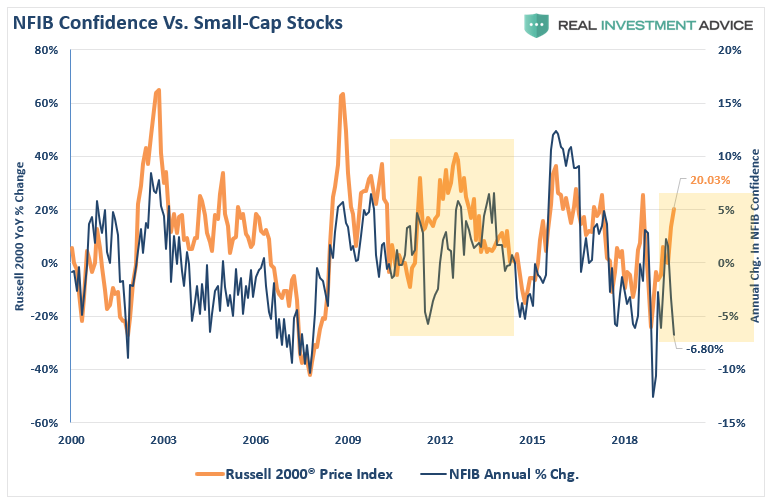

The @NFIB #survey doesn't get much #media attention, but it should. Small businesses make up almost 70% of #employment and their #confidence tells us much about the #economy and #smallcap stocks.

realinvestmentadvice.com/nfib-survey-se…

realinvestmentadvice.com/nfib-survey-se…

In December, the #NFIB survey declined to 95.9 from a peak of 108.8. Notably, many suggest the drop was “#politically driven” by #conservative owners. While there was indeed a drop following the election, the decline continues what started in 2018.

