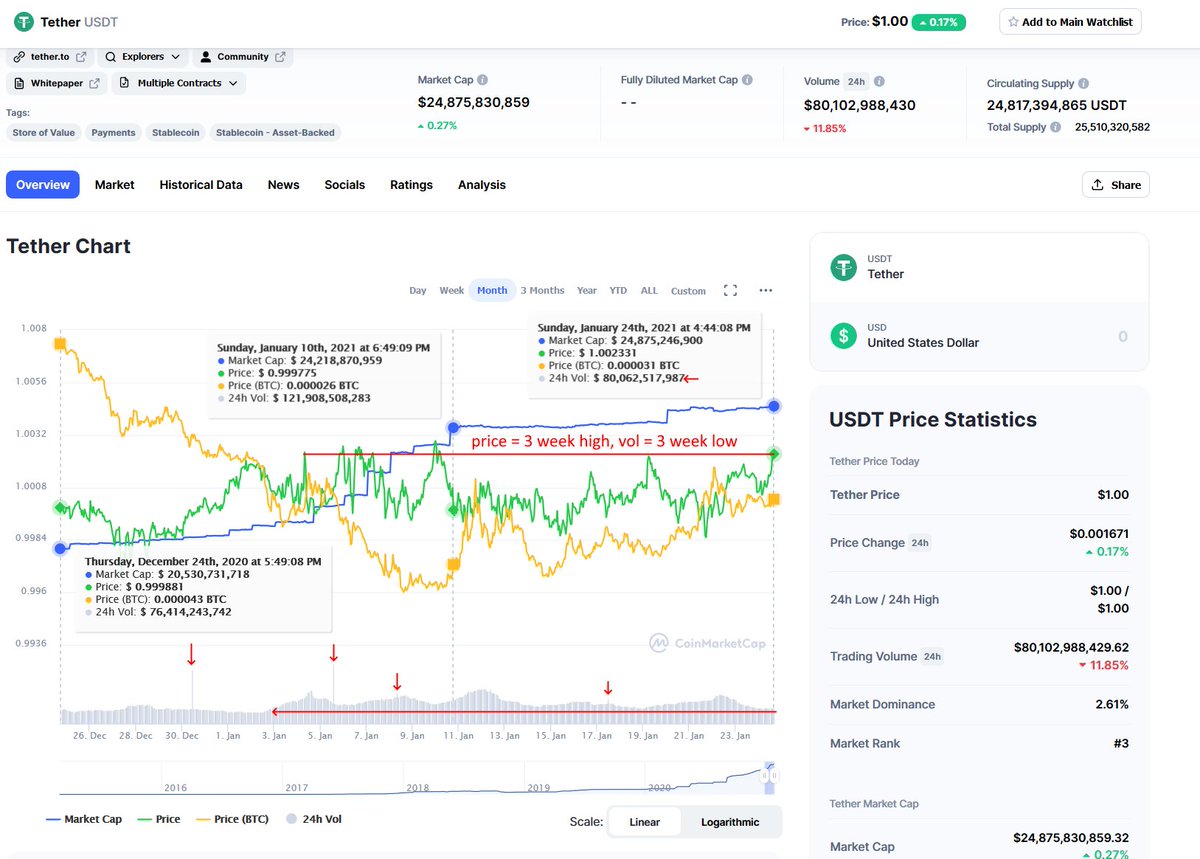

#Tether watch!

Yknow what. I think i've located Tether's missing billions.

