#Tether/#kraken/#USDC/#BUSD/#HUSD Watch!

We really need a sweep, i'm losing too many characters here on the intro.

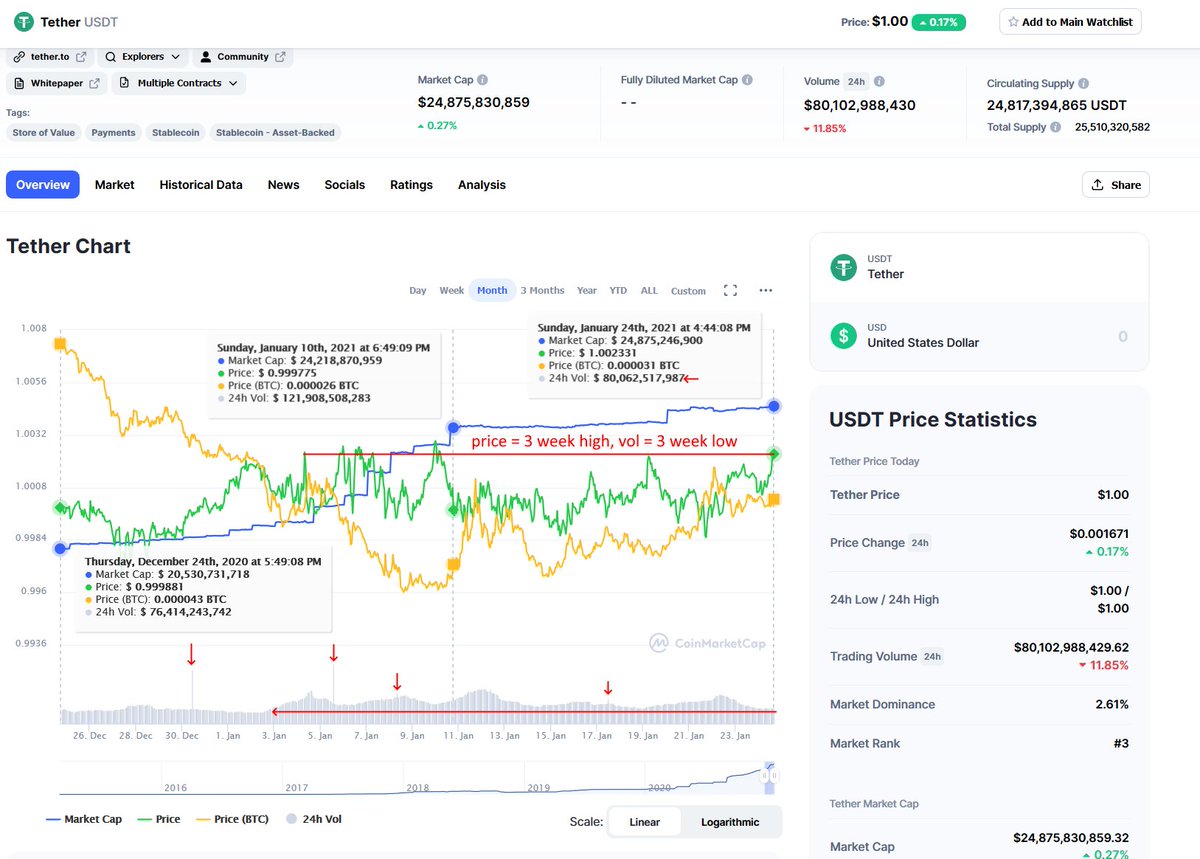

Tether's up to $24,8 billion supply - lackluster to say the least. Volume's cratered.

#Fintwit #bitcoin #BTC $BTC #ETH $ETH #USDT $USDT $USDC $BUSD $HUSD

We really need a sweep, i'm losing too many characters here on the intro.

Tether's up to $24,8 billion supply - lackluster to say the least. Volume's cratered.

#Fintwit #bitcoin #BTC $BTC #ETH $ETH #USDT $USDT $USDC $BUSD $HUSD

Their lack of printing has to be compensated somewhere.

Well, it's not #BUSD. That has been going sideways.

$BUSD volume's cratered the same.

MEANWHILE; I wonder when #Tether/#USDC called upon BUSD's dollar reserves to make due. Also no weird price floor action here, nope.

Well, it's not #BUSD. That has been going sideways.

$BUSD volume's cratered the same.

