clearly a lot of work has gone into your report, and i don't mean to denigrate it, but there are some big issues that have been glossed over, and some errors, to the report's detriment.

to name a few…

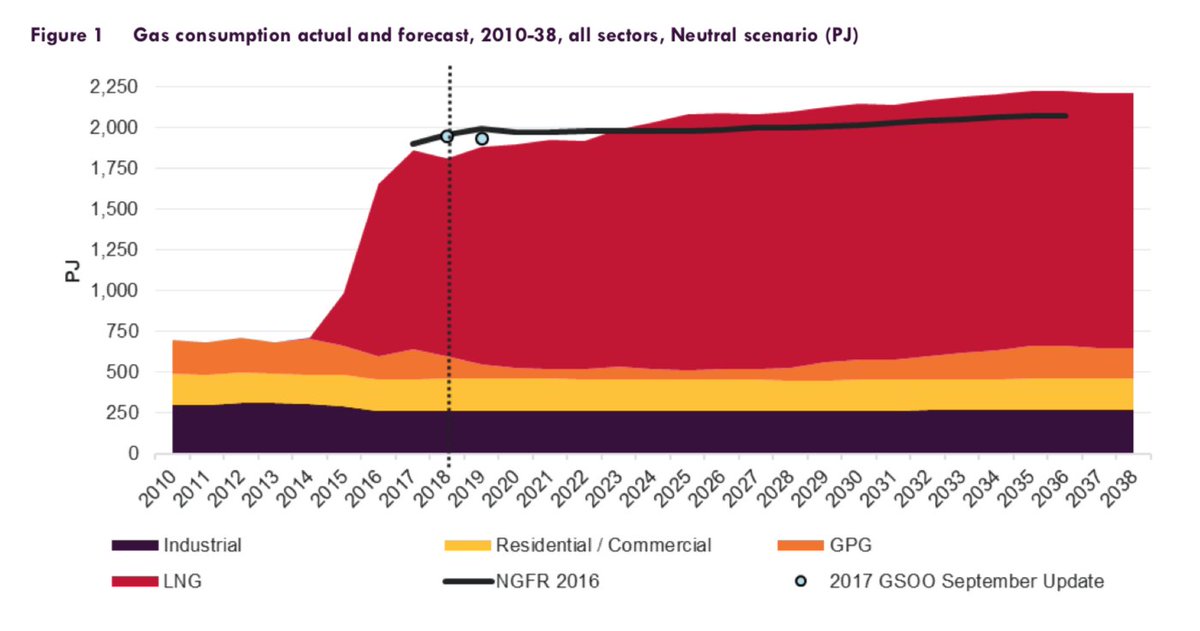

aemo.com.au/-/media/Files/…

hard to square this claim with the fact that international markets set our gas prices.