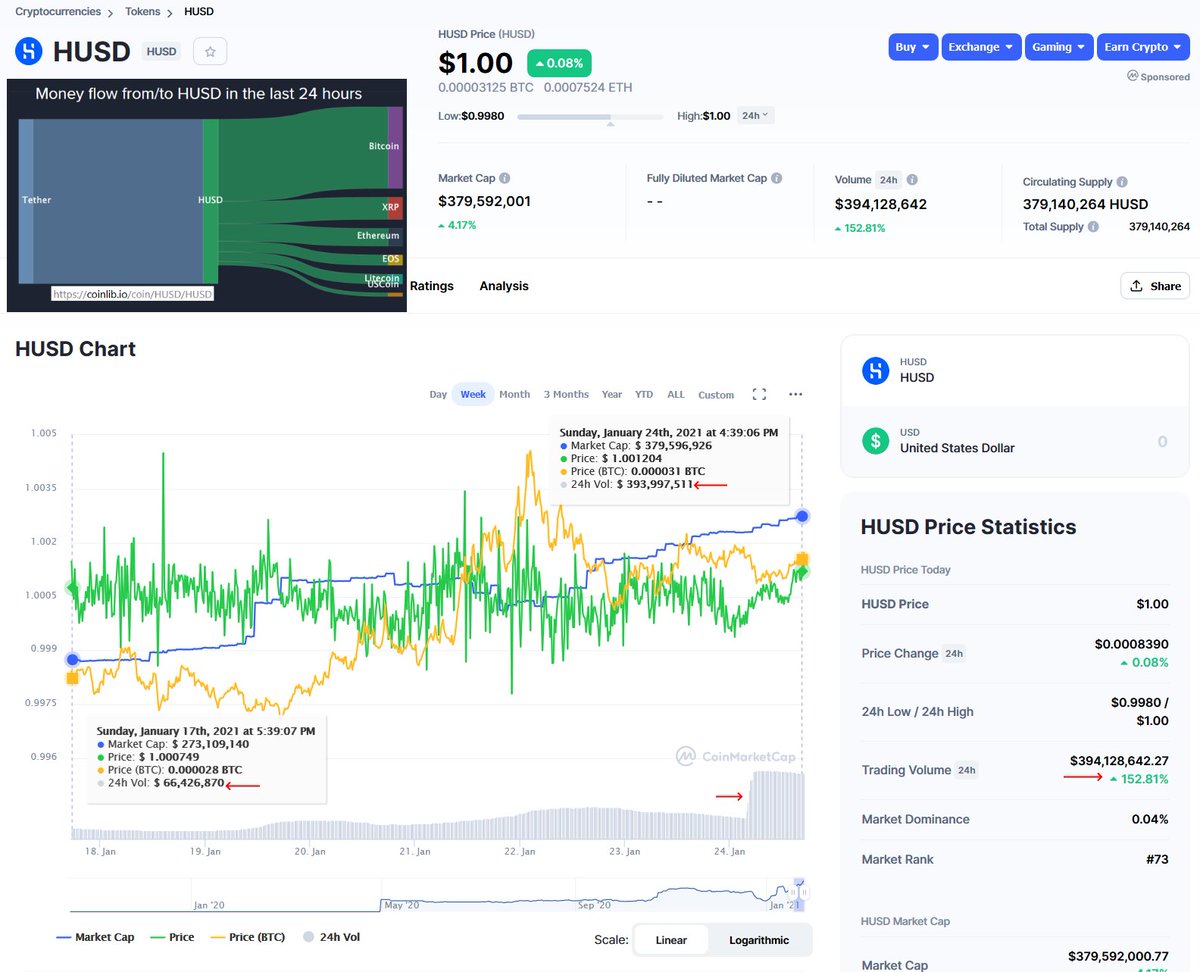

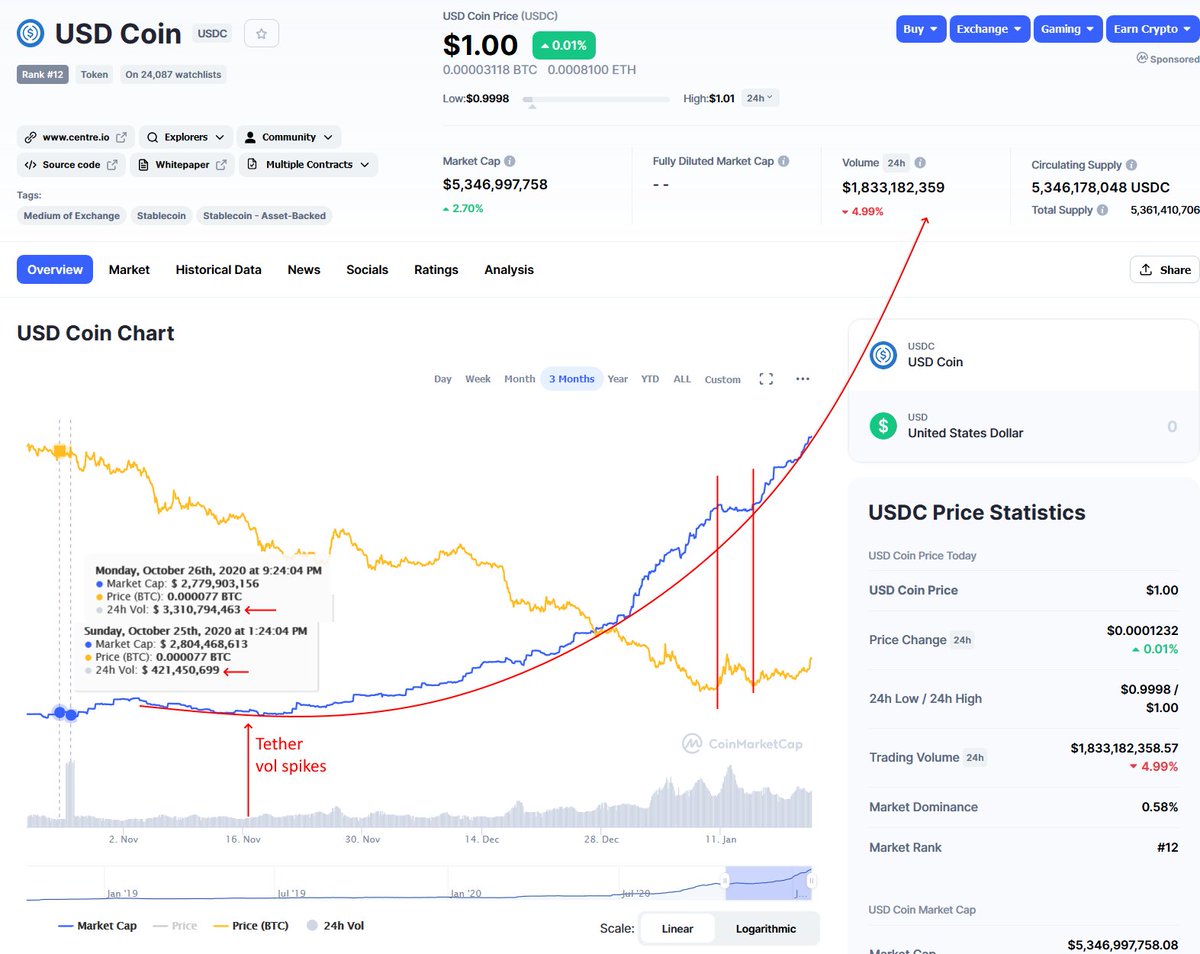

So far, we've only *assumed* $BUSD and $USDC went up because of organic demand.

But... They didn't. It's Tether, again.

#Fintwit #bitcoin #Ethereum #BTC $BTC #ETH $ETH #USDT $USDT #BUSD #USDC #Binance

Yknow what. I think i've located Tether's missing billions.

So far, we've only *assumed* $BUSD and $USDC went up because of organic demand.

But... They didn't. It's Tether, again.

#Fintwit #bitcoin #Ethereum #BTC $BTC #ETH $ETH #USDT $USDT #BUSD #USDC #Binance

Also i have questions why $USDC used to fluctuate so much, and then suddenly, stabilized. Same pretty much goes for $BUSD.

Well, they're supposed to stabilize, as stable coins right?

Well... yeah... But because of #USD... Not other #crypto.

Well, they're supposed to stabilize, as stable coins right?

Well... yeah... But because of #USD... Not other #crypto.

I think you can feel this coming!

Wait for it!

$USDC IS *NOT* BACKED BY #USD! IN FACT, COINLIB SAYS THE MAJORITY OF THE PRICE OF USDC COMES FROM #ETHEREUM VOLUME! NOT DOLLAR VOLUME!

#DOLLAR VOLUME IS ONLY 10%!

IF IT WASN'T FOR EXRATES, USD PRICE OF USDC WOULD BE $3,820!!!!!

Wait for it!