MEANWHILE; I wonder when #Tether/#USDC called upon BUSD's dollar reserves to make due. Also no weird price floor action here, nope.

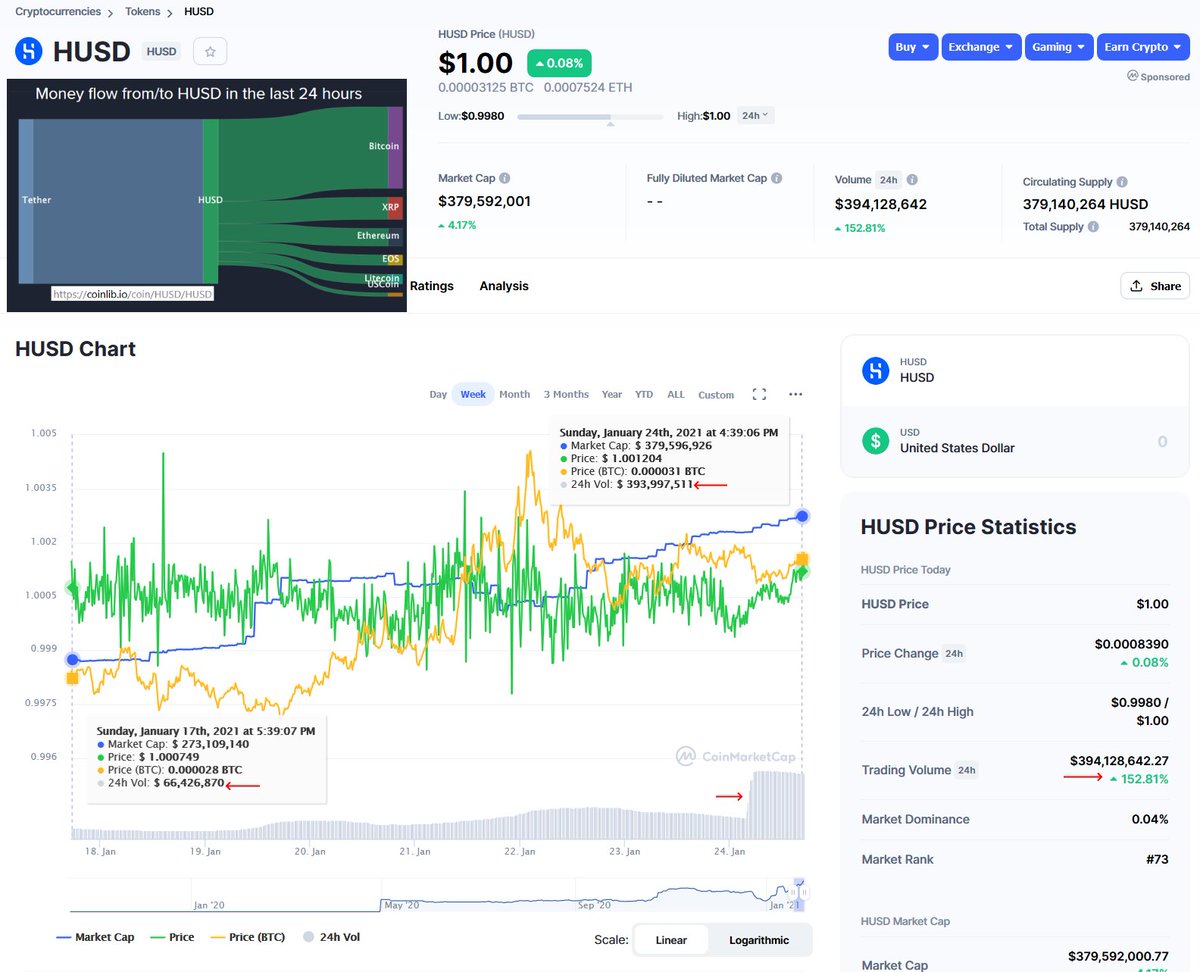

It seems to be #HUSD that's covering for the pack, as it's the only one of the #Stablecoins still going up in marketcap. Considerably, too.

AND, as opposed to $USDC, $BUSD and $Tether - $HUSD volume has EXPLODED!

As i said. #Huobi = the Asian connection.

AND, as opposed to $USDC, $BUSD and $Tether - $HUSD volume has EXPLODED!

As i said. #Huobi = the Asian connection.

