Global, high Sharpe ratio, Alpha extracting Long/Short Trader. #quant asset allocator. Not advice. Not your fiduciary. Do your own due diligence. CFA.

2 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/trendwhizo/status/1548022107358912513

🚨 S&P 500 earnings growth in CQ2 2022 👇

🚨 S&P 500 earnings growth in CQ2 2022 👇

Fed will be data driven.

Fed will be data driven.

https://twitter.com/profplum99/status/1548860131592417281

🔥 iTraxx ramp

🔥 iTraxx ramp

https://twitter.com/trendwhizo/status/1543319191071096842$TSLA - For past 8Qs, the NLP analyses of transcript indicates, the Co officials deflect significantly to analyst questions.

2/

2/

2/n Old Classic Book: Larry McMillan's Options as Strategic Investment

2/n Old Classic Book: Larry McMillan's Options as Strategic Investment

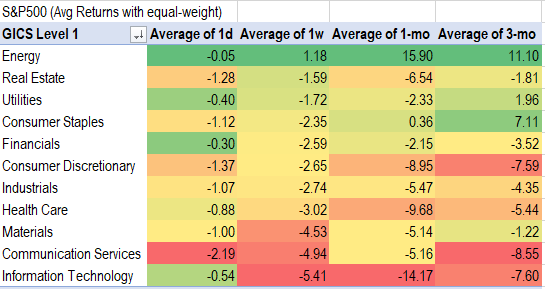

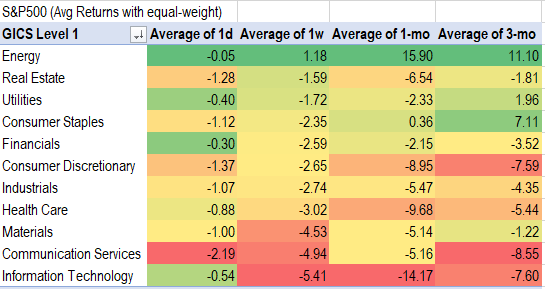

S&P 500 - avg returns of large cap index components by GICS Level 1 & Level 2 factors 1day, 1 week, 1 month, 1 quarter.

S&P 500 - avg returns of large cap index components by GICS Level 1 & Level 2 factors 1day, 1 week, 1 month, 1 quarter.