$USDC IS *NOT* BACKED BY #USD! IN FACT, COINLIB SAYS THE MAJORITY OF THE PRICE OF USDC COMES FROM #ETHEREUM VOLUME! NOT DOLLAR VOLUME!

#DOLLAR VOLUME IS ONLY 10%!

IF IT WASN'T FOR EXRATES, USD PRICE OF USDC WOULD BE $3,820!!!!!

And what exchange is *by far* determining price the most?

#Poloniex.

WELL COINLIB TRACKS THEM AS WELL! AND GWHAT DO WE FIND?!

#Poloniex.

WELL COINLIB TRACKS THEM AS WELL! AND GWHAT DO WE FIND?!

Let's just throw $BUSD in there as well.

What a suprise. I can't even find USD. #Stablecoins my hiney.

What a suprise. I can't even find USD. #Stablecoins my hiney.

I DON'T GIVE A SHIT IF #TETHER IS BACKED BY DOLLARS OR NOT!

WHERE IN THE HEAVENS NAME ARE THE REAL #USD GOING FLOWING INTO #CRYPTO EVERY DAY?!

NO ONE IS *ACTUALLY* TRADING DOLLARS >ANYWHERE<

Where in the hell are all these dollars ending up?!

WHERE IN THE HEAVENS NAME ARE THE REAL #USD GOING FLOWING INTO #CRYPTO EVERY DAY?!

NO ONE IS *ACTUALLY* TRADING DOLLARS >ANYWHERE<

Where in the hell are all these dollars ending up?!

Oh and yes, i hear $USDC is audited.

So i looked it up. Unlike other people i can actually read and google.

centre.io/usdc-transpare…

There are strange things there too.

So i looked it up. Unlike other people i can actually read and google.

centre.io/usdc-transpare…

There are strange things there too.

FIRST OFF: THE LEGALESE! From the November report:

"In making an assessment of the risks of material misstatement, we considered and obtained an understanding of internal control relevant to the preparation of, and the Reserve Account Information in...

"In making an assessment of the risks of material misstatement, we considered and obtained an understanding of internal control relevant to the preparation of, and the Reserve Account Information in...

, the accompanying Reserve Account and Blacklisted Account Reports in order to design procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of such internal control. Accordingly, no such opinion is expressed"

In english: In order to determine whether or not they were being fed bullshit, they obtained an understanding of the procedures in how they were fed bullshit.

So they designed procedures to work with the bullshit but they can't say if their procedures are bullshit. So they don't

So they designed procedures to work with the bullshit but they can't say if their procedures are bullshit. So they don't

In other words: No. Culpability.

"We believe that the evidence we obtained is sufficient and appropriate to provide a reasonable basis for our opinion"

BELIEVE! But they can't be sure and won't form an opinion on it. Also, Naturally, they only look at USDC's own materials.

"We believe that the evidence we obtained is sufficient and appropriate to provide a reasonable basis for our opinion"

BELIEVE! But they can't be sure and won't form an opinion on it. Also, Naturally, they only look at USDC's own materials.

" in the accompanying Reserve Account Report as of November 30, 2020 at 11:59 PM Pacific Time (“PT”) (“Report Date and Time”) is correctly state"

It's the #Tether trick all over again. *as long as* they have the money in that account at that time, "it's all there" for a month.

It's the #Tether trick all over again. *as long as* they have the money in that account at that time, "it's all there" for a month.

There's something else that's off.

The June report is signed July 15th.

July = August 14th.

August = September 16th.

September = October 16th.

October = November 23rd.

November = December 16th.

Why the delay?

It is now January 21st. No December report as of yet.

The June report is signed July 15th.

July = August 14th.

August = September 16th.

September = October 16th.

October = November 23rd.

November = December 16th.

Why the delay?

It is now January 21st. No December report as of yet.

I mean, December 31st already happened. They clearly can do things within 2 weeks. The holidays sucks sure but that doesn't give you a pass on the audits.

The December 2019 audit: signed January 15th.

Dec 2018: January 15th.

Oct 2018: November 16th.

Oct 2019: November 14th.

The December 2019 audit: signed January 15th.

Dec 2018: January 15th.

Oct 2018: November 16th.