realinvestmentadvice.com/nfib-survey-se…

realinvestmentadvice.com/nfib-survey-se…

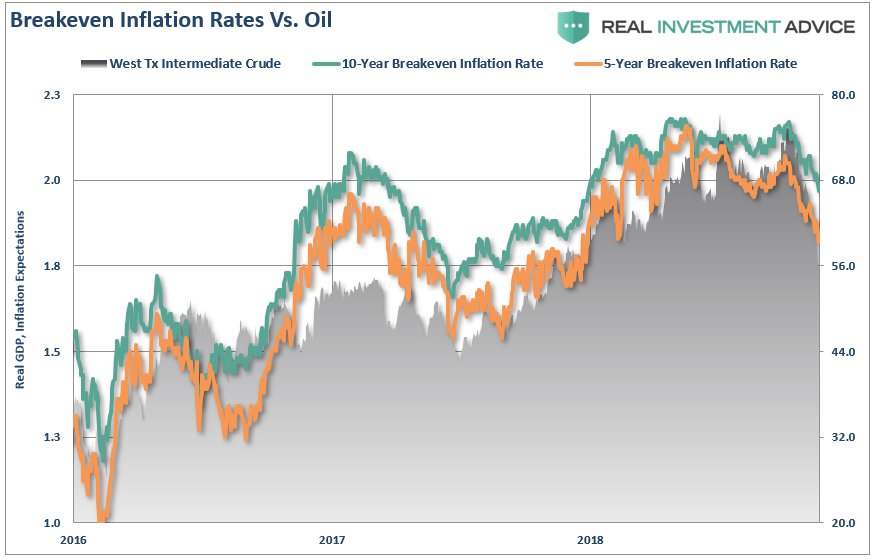

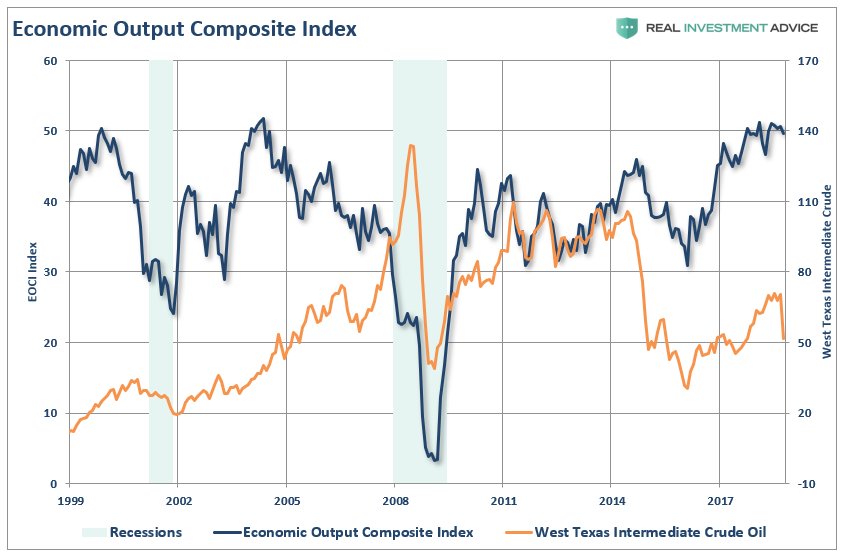

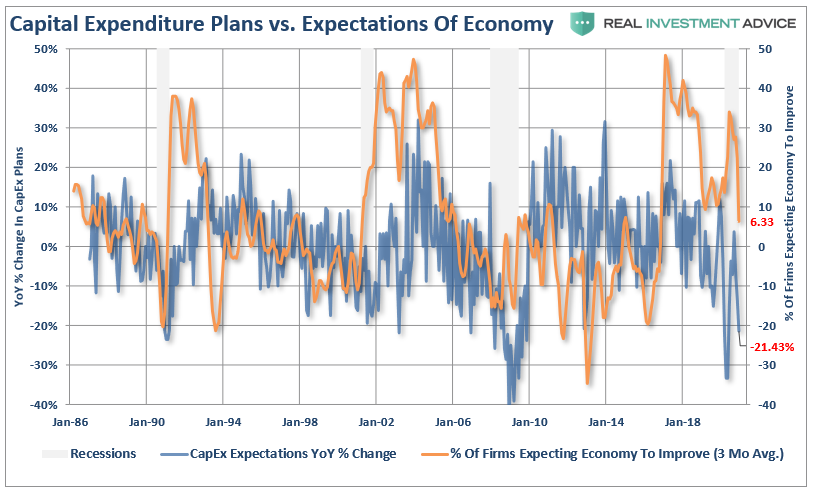

Hopes for a #strong #economic recovery may be premature. While #stimulus will give a short-term lift to the economy, once it is spent, growth fades. Businesses won't #invest into artificial supports.

realinvestmentadvice.com/nfib-survey-se…

realinvestmentadvice.com/nfib-survey-se…

Businesses also won't #hire aggressively in an #economy supported by short-term #stimulus. While the support will create a temporary lift in activity, hiring #employees is a permanent #cost.

realinvestmentadvice.com/nfib-survey-se…

realinvestmentadvice.com/nfib-survey-se…

Small businesses are generally not hugely profitable. Therefore, political agenda items that increase operating #costs will get offset by reduced #employment and #investment. #Taxes, #Regulations, etc.

