadvice.com/technically-sp…

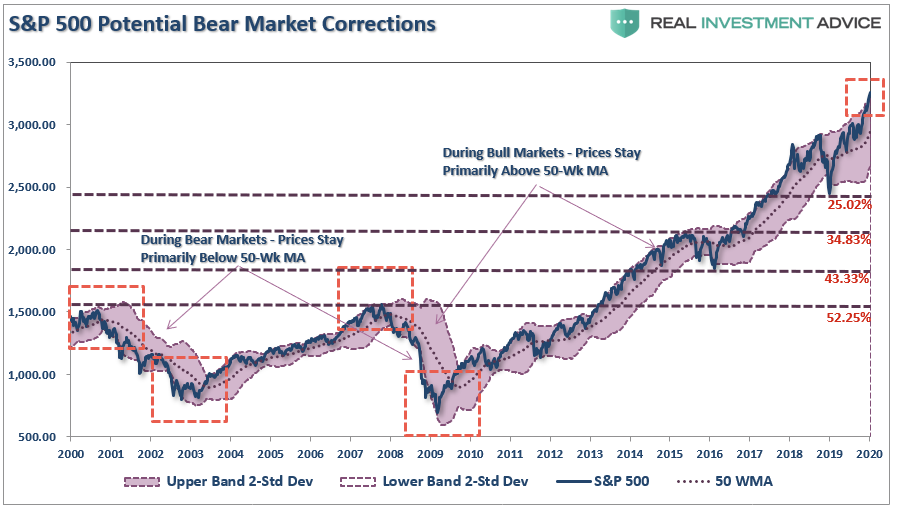

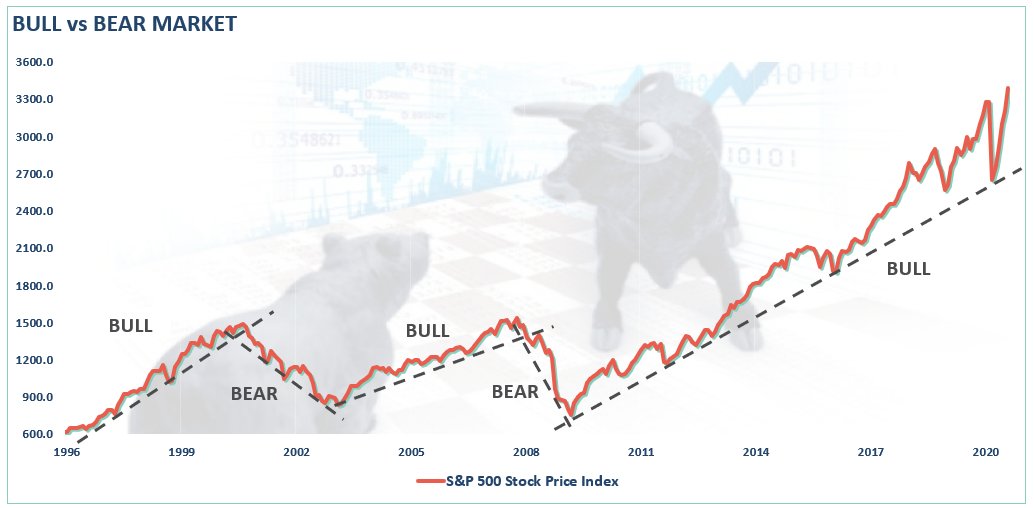

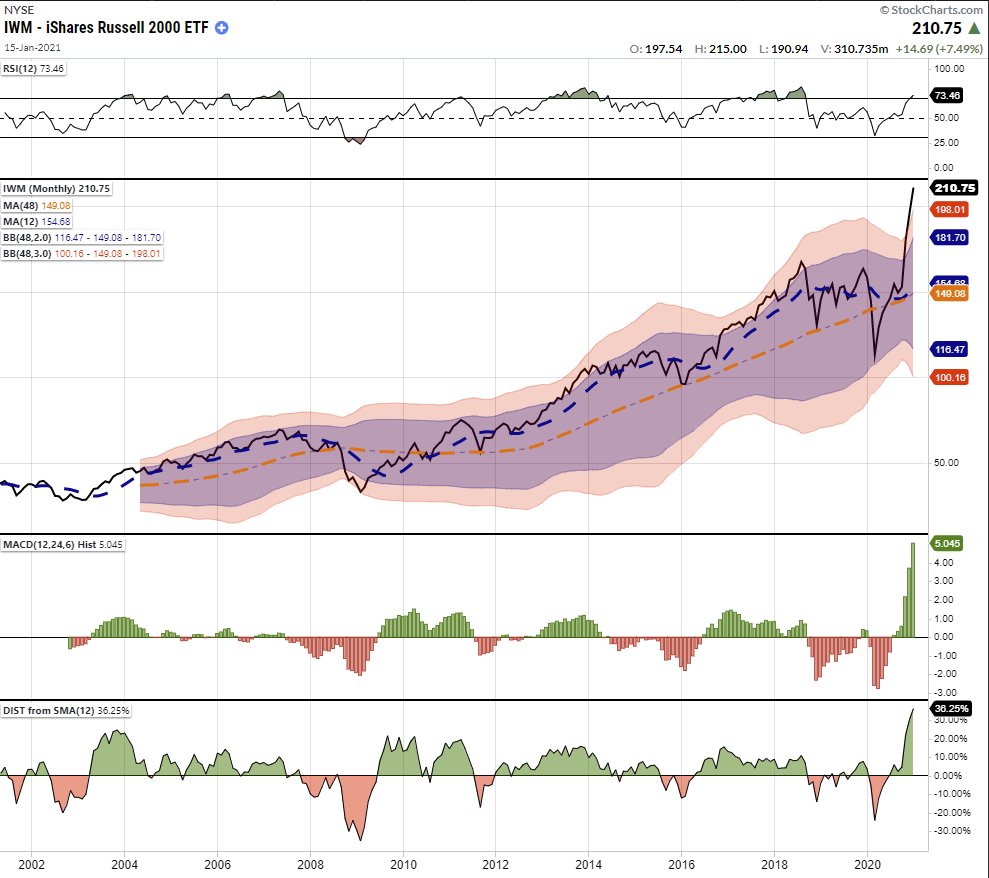

Repeat after me: March was not a #bearmarket.

‘Corrections’ generally occur over short time frames, do not break the prevailing trend in prices, and are quickly resolved by markets reversing to new highs."

realinvestmentadvice.com/technically-sp…

‘Corrections’ generally occur over short time frames, do not break the prevailing trend in prices, and are quickly resolved by markets reversing to new highs."

realinvestmentadvice.com/technically-sp…

Reason 2 that March was not a #bearmarket

#Exuberance in terms of investors allocation to #equities takes years to recover following a real bear market.

realinvestmentadvice.com/technically-sp…

#Exuberance in terms of investors allocation to #equities takes years to recover following a real bear market.

realinvestmentadvice.com/technically-sp…

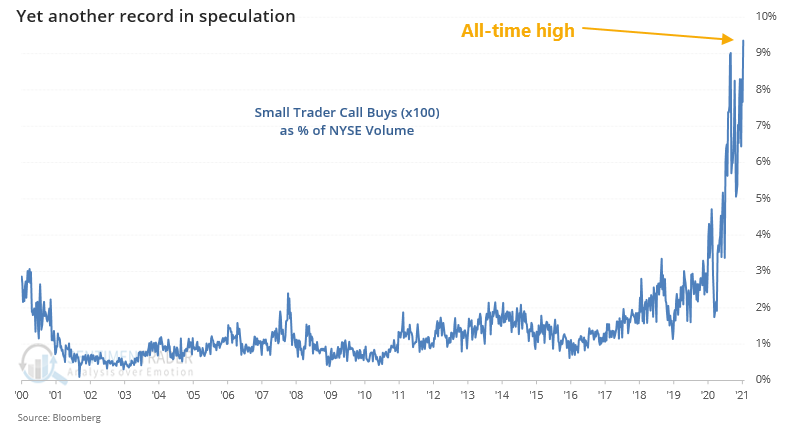

Reason 3 - March was not a #bearmarket.