Oct 2019: November 14th.

I went through them all. The latest dates are 17th december, 18th of July and 23rd of November.

Why the massive 6 day gap? And this month again?

Oh.. And it's not as if Granton&Thornton is squeeky clean:

accountancydaily.co/grant-thornton…

cityam.com/partner-profit…

accountingtoday.com/news/grant-tho…

Why the massive 6 day gap? And this month again?

Oh.. And it's not as if Granton&Thornton is squeeky clean:

accountancydaily.co/grant-thornton…

cityam.com/partner-profit…

accountingtoday.com/news/grant-tho…

sec.gov/news/pressrele…

ft.com/content/0bef9e…

wsj.com/articles/SB107…

thetimes.co.uk/article/grant-…

That's a 200 million lawsuit from not even 2 weeks ago!!!!

ft.com/content/0bef9e…

wsj.com/articles/SB107…

thetimes.co.uk/article/grant-…

That's a 200 million lawsuit from not even 2 weeks ago!!!!

Face it gang.

The entire #Crypto space is nothing but fraud and deception.

Why do you think i'm calling for the #CryptoPurge? IT NEEDS IT!

#Fintwit #Tether #bitcoin #Ethereum #BTC $BTC #ETH $ETH #USDT $USDT #XRP $XRP #DOT $DOT #LINK $LINK #BNB $BNB #USDC $USDC #BUSD $BUSD

The entire #Crypto space is nothing but fraud and deception.

Why do you think i'm calling for the #CryptoPurge? IT NEEDS IT!

#Fintwit #Tether #bitcoin #Ethereum #BTC $BTC #ETH $ETH #USDT $USDT #XRP $XRP #DOT $DOT #LINK $LINK #BNB $BNB #USDC $USDC #BUSD $BUSD

Also give it up losers, Huobi's not gonna give you an exit either.

Liquidity is piss poor. LOOK AT THE LARGEST VOLUME EXCHANGE PAIR, USDT/BTC, WITH A LIQUIDITY OF 692! ARE YOU KIDDING ME?!

Liquidity is piss poor. LOOK AT THE LARGEST VOLUME EXCHANGE PAIR, USDT/BTC, WITH A LIQUIDITY OF 692! ARE YOU KIDDING ME?!

ALRIGHT! I'M CALLING IT!

#TETHER'S VERY LOW IF NOT OUT OF #USD!

Kraken's stuck at 0.9985, so they're using Euros and Yuan to prop up the price.

But liquidity is VERY low. So that's why the price still seems good in some exchanges.

Don't be fooled though. We're near the end.

#TETHER'S VERY LOW IF NOT OUT OF #USD!

Kraken's stuck at 0.9985, so they're using Euros and Yuan to prop up the price.

But liquidity is VERY low. So that's why the price still seems good in some exchanges.

Don't be fooled though. We're near the end.

Jesus... There's no liquidity at all on the largest exchanges... Usually those numbers are above 700-800 *at least*, if not 900.

#Fintwit #Tether #tetherscam #bitcoin #Ethereum #BTC $BTC #ETH $ETH #USDT $USDT #XRP $XRP #DOT $DOT #LINK $LINK #BNB $BNB #USDC $USDC #BUSD $BUSD

#Fintwit #Tether #tetherscam #bitcoin #Ethereum #BTC $BTC #ETH $ETH #USDT $USDT #XRP $XRP #DOT $DOT #LINK $LINK #BNB $BNB #USDC $USDC #BUSD $BUSD

#Kraken, today, $USDT/#USD pair, 14 seconds apart.

To show you how bullshit the buyside liquidity is, it's all spoofing.

And yes it went away again too.

To show you how bullshit the buyside liquidity is, it's all spoofing.

And yes it went away again too.

I'll add another tweet here since the day seems to have ended - liquidity is restored to the USDT pairs - But make no mistake, it's not Dollar liquidity.

Today was a scare for anybody who bought in below $30K: Sell.

For anybody above that... May god have mercy on your soul...

Today was a scare for anybody who bought in below $30K: Sell.

For anybody above that... May god have mercy on your soul...

• • •

Missing some Tweet in this thread? You can try to

force a refresh