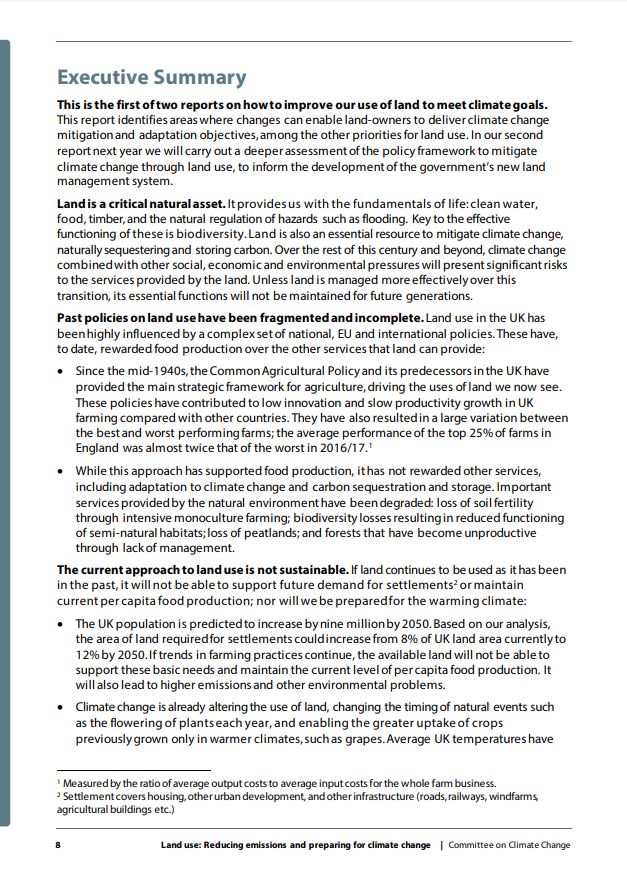

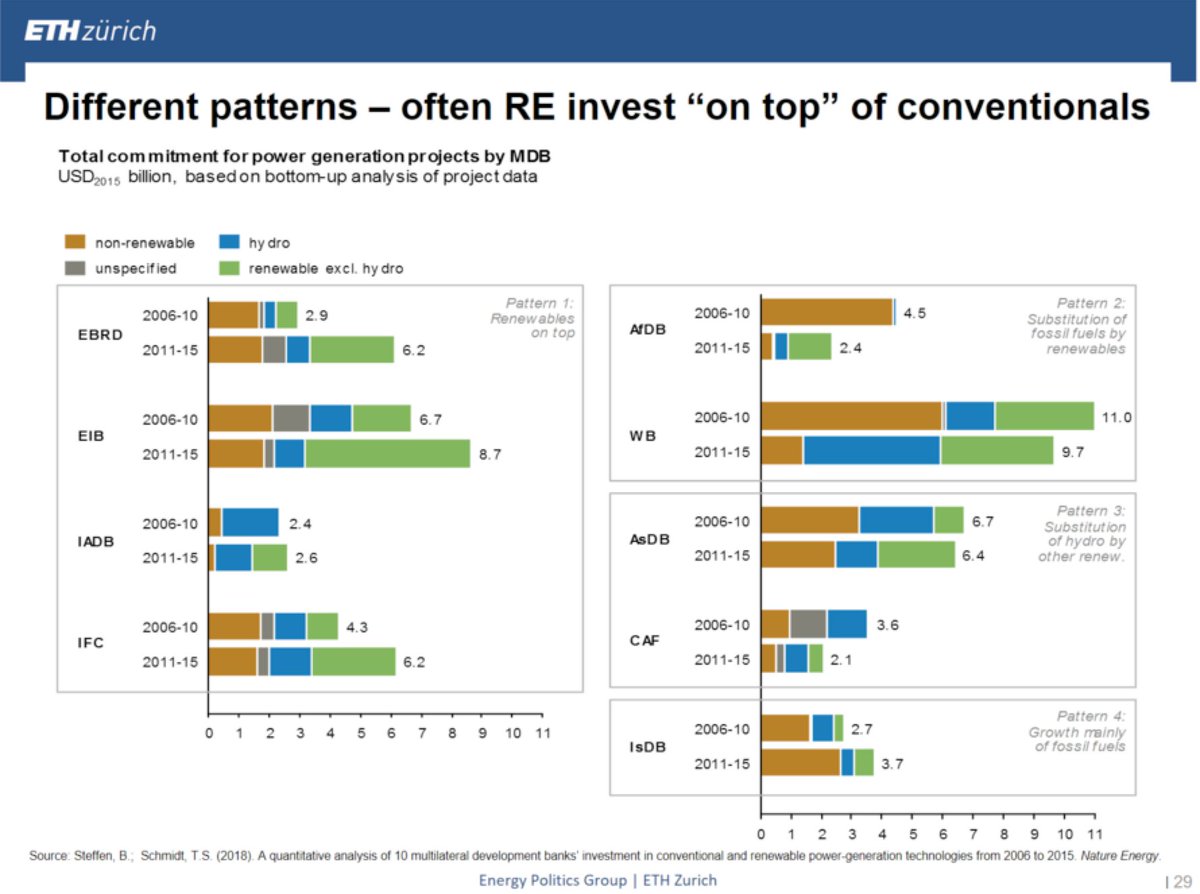

-> "On top" of fossil [@EBRD, @EIB, @the_IDB, @IFC]

-> Fossil substituion with RE [@AfDB_Group, @WorldBank]

-> Hydro substituion with RE [@ADB_HQ, @AgendaCAF]

-> Mainly growth in fossil fuels [@isdb_group]