realinvestmentadvice.com/nfib-survey-se…

realinvestmentadvice.com/nfib-survey-se…

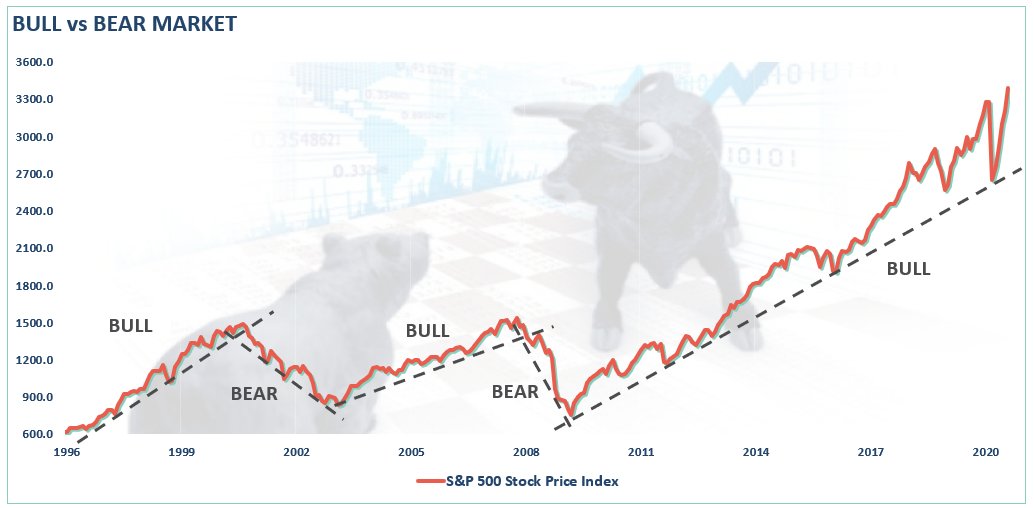

This #thread points out the issues facing #investors piling into #smallcap stocks ($IWM). The small business survey suggests investor #exuberance may be overdone. There is a decent correlation between confidence and small-caps.

realinvestmentadvice.com/nfib-survey-se…

realinvestmentadvice.com/nfib-survey-se…

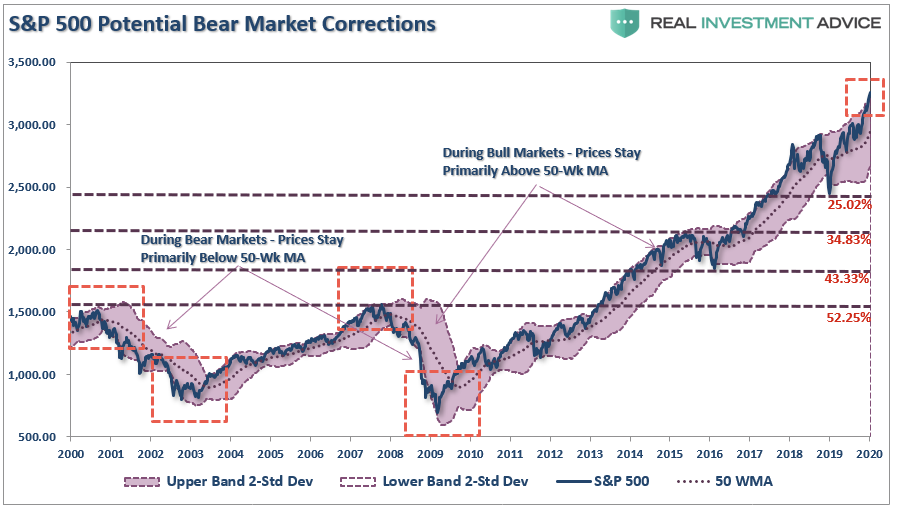

Given that investors continue to push the small-cap index to historical deviations from long-term means, the risk of disappointment is extremely high.

realinvestmentadvice.com/nfib-survey-se…

realinvestmentadvice.com/nfib-survey-se…

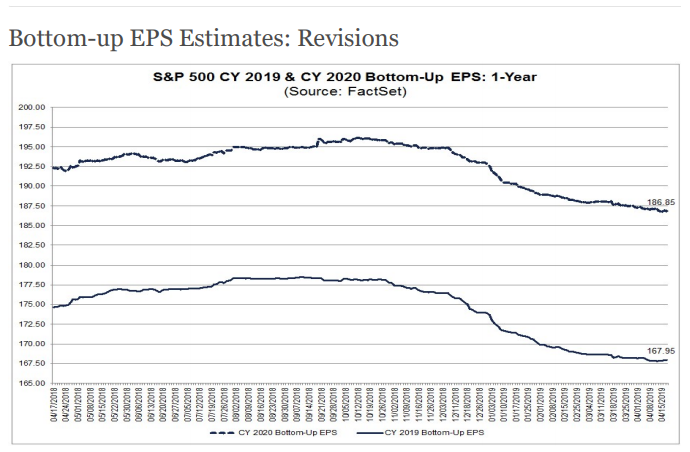

#Smallcap companies’ valuations on a 2-year forward estimate all but guarantee a poor outcome for investors in the future.

realinvestmentadvice.com/nfib-survey-se…

realinvestmentadvice.com/nfib-survey-se…

• • •

Missing some Tweet in this thread? You can try to

force a refresh