Investors do not immediately rush back into the market, leverage up, and take on incredible #speculative actions following a bear market.

realinvestmentadvice.com/technically-sp…

Investors do not immediately rush back into the market, leverage up, and take on incredible #speculative actions following a bear market.

realinvestmentadvice.com/technically-sp…

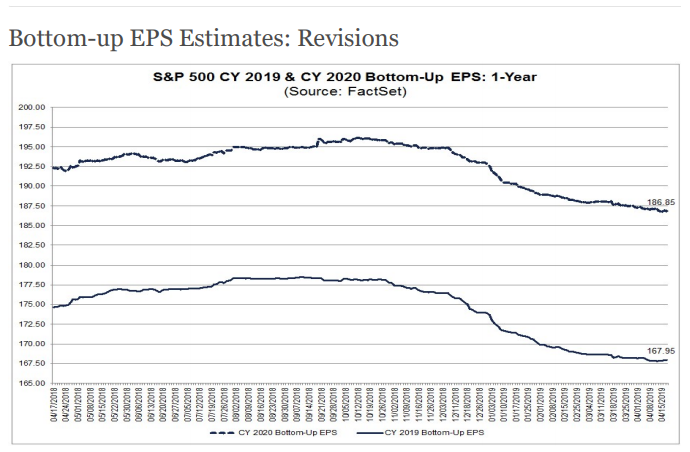

Reason 4 - Following an actual #bearmarket, negative #cash #balances are reversed as #margin calls force mass liquidation of holdings. Such didn't occur in March.

realinvestmentadvice.com/technically-sp…

realinvestmentadvice.com/technically-sp…

Since the March #correction, individuals are leverage up at the fastest rate seen since the peaks in 2000 and 2008.

realinvestmentadvice.com/technically-sp…

realinvestmentadvice.com/technically-sp…

I can't imagine where all of the #speculative action is occurring as the 8-month rate of change in #Margin #debt is fast approaching previous peaks.

realinvestmentadvice.com/technically-sp…

realinvestmentadvice.com/technically-sp…

• • •

Missing some Tweet in this thread? You can try to

force a refresh