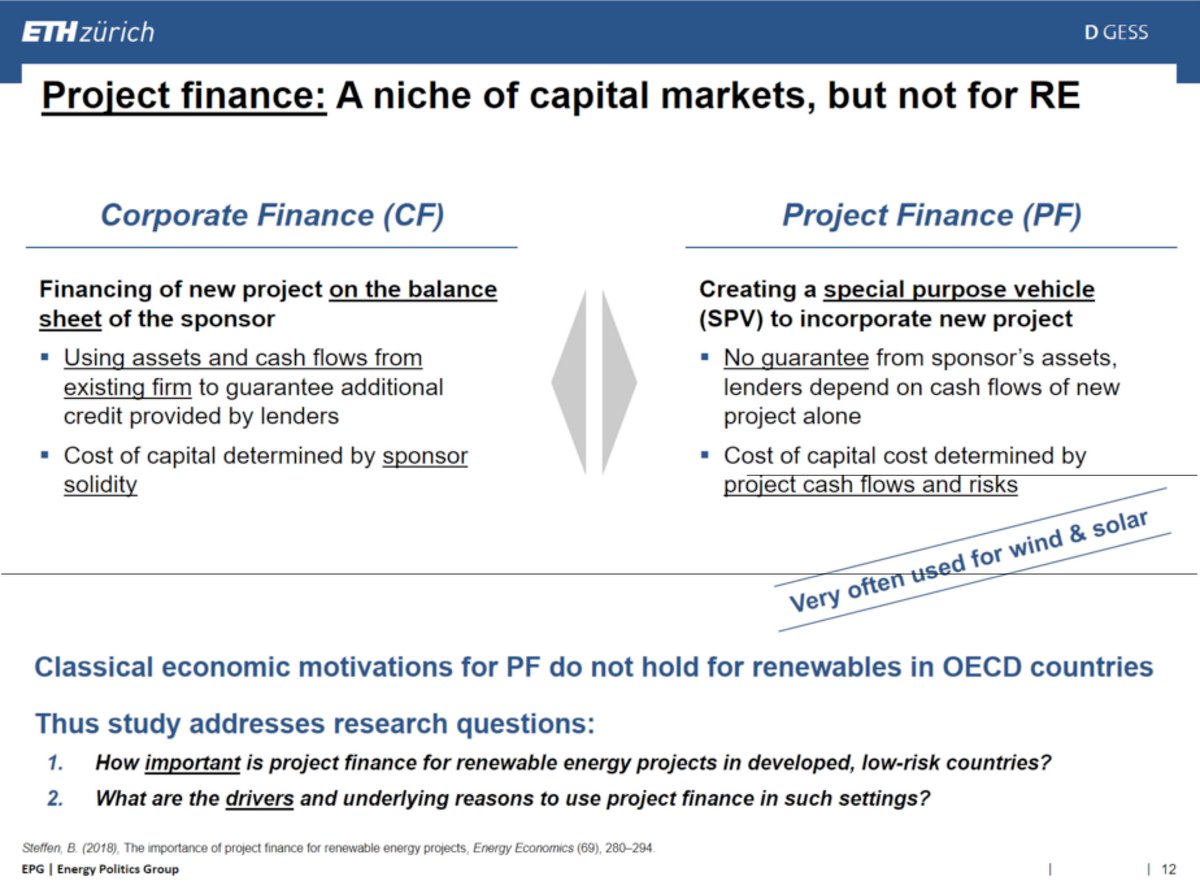

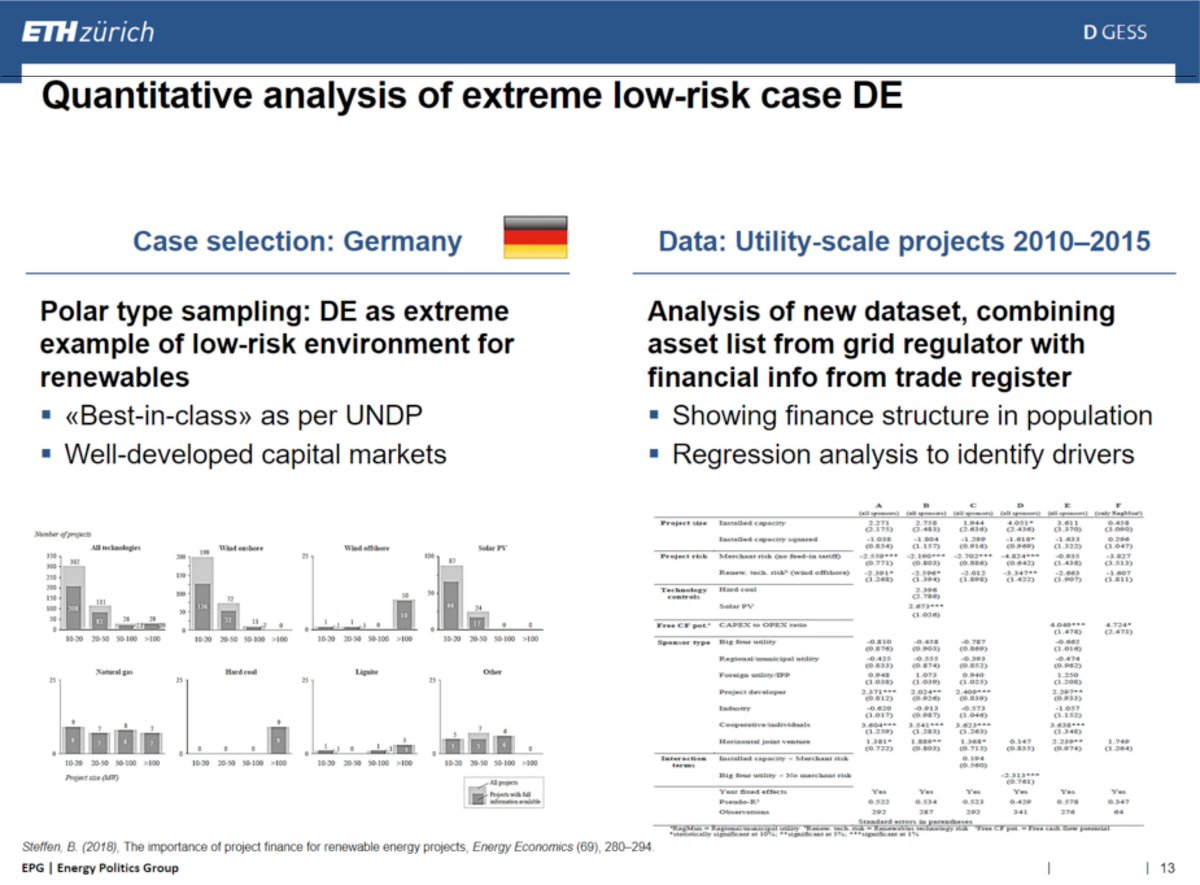

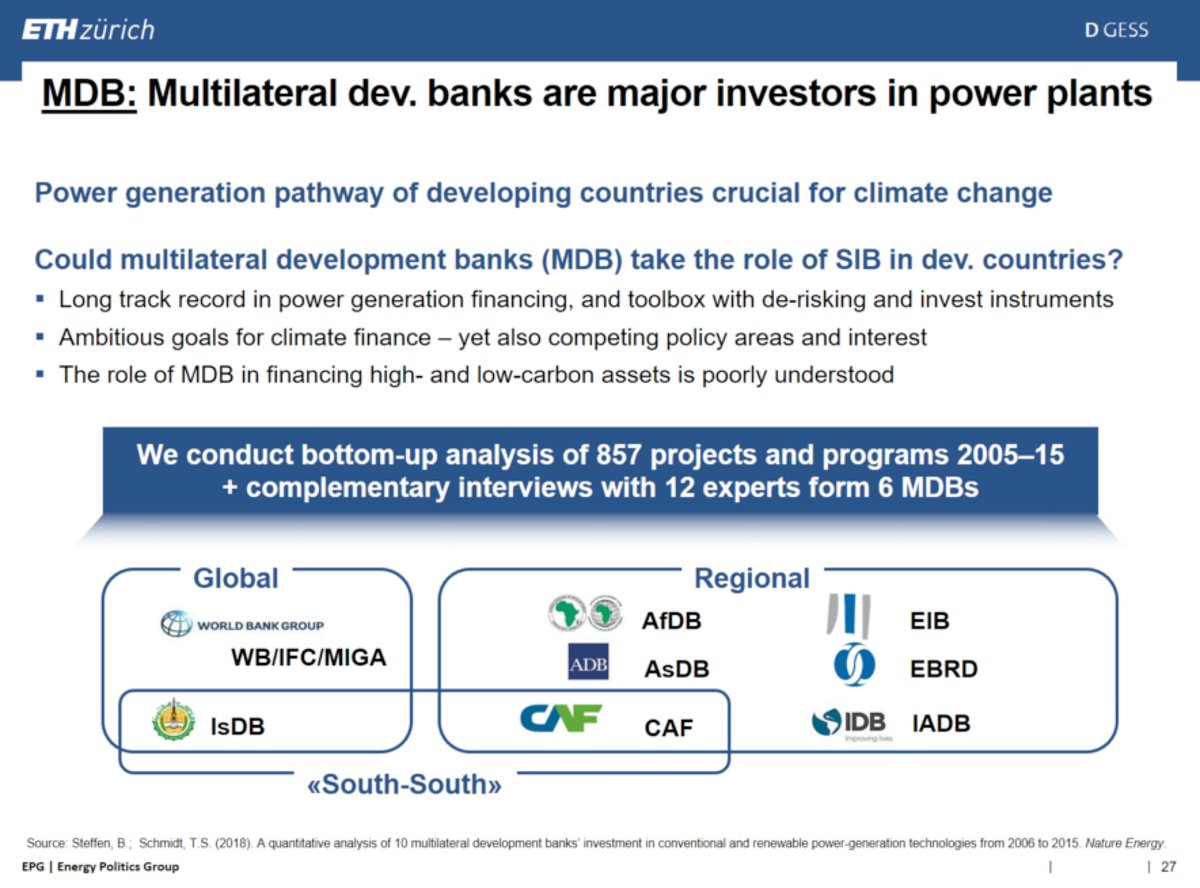

-> Public banks can be a powerful policy instrument to enhance financing conditions and lower the cost of capital for new technologies (!)

-> [for modellers] More need for technology- and time-specific cost of capital analysis, no more uniform discount..