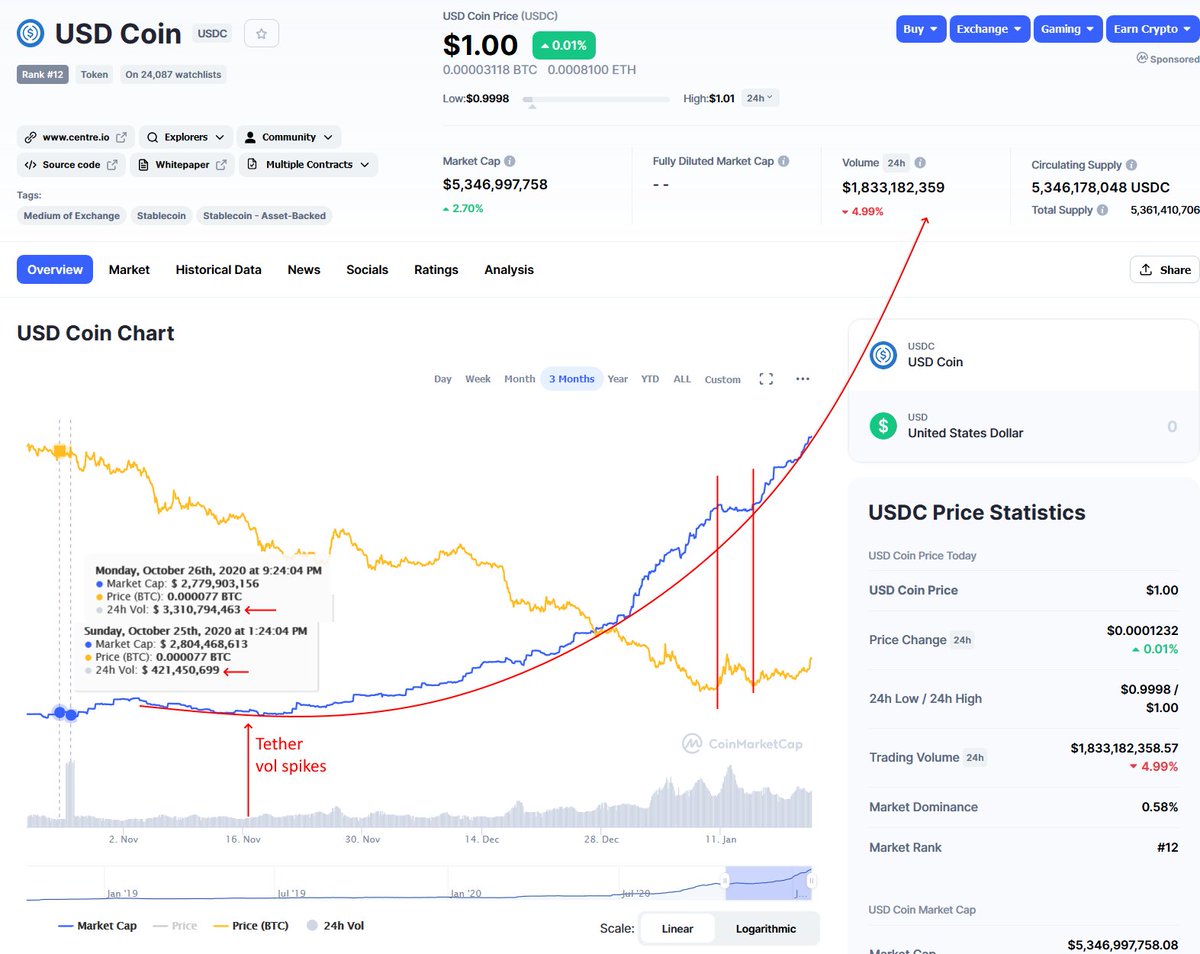

And then there's this $USDC asshole.

I don't think it's doing so hot.

If ya need more info on the connections in #stablecoins:

#Fintwit #kraken #tetherscam #bitcoin #Ethereum #BTC

$BTC #ETH $ETH #USDT $USDT #XRP $XRP #DOT

$DOT #LINK $LINK #BNB $BNB

I don't think it's doing so hot.

If ya need more info on the connections in #stablecoins:

https://twitter.com/DesoGames/status/1353020444664803328

#Fintwit #kraken #tetherscam #bitcoin #Ethereum #BTC

$BTC #ETH $ETH #USDT $USDT #XRP $XRP #DOT

$DOT #LINK $LINK #BNB $BNB

• • •

Missing some Tweet in this thread? You can try to

